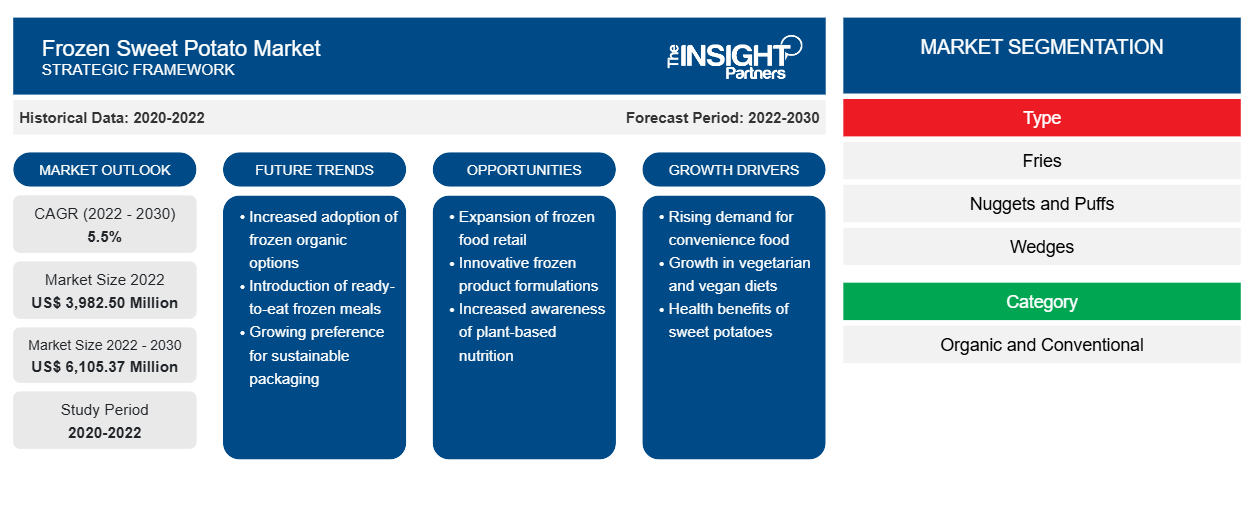

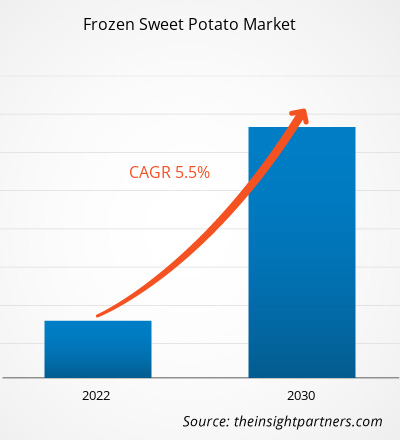

[Research Report] The frozen sweet potato market size was valued at US$ 3,982.50 million in 2022 and is projected to reach US$ 6,105.37 million by 2030; the market is expected to register a CAGR of 5.5% from 2022 to 2030.

Market Insights and Analyst View:

Frozen sweet potato products offer a convenient and versatile option for incorporating these nutritious root vegetables into one meal. Whether in the form of fries, wedges, nuggets, hashbrowns, or other products, these frozen products provide a time-saving solution for busy individuals seeking a healthy addition to their diet. Changing people's lifestyles and hectic work schedules drive the demand for convenience food. People are shifting toward products that provide them convenience and help them save time. These factors are driving the demand for frozen food. Frozen food is easy to prepare at home with no time. Further, it has an extended shelf life and is easy to store. Frozen sweet potatoes are becoming popular snack items among younger populations and kids due to their versatile flavor and crispy texture. Thus, the rising demand for frozen food and the increasing popularity of frozen sweet potato products drive the market growth.

Growth Drivers and Challenges:

The emergence of e-commerce has resulted in considerable changes in the way people shop and purchase food products. The rising penetration of smartphones and the internet, quick access to emerging technologies, rising purchasing power, and convenience provided by online retail shopping platforms are among the key factors bolstering e-commerce. People increasingly prefer online retail platforms for purchasing frozen foods. According to the American Frozen Food Institute, online sales of frozen food products, including frozen snacks, increased by 75% in 2020. The online sales of food and beverages grew significantly during the COVID-19 outbreak due to the shutdown of brick-and-mortar stores and the imposition of several social restrictions by governments of various countries across the globe. With the rising penetration of e-commerce across multiple geographies, the manufacturers of frozen foods, such as Conagra Brands Inc, McCain Foods Ltd, and Aviko BV, are also enhancing their online presence by selling products through Amazon, Tesco, and other well-known e-commerce platforms. The growing adoption of e-commerce platforms is eliminating the dependency on offline retail stores. Thus, the rising sales of frozen snacks via e-commerce platforms are anticipated to create lucrative opportunities for the growth of the frozen sweet potato market size during the forecast period.

Cold chain logistics are essential for the streamlined functioning and proliferation of the frozen sweet potato businesses globally. However, several developing countries in both regions still lack cold chain infrastructure and are unable to provide safe frozen food products to consumers. Although frozen food products have a long shelf life, their wastage is inevitable if not stored at specified low temperatures during handling, transportation, and storage, resulting in contaminated products. Thus, the risk of frozen food wastage due to the lack of cold chain infrastructure in developing countries hampers the growth of the frozen sweet potato market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Frozen Sweet Potato Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Frozen Sweet Potato Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

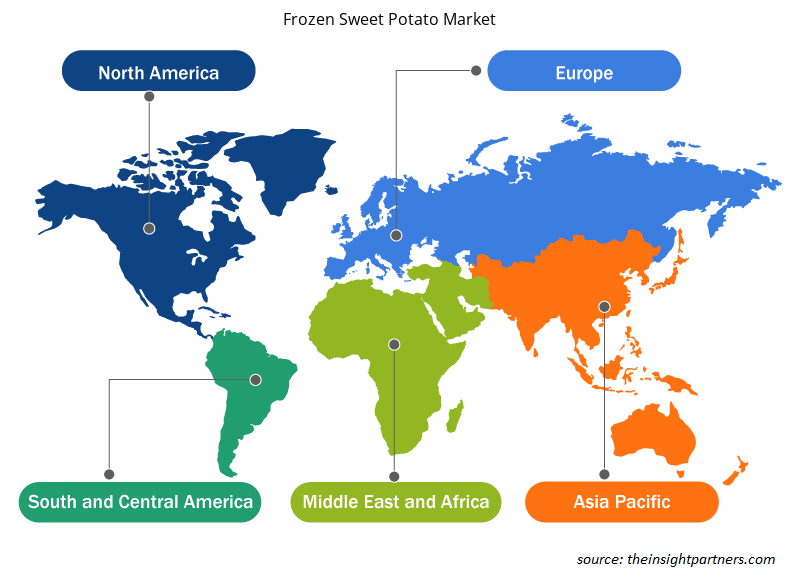

The global frozen sweet potato market analysis is categorized on the basis of type, category, end user, and geography. Based on type, the market is segmented into fries, nuggets and puffs, wedges, hashbrowns, and others. In terms of category, the market is bifurcated into organic and conventional. In terms of end user, the market is divided into food service and food retails. By geography, the market is broadly segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. The market in North America is further segmented into the US, Canada, and Mexico. The European market is subsegmented into Germany, France, the UK, Italy, Spain, and the Rest of Europe. The market in Asia Pacific is further segmented into China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. The market in the MEA is subsegmented into South Africa, Saudi Arabia, the UAE, and the Rest of MEA. The market in South & Central America market is further categorized into Brazil, Argentina, and the Rest of South & Central America.

Segmental Analysis

Based on category, the frozen sweet potato market size is divided into conventional and organic. The conventional segment holds a significant frozen sweet potato market share, and organic is expected to grow considerably during the forecast period. Organic frozen sweet potato products are produced using organically harvested sweet potatoes. The demand for frozen sweet potatoes has been attributed to growing consumer preference for healthier and environmentally conscious food choices. Organic products are perceived as free from synthetic pesticides and chemicals, aligning with the rising awareness of health concerns associated with synthetic chemicals. Consumers are increasingly looking for products that provide convenience as well as nutritional benefits.

Regional Analysis:

Among all major regions, North America dominated the frozen sweet potato market in 2022. The market in this region was valued at US$ 1,240.95 million in 2022. Europe is the second major contributor to the global market, holding approximately 29% of the frozen sweet potato market share. The frozen sweet potato market trends in North America are attributed to the growing consumption of sweet potatoes, rising demand for convenience food products, rising initiatives for product promotion, and the growing interest in healthy food products. The market for sweet potatoes in North America has increased significantly in the past years, and it will continue to grow in the future.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the frozen sweet potato market are listed below:

- In March 2022, the KUK announced the launch of frozen sweet potato chips in Dubai, UAE; the launch aimed to expand its product portfolio and consumer base.

Frozen Sweet Potato Market Regional Insights

Frozen Sweet Potato Market Regional Insights

The regional trends and factors influencing the Frozen Sweet Potato Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Frozen Sweet Potato Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Frozen Sweet Potato Market

Frozen Sweet Potato Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 3,982.50 Million |

| Market Size by 2030 | US$ 6,105.37 Million |

| Global CAGR (2022 - 2030) | 5.5% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Frozen Sweet Potato Market Players Density: Understanding Its Impact on Business Dynamics

The Frozen Sweet Potato Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Frozen Sweet Potato Market are:

- Conagra Brands Inc

- Ardo Foods NV

- Aviko BV

- Birds Eye Ltd

- Lamb Weston Holdings Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Frozen Sweet Potato Market top key players overview

COVID-19 Impact:

The COVID-19 pandemic affected almost all industries in various countries in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA). Various industries, including food & beverages, suffered severe disruptions due to disturbances in supply chains and shutdowns of production plants amid the COVID-19 pandemic. Many businesses announced possible delays in product deliveries and slumps in their future sales. Thus, suspended operations in various industries hindered the frozen sweet potato market growth in 2020.

On the contrary, the COVID-19 pandemic altered global consumer preferences as health became their top priority. The preferences for healthy snacks, along with the demand for products with organic ingredients, increased. This factor triggered the demand for frozen sweet potatoes. However, severe distribution network disruptions and business shutdowns resulted in a demand and supply gap in the world. Manufacturers in the frozen sweet potato market witnessed labor shortages and faced challenges in sourcing raw materials, which negatively impacted their profitability. In 2021, governments of various countries announced relaxations in the restrictions, such as trade bans, lockdowns, and business shutdowns. Manufacturers were permitted to operate at full capacity, which helped them overcome the demand and supply gaps. Also, with the introduction of vaccines, the marketplace witnessed recovery, which benefitted the frozen sweet potato market.

Competitive Landscape and Key Companies:

Conagra Brands Inc, Ardo Foods NV, Aviko BV, Birds Eye Ltd, Lamb Weston Holdings Inc, Le Duc Fine Food BV, McCain Foods Ltd, Mondial Foods BV, Handy Food Innovation Ltd, and Sunbulah Food & Fine Pastries Manufacturing Co Ltd are among the top 10 companies operating in the global frozen sweet potato market report. These companies focus on developing organic products, which is expected to offer new opportunities to the market in the coming years.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Category, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Based on the distribution channel, the food service segment accounted for the largest revenue share. In recent years, the demand for different types of frozen sweet potato products has increased from hotels, quick service restaurants (QSRs), and fast-food chains. The frozen sweet potato products offer convenience to chefs and food service establishments, allowing for easy incorporation into various dishes without the time-consuming process of peeling and chopping fresh sweet potatoes.

The major players operating in the global frozen sweet potato market include Conagra Brands Inc, Ardo Foods NV, Aviko BV, Birds Eye Ltd, Lamb Weston Holdings Inc, Le Duc Fine Food BV, McCain Foods Ltd, Mondial Foods BV, Handy Food Innovation Ltd, and Sunbulah Food & Fine Pastries Manufacturing Co Ltd, among others.

North America market dominated the frozen sweet potato market and continues to be the largest segment by 2028. The largest share of North America can be attributed to increasing awareness regarding healthy snacking products and surge in strategic initiatives from manufacturers for variety of product launch.

The rising demand for frozen snacks and strategic initiatives by key market players are major factors driving the growth of global frozen sweet potato market.

Increasing demand for healthy alternatives to conventional snacking items is expected to provide lucrative growth opportunities to the global frozen sweet potato market during the forecast period.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Frozen Sweet Potato Market

- Conagra Brands Inc

- Ardo Foods NV

- Aviko BV

- Birds Eye Ltd

- Lamb Weston Holdings Inc

- Le Duc Fine Food BV

- McCain Foods Ltd

- Mondial Foods BV

- Handy Food Innovation Ltd

- Sunbulah Food & Fine Pastries Manufacturing Co Ltd

Get Free Sample For

Get Free Sample For