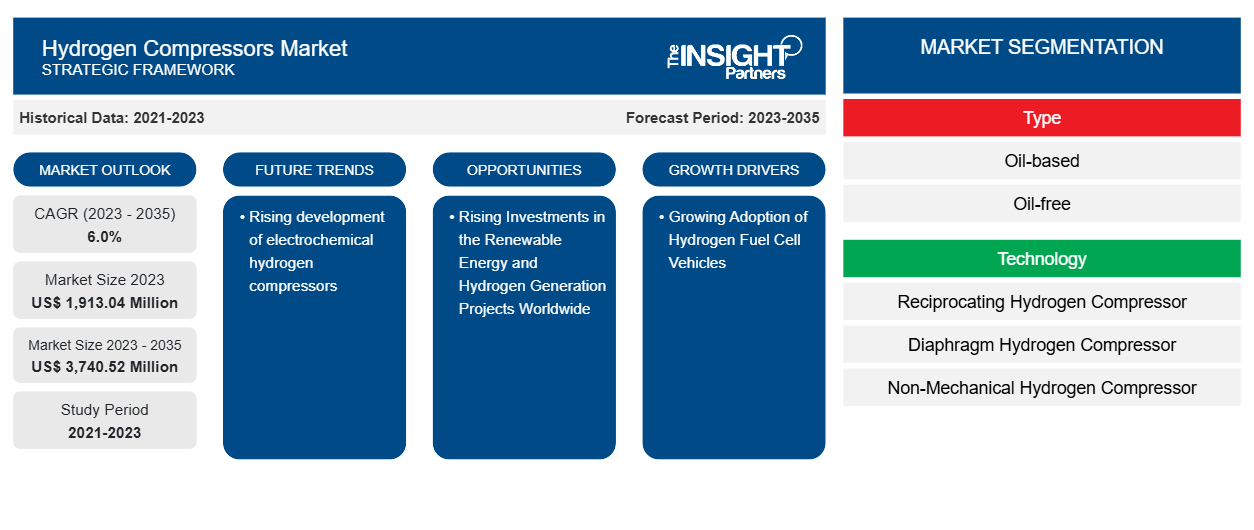

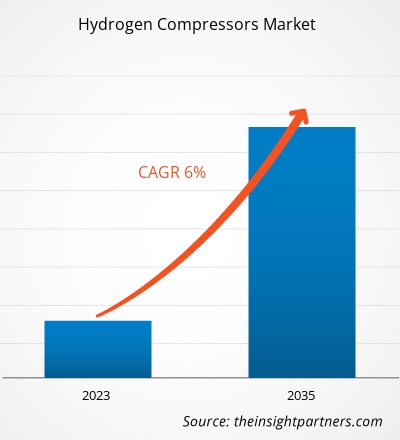

The hydrogen compressors market size is projected to reach US$ 3,740.52 million by 2035 from US$ 1,913.04 million in 2023. The market is expected to register a CAGR of 6.0% during 2023–2035. Increasing shift toward green hydrogen is likely to bring in new trends in the market in the coming years.

Hydrogen Compressors Market Analysis

The surging adoption of hydrogen fuel cell vehicles and the tremendous growth of oil and gas and chemical and petrochemical industries across the globe are expected to fuel the demand for hydrogen compressors in the coming years. In addition, the current growth of the hydrogen compressors market is attributed to the introduction of advanced hydrogen compressors. However, the high installation and maintenance cost of hydrogen compressors hampers the market growth. Moreover, the increase in investments in the energy industry and hydrogen infrastructure development and expansion across the globe is projected to create opportunities for the major players operating in the hydrogen compressor market during the forecasted period. Further, the shift toward using green hydrogen in various industries is anticipated to be the key future trend in the market.

There is a rise in investments in the renewable energy sector due to increased government initiatives and funding, which promotes the adoption of hydrogen compressors. Per the IEA, global investments in the renewable energy sector reached US$ 358.0 billion in the first six months of 2023, an increase of 22% rise compared to the start of last year and an all-time high for any six months. Renewable energy companies compared to last year, 2022. The venture capital firms and private equity companies are expanding their operations in the renewable energy sector, reaching US$ 10.4 billion in the first quarter of 2023. China accounted for the largest market share in the first quarter of 2023, with investment reaching US$ 177 billion, increased by 16% compared to the first quarter of 2022. Also, the US secured an investment of ~US$ 36 billion, followed by Germany, with an investment of US$ 11.9 billion for the expansion of the renewable energy sector.

Hydrogen Compressors Market Overview

Hydrogen is one of the most energy-efficient fuels with the largest energy content per weight, with a density of 90g per cubic meter, under ambient conditions. To achieve a functional level of energy density, efficient compression of hydrogen is required. Hydrogen compressors are used effectively to compress small to medium amounts of hydrogen to high values. Depending on the requirements, hydrogen compressors are also used for extremely high pressures; for example, above 5,000 bar (75,000 PSI). In addition, less than 250 bar (3,600 PSI) pressure is required to compress large quantities of oil-free hydrogen, which, in turn, is expected to fuel the demand for hydrogen compressors during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Hydrogen Compressors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Hydrogen Compressors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Hydrogen Compressors Market Drivers and Opportunities

Growing Adoption of Hydrogen Fuel Cell Vehicles

Governments of various countries across the globe are continuously focusing on the development of eco-friendly solutions for various industries, including automotive, due to rising concerns associated with the depletion of natural resources and environmental degradation. In addition, a shift in consumer preferences owing to a surge in awareness related to the effects of air pollution and boosting levels of traffic and greenhouse gas emissions has driven the need for hydrogen fuel cell vehicles. The rise in government investments in hydrogen fuel infrastructure and incentives offered to the buyers are allowing the original equipment manufacturers (OEMs) to expand their revenue stream as well as their geographical presence. For instance, the Government of India launched the National Green Hydrogen Mission in January 2023 with an investment of approximately US$ 2,000 million. Further, there is a rise in research and development activities by vehicle manufacturers players across the globe. For instance, in December 2020, Toyota launched its redesigned Mirai. The company updated a variety of internal and external functions, including its hydrogen fuel cell system.

There are a variety of benefits of hydrogen fuel cell vehicles over conventional ICE vehicles. Fuel cell electric vehicles (FCEVs) provide improved fuel economy to internal combustion engine (ICE) vehicles. The FCEV has a fuel economy of ~63 miles per gallon gasoline equivalent (MPGge), and an ICE vehicle records 29 MPGge on roads. Hybridization enhances the fuel economy of an FCEV by approximately 3.2%. Moreover, the FCEVs can travel almost 300 miles without refueling. Honda Clarity has the highest EPA driving rating for any zero-emission vehicle in the US. It has a driving range of up to 366 miles. Owing to these benefits, the demand for hydrogen fuel cell vehicles has increased. For instance, as per the data presented in a research paper published in May 2024, South Korea (19,270) and the US (12,283) are the leading countries in fuel cell vehicle adoption in the passenger car, buses, and truck segments. Government incentives and product development activities by key players for hydrogen vehicles are leading to increased demand for hydrogen infrastructure, ultimately driving the market.

Rising Investments in Renewable Energy and Hydrogen Generation Projects Worldwide

With rising urbanization and rapid industrial growth, energy consumption across the globe has proliferated. To meet this huge demand for power, there is a rapid increase in the launch of hydrogen-generated power projects. According to the Ember Climate Organization, total global energy demand reached ~13,393 TWh in the first quarter of 2022, an increase from 13,004 TWh compared to 2021. Such an increase in demand for energy and power, owing to rising residential and industrial manufacturing requirements, is driving the demand for hydrogen compressors. Renewable energy plays a significant role in making electricity. Per the International Energy Agency (IEA), the global demand for electricity is anticipated to increase by 2.1% annually by 2040.

Hydrogen Compressors Market Report Segmentation Analysis

Key segments that contributed to the derivation of the hydrogen compressors market analysis are type, technology, and end user.

- Based on type, the hydrogen compressors market is divided into lubricated and oil-free. The lubricated segment held a larger share of the market in 2023.

- Based on technology, the hydrogen compressors market is segmented into reciprocating hydrogen compressors, diaphragm hydrogen compressors, nonmechanical hydrogen compressors, and others. The reciprocating hydrogen compressors segment dominated the market in 2023.

- Based on end user, the market is categorized into power plants, oil and gas, food and beverages, petrochemical and chemical, hydrogen fueling station, hydrogen storage, and others. The petrochemical and chemical segment held the largest share of the market in 2023.

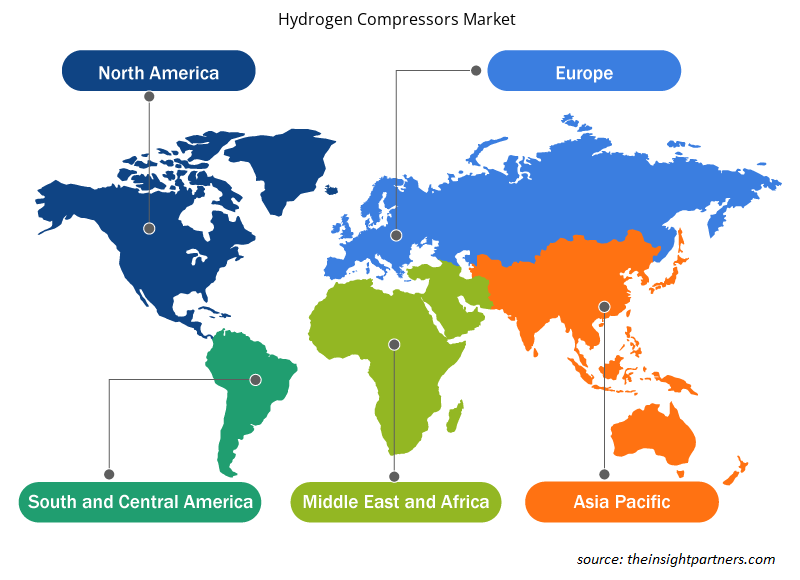

Hydrogen Compressors Market Share Analysis by Geography

The geographic scope of the hydrogen compressors market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The North America hydrogen compressor is segmented into the US, Canada, and Mexico. The market growth is attributed to a significant demand for hydrogen compressors owing to the growth in the oil and gas sector. Well-established infrastructure in developed countries, including the US and Canada, helps manufacturing firms explore the limits of science, technology, and commerce. Technological advancements have led to high competition in the manufacturing sector in the region. As per the National Institute of Standards and Technology (NIST), the manufacturing sector in the US was valued at US$ 2.9 trillion in 2023, accounting for a 10.0% share of its total GDP. Such prominent manufacturing and industrial sectors generate a vast demand for hydrogen as a clean fuel in North America, which, in turn, is projected to boost the hydrogen compressor market during the forecast period.

The US produces ~10 million metric tons of hydrogen per year, mainly used in petroleum refining and ammonia production. Hydrogen holds a significant potential to power zero-emission operations in chemical processes, clean energy systems, and transportation, among other applications. Hydrogen is also emerging as an attractive fuel in the functioning of data centers, ports, steel manufacturing facilities, and medium- to heavy-duty trucks. In January 2023, the Department of Energy (DOE) announced a US$ 8 billion investment in Regional Clean Hydrogen Hubs (H2Hubs) as part of the Infrastructure Investment and Jobs Act. These H2Hubs will showcase the entire clean hydrogen value chain, promoting production, processing, delivery, storage, and end-use applications. The DOE's efforts align with the Biden Administration's ambitious targets of achieving a carbon-free electric grid by 2035 and transitioning to a net-zero emissions economy by 2050. The funding aims to accelerate advancements in hydrogen technology and infrastructure, driving progress toward a more sustainable and environmentally friendly future in the US.

Hydrogen Compressors Market Regional Insights

The regional trends and factors influencing the Hydrogen Compressors Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Hydrogen Compressors Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Hydrogen Compressors Market

Hydrogen Compressors Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,913.04 Million |

| Market Size by 2035 | US$ 3,740.52 Million |

| Global CAGR (2023 - 2035) | 6.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2035 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Hydrogen Compressors Market Players Density: Understanding Its Impact on Business Dynamics

The Hydrogen Compressors Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Hydrogen Compressors Market are:

- Burckhardt Compression AG

- Atlas Copco AB

- Fluitron, Inc.

- Howden Group

- Gardner Denver Nash

- LLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Hydrogen Compressors Market top key players overview

Hydrogen Compressors Market News and Recent Developments

The hydrogen compressors market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A key development in the hydrogen compressors market is listed below:

- Howden signed a contract to provide three hydrogen diaphragm compressors for the Raven SR renewable hydrogen production facility in Richmond, California. (Source: Howden, Press Release, June 2022)

Hydrogen Compressors Market Report Coverage and Deliverables

The "Hydrogen Compressors Market Size and Forecast (2021–2035)" report provides a detailed analysis of the market covering below areas:

- Hydrogen compressors market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Hydrogen compressors market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Hydrogen compressors market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the hydrogen compressors market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Stage, End Users and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The hydrogen compressors market is expected to reach US$ 3,740.52 million by 2035; it is expected to register a CAGR of 6.0% during 2023–2035.

Middle East and Africa is anticipated to grow at the fastest CAGR over the forecast period.

The lubricated segment led the hydrogen compressors market with a significant share in 2023.

Atlas Copco AB; Howden Group; HAUG Sauer Kompressoren AG; Burckhardt Compression AG; Fluitron, Inc.; Gardner Denver Nash, LLC; NEUMAN & ESSER GROUP; Hydro-Pac, Inc.; Lenhardt & Wagner GmbH; PDC Machines Inc.; Sundyne; and Ariel Corporation are among the key players operating in the global hydrogen compressors market.

Rising development of electrochemical hydrogen compressor (EHC) is driving the market trend. The electromechanical hydrogen compressors are presently in the research and development stage and electrochemical reactions, ionic liquids, and metal hydrides.

Growing adoption of hydrogen fuel cell vehicles drives the market growth. Governments of various countries across the globe are continuously focusing on the development of eco-friendly solutions for various industries, including automotive, due to rising concerns associated with the depletion of natural resources and environmental degradation. In addition, a shift in consumer preferences owing to a surge in awareness related to the effects of air pollution and boosting levels of traffic and greenhouse gas emissions has driven the need for hydrogen fuel cell vehicles.

The hydrogen compressors market was valued at US$ 1,913.04 million in 2023 and is anticipated to grow at a CAGR of 6.0% over the forecast period.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - Hydrogen Compressors Market

- Atlas Copco AB

- Burckhardt Compression AG

- Fluitron, Inc.

- Gardner Denver Nash, LLC

- Howden Group

- HAUG Sauer Kompressoren AG

- NEUMAN & ESSER GROUP

- Hydro-Pac, Inc.

- Lenhardt & Wagner GmbH

- PDC Machines Inc.

Get Free Sample For

Get Free Sample For