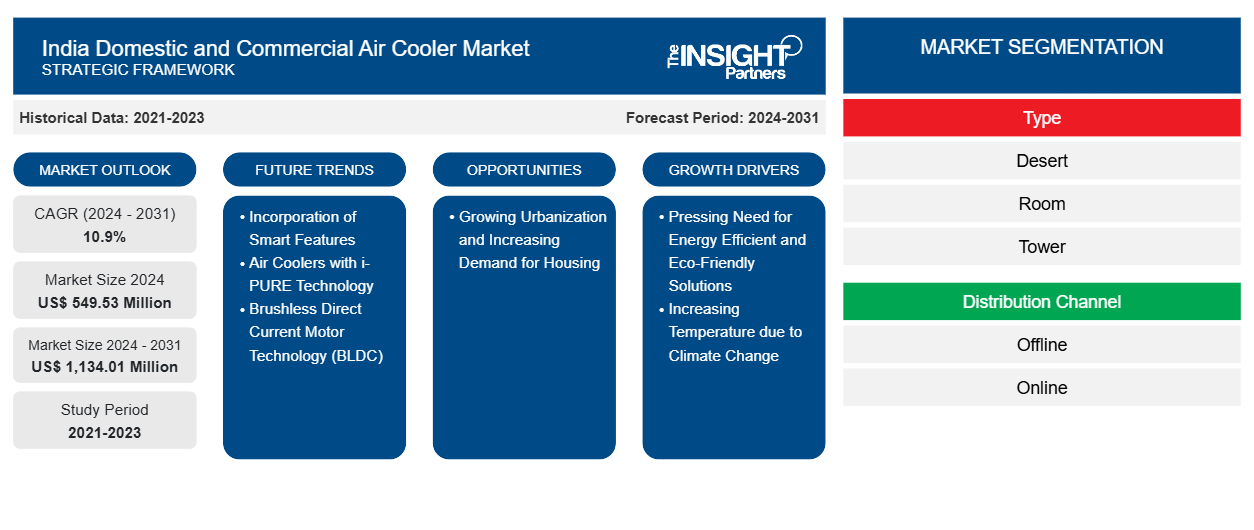

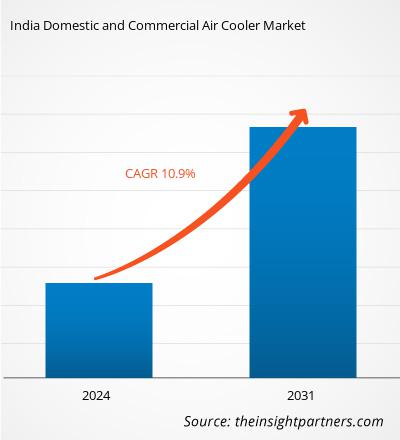

The India domestic and commercial air cooler market size is projected to reach US$ 1,134.01 million by 2031 from US$ 549.53 million in 2024. The market is expected to register a CAGR of 10.9% during 2024–2031. Air coolers with i-PURE technology are likely to bring new trends to the market in the coming years.

India Domestic and Commercial Air Cooler Market Analysis

An air cooler is a device that cools the air naturally through evaporation. It works by taking in warm air and directing it via water-soaked pads. As the air passes over the water, it evaporates and lowers the temperature of the air, which is then circulated back into the room. They are ideally suited to dry and hot conditions, where low humidity increases the cooling impact. Furthermore, air coolers are substantially less expensive than air conditioners in terms of initial purchase price. According to Voltas, air coolers range in price from INR 3,000 to INR 12,000, making them an affordable option for those looking for a basic cooling solution.

India Domestic and Commercial Air Cooler Market Overview

The India domestic and commercial air cooler market is predicted to witness strong growth due to the rising demand for energy-efficient and eco-friendly cooling solutions in the region. The growing environmental awareness, rising energy costs, and customers' inclination toward sustainable living are among the major reasons for the rise in the demand for air coolers in India. Also, India is witnessing a significant increase in the frequency and intensity of heat waves in its various regions, which is further fueling the demand for air coolers. In addition, the growing urbanization and increasing housing demand in various cities of India are further expected to fuel the growth of the India domestic and commercial air cooler market. Furthermore, the growing integration of cut-edge technologies such as i-PURE technology, Brushless Direct Current Motor Technology (BLDC), Wi-Fi connectivity, smartphone apps, and voice control capabilities is further propelling the growth of the India domestic and commercial air cooler market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

India Domestic and Commercial Air Cooler Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

India Domestic and Commercial Air Cooler Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

India Domestic and Commercial Air Cooler Market Drivers and Opportunities

Increasing Temperatures Due to Climate Change

Climate change has had a considerable impact on summer temperatures in India, and it is becoming a source of concern for the country's large population. India, with its numerous climate zones, is experiencing a noticeable increase in summer temperatures as a result of global climate change. Climate change has resulted in a significant increase in the frequency and intensity of heat waves in India. The India Meteorological Department (IMD) revealed that the annual mean land surface air temperature in 2024 was 25.75 degrees Celsius, 0.65 degrees Celsius higher than the long-term average (1991–2020), and the highest since records began in 1901. The average low temperature was 20.24 degrees Celsius, 0.90 degrees Celsius more than the norm, while the average maximum temperature was 31.25 degrees Celsius, 0.20 degrees higher than normal.

The year 2024 was recorded as the hottest year in India. Several cities in India witnessed record heat. Phalodi, a small village in Rajasthan, frequently endures severe temperatures due to its desert environment. In May 2024, it hit 50.8°C, making it one of India's hottest spots. Similarly, Nagpur recorded temperatures as high as 48.5°C. Also, the capital city, Delhi, registered 48.0°C, one of its hottest temperatures. Furthermore, it is expected that rising temperatures will continue beyond 2025. Hence, with the increasing temperature in the country, the demand for air coolers is continuously increasing as it is a cost-effective and energy-efficient tool for comfort. In addition, it is also an essential device for mitigating the effects of global warming.

Growing Urbanization and Increasing Demand for Housing

India is witnessing tremendous growth in the population. According to the report by the United Nations, India's population in 2024 was 1.45 billion and will reach ~1.69 billion in 2054. With this increase in population, there is also a rise in urbanization in the country. According to the World Bank Group, by 2036, the towns and cities in India will be home to 600 million people, or 40% of the population, up from 31% in 2011. Such growth in population and urbanization in the country is boosting the demand for housing, leading to a rise in the number of residential construction projects in the country. As per Jones Lang LaSalle IP, Inc., in the first half of 2024, ~159,455 residential units were launched, which is approximately 55% of the total units launched throughout the entire year of 2023. Also, during Q2 2024, Bengaluru, Mumbai, and Delhi NCR were the top cities in terms of new project launches, accounting for ~60% share. Among the three metro cities, Delhi NCR holds approximately 64% share. In addition, ~154,921 units were sold in the first half of 2024, with a 22% increase compared to the same period in 2023.

A few mega construction projects carried out in India are mentioned below.

- Terminus & NCC's The Line and Highline is a mixed-use residential-commercial project located in Kokapet, Hyderabad, Telangana.

- Sobha Neopolis is a residential construction project located in Panathur, Bangalore, with a construction cost of US$ 257.61 million (INR 2,226 crore) and a construction area of 4,637,286 sq. ft.

- ACE Starlit, a residential project, is being developed in a prime locality of Noida.

Thus, the growing number of residential projects in India is expected to fuel the demand for domestic and commercial air coolers during the forecast period.

India Domestic and Commercial Air Cooler Market Report Segmentation Analysis

Key segments that contributed to the derivation of the India domestic and commercial air cooler market analysis are type, distribution channel, area, tank size, air delivery, and end user.

- Based on type, the India domestic and commercial air cooler market is segmented into desert, room, tower, and window. The desert segment held the largest share of the market in 2024.

- In terms of distribution channel, the India domestic and commercial air cooler market is segmented into offline and online. The offline segment held a larger share of the market in 2024.

- Based on area, the India domestic and commercial air cooler market is segmented into urban and rural. The urban segment held a larger share of the market in 2024.

- In terms of tank size, the India domestic and commercial air cooler market is segmented into 50–125 liters, 20–50 liters, and above 125 liters. The 50-125 liters segment held the largest share of the market in 2024.

- Based on air delivery, the India domestic and commercial air cooler market is segmented into 1000–8500 CMH, 8500–2000 CMH, and above 20000 CMH. The 1000–8500 CMH segment held the largest share of the market in 2024.

- In terms of end user, the India domestic and commercial air cooler market is segmented into residential, commercial, and industrial. The residential segment held the largest share of the market in 2024.

India Domestic and Commercial Air Cooler Market Share Analysis by Geography

The geographic scope of the India domestic and commercial air cooler market report is mainly divided into four regions: Central and North, West, East, and South.

West held a significant market share in 2024. The West region comprises Maharashtra, Madhya Pradesh, Gujarat, Goa, Dadra and Nagar Haveli, and Daman and Diu. In various parts of Madhya Pradesh and Maharashtra, the rising mercury levels have been caused by a combination of geographical factors and changing weather patterns. In March 2024, Guna and Sagar in Madhya Pradesh were among the worst affected, with temperatures reaching 41.6 and 42.5°C, respectively. Both of these temperatures indicate a large divergence from the usual, resulting in an uncomfortable increase of more than 5 degrees Celsius above normal. A similar trend was observed in various districts of Maharashtra, where temperatures had risen above acceptable levels. Akola, in Maharashtra's Vidarbha area, was particularly hard impacted, with temperatures reaching 42.6 degrees Celsius. This is one of the highest temperatures recorded in the region in March 2024. Furthermore, in May 2024, Madhya Pradesh, Maharashtra, and Gujarat witnessed the maximum temperatures above 45°C. Thus, such a tremendous increase in the temperature compared to previous years is fueling the demand for air coolers in the region.

India Domestic and Commercial Air Cooler Market Regional Insights

The regional trends and factors influencing the India Domestic and Commercial Air Cooler Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses India Domestic and Commercial Air Cooler Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for India Domestic and Commercial Air Cooler Market

India Domestic and Commercial Air Cooler Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 549.53 Million |

| Market Size by 2031 | US$ 1,134.01 Million |

| Global CAGR (2024 - 2031) | 10.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | India

|

| Market leaders and key company profiles |

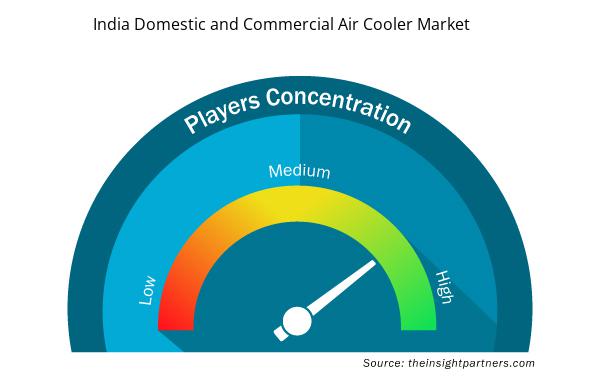

India Domestic and Commercial Air Cooler Market Players Density: Understanding Its Impact on Business Dynamics

The India Domestic and Commercial Air Cooler Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the India Domestic and Commercial Air Cooler Market are:

- Symphony Ltd

- Bajaj Electricals Ltd

- Havells India Ltd

- Honeywell International Inc

- Crompton Greaves Consumer Electricals Ltd

- Intex Technologies India Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the India Domestic and Commercial Air Cooler Market top key players overview

India Domestic and Commercial Air Cooler Market News and Recent Developments

The India domestic and commercial air cooler market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the India domestic and commercial air cooler market are listed below:

- Orient Electric Limited had expanded its already extensive lineup of air coolers with the addition of new high-capacity models across the Desert and Commercial categories. With larger tank capacities, advanced features, and superior performance, these high-capacity coolers cater to larger spaces and more demanding cooling needs. (Source: Orient Electric, Press Release, April 2024)

- Somany Home Innovation Limited (SHIL), makers of "Hindware Appliances," launched India's first foldable Air Cooler, "i-Fold," and a futuristic range of IoT-enabled Air Coolers. The new range is in sync with the growing need of consumers for building smart homes. (Source: Hindware Home Innovation Ltd., Press Release, March 2021)

India Domestic and Commercial Air Cooler Market Report Coverage and Deliverables

The "India Domestic and Commercial Air Cooler Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- India domestic and commercial air cooler market size and forecast at the country level for all the key market segments covered under the scope

- India domestic and commercial air cooler market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- India domestic and commercial air cooler market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the India domestic and commercial air cooler market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Hot Melt Adhesives Market

- Fertilizer Additives Market

- Adaptive Traffic Control System Market

- Virtual Production Market

- Retinal Imaging Devices Market

- Social Employee Recognition System Market

- Explosion-Proof Equipment Market

- 3D Audio Market

- Medical Audiometer Devices Market

- Smart Water Metering Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The India domestic and commercial air cooler market was valued at US$ 549.53 million in 2024 and is projected to reach US$ 1134.05 million by 2031; it is expected to grow at a CAGR of 10.9% during 2024–2031.

Pressing need for energy efficient and eco-friendly solutions and increasing temperature due to climate change are the driving factors impacting the India domestic and commercial air cooler market.

Brushless Direct Current Motor Technology (BLDC), increasing demand for customizable air coolers are the future trends of the India domestic and commercial air cooler market.

The India domestic and commercial air cooler market are expected to reach US$ 1134.05 million in the year 2031.

The South held the largest market share in 2024, followed by East.

The key players, holding majority shares, in India domestic and commercial air cooler market includes Symphony, Bajaj Electricals India, Havells India Ltd, and Crompton.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - India domestic and commercial air cooler market

- Symphony Ltd

- Bajaj Electricals Ltd

- Havells India Ltd

- Honeywell International Inc

- Crompton Greaves Consumer Electricals Ltd

- Intex Technologies India Ltd

- Voltas Ltd

- Blue Star Ltd

- Hindware Home Innovation Ltd

- Orient Electric Ltd

Get Free Sample For

Get Free Sample For