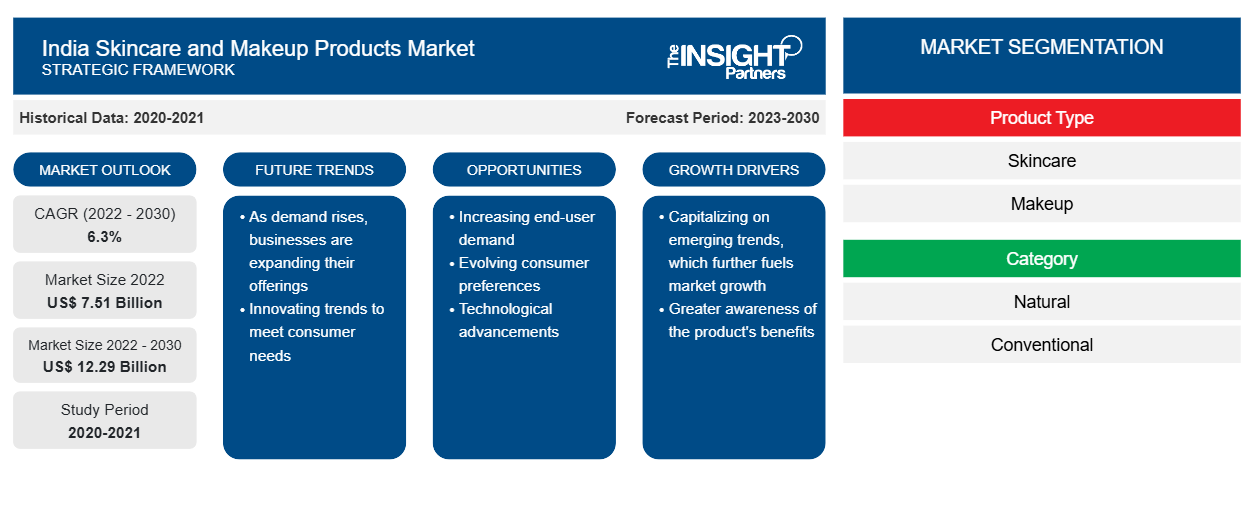

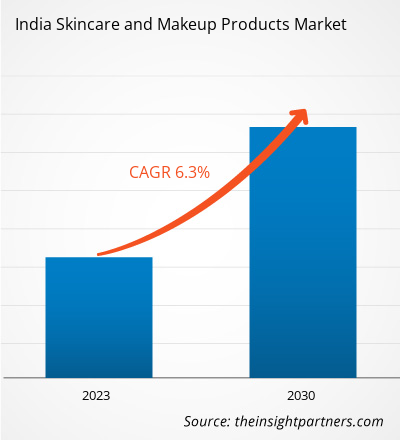

The India skincare and makeup products market size is expected to reach US$ 12.29 billion by 2030 from US$ 7.51 billion in 2022; the market is estimated to register a CAGR of 6.3% from 2022 to 2030.

Market Insights and Analyst View:

Skincare and makeup products play a significant role in enhancing one's appearance and maintaining healthy skin. Skincare products refer to a range of items designed to nourish, protect, and improve the condition of the skin. Cleansers, moisturizers, serums, and masks are a few examples of skincare products which have a significant India skincare and makeup products market share. The products contain ingredients that target specific concerns, including dryness, acne, or aging, promoting a radiant and youthful complexion. On the other hand, makeup products encompass a variety of cosmetics such as foundation, lipstick, eyeshadow, and mascara. These products are used to enhance facial features and create different looks. While skincare products focus on long-term skin health, makeup provides the tools to express individual style and boost confidence in the short term. Both skincare and makeup products are important as they allow individuals to care for their skin, address specific concerns, and create a personalized aesthetic, ultimately contributing to overall well-being and self-expression.

Growth Drivers and Challenges:

In recent times, awareness regarding skin health and appearance has increased significantly among consumers across India. Consumers seek skincare and makeup products that make their skin appear healthy, youthful, and radiant, as they are conscious about their appearance in social settings.

Moreover, rising disposable income of consumers increases their purchasing power. According to World Bank data, consumer expenditure in India increased from US$ 1.9 trillion in 2018 to US$ 2.4 trillion in 2022. According to the survey data published in the Journal of Emerging Technologies and Innovative Research (JETIR), in 2023, an average of 45% of consumers spent less than ₹500 on cosmetics every month, with 38% spending around ₹500–1,000 per month, 11% spending ₹1,000–2,000, and 5% spending over ₹2,000 on cosmetics every month. It was also seen that, on average, 65% of consumers purchase 1 to 3 cosmetic products every month. The data was collected online via a Google form based on the questionnaire developed by the researchers.

Availability of various regional and international brands in the market gives consumers access to a variety of products as per their skin type. Moreover, the demand for luxury cosmetics is increasing among millennials and Gen Z consumers, owing to their preference for grooming up regularly to look fashionable and presentable. Additionally, men are increasingly using cosmetics products, gradually breaking down gender stereotypes. All these factors significantly influence consumers to spend more on skincare and makeup products. Thus, the rising spending on skincare and makeup products by consumers in India drives the market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

India Skincare and Makeup Products Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

India Skincare and Makeup Products Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “India Skincare and Makeup Products Market Analysis and Forecast to 2030” is a specialized and in-depth study with a significant focus on market trends and growth opportunities. The report aims to provide a market overview with detailed market segmentation on the basis of product type, category, end user, and distribution channel. The market has witnessed high growth in the recent past and is expected to continue this trend during the forecast period. The report provides key statistics on the use of skincare and makeup products in India. In addition, the India skincare and makeup products market report provides a qualitative assessment of various factors affecting the market performance in the country. The report also includes a comprehensive analysis of the leading players in the market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, India skincare and makeup products market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

The India skincare and makeup products market forecast is estimated on the basis of various secondary and primary research findings such as key company publications, association data, and databases. Further, the ecosystem analysis and Porter's five forces analysis provide a 360-degree view of the market, which helps understand the entire supply chain and various factors affecting the market performance.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

The India skincare and makeup products market is segmented on the basis of product type, category, end user, and distribution channel. Based on product type, the market is segmented into skincare and makeup. The skincare segment held a larger share in 2022. Products used for cleaning, massaging, moisturizing, and other functions for body skin, particularly the face, hands, and feet, are considered under skincare. Cleansers, sunscreen, toners, creams and lotions, facial masks, serums, talc, shower gel, and soap are among the products considered under the skincare category. Skincare products are intended to protect the body from environmental toxins and enhance the quality of the skin. Common skin problems are eczema, acne, rosacea, and sunburn. The rising awareness about skincare routines and the increasing prevalence of skin diseases in the country boost the demand for skincare products.

Based on category, the India skincare and makeup products market is segmented into natural and conventional. The conventional segment dominated the India skincare and makeup products market share in 2022. Conventional products may contain chemicals such as paraben, synthetic colors, synthetic fragrances, or petroleum-based ingredients. Due to easy availability of raw materials and reduced cost of production, manufacturers are largely involved in producing and distributing conventional skincare and makeup products. Also, major market players are involved in research and development activities to create product differentiation and provide added functionality to conventional products. With the rising popularity of natural and organic skincare and makeup products, manufacturers are inclining toward product innovation with natural ingredients, which might drive the market growth for the conventional segment in the coming years.

Based on end user, the India skincare and makeup products market is segmented into men, women, unisex, and kids. The women segment dominated the market in 2022. In India, women spend more on skincare and makeup products than men. Young and working women are increasingly searching for skincare and beauty solutions. According to the data from the Periodic Labour Force Survey (PLFS July 2021–June 2022), 29.4% of women were part of India's labor force in 2021–2022. Thus, the high working women population in the country boosts the demand for cosmetics. Promoting beauty contests such as Miss India, Miss Diva, and Miss Supranational attracts more women toward beauty and skincare products across India. Thus, the demand for skincare and makeup products is high among women in India, which is expected to drive the India skincare and makeup products market growth for the segment in the coming years.

India Skincare and Makeup Products Market – by Distribution Channel, 2022 and 2030

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis:

The India skincare and makeup products market was valued at more than US$ 7 billion in 2022. In India, the beauty & cosmetics industry is among the fastest-growing sectors owing to the acceptance of Western culture in the country. In urban areas, there is an increase in customers' preference toward various skincare and makeup products due to the expanding disposable income, debut of innovative products, and intense advertising activities by manufacturers in the country. People face significant skin rashes and sensitivity in many regions due to environmental conditions such as dry air, cold, pollution, humidity, and UV rays. Therefore, they prefer skincare products with hydrating properties such as vitamin C serums, hyaluronic acid creams, moisturizers, and skin toners, which drive the India skincare and makeup products market growth. Increasing advertisements and promotional activities focused on targeting specific age groups, such as aging women and young population, boost the demand for age-group-associated skincare products. Moreover, the increasing working women population propels the demand for makeup products as they want to look young and radiant in social gatherings. The rising adoption of skincare and makeup products among male population in India is expected to drive the market growth during the forecast period. Consumers are discovering products and brands via advertisements and promotional campaigns on various social media platforms, including Instagram and Facebook. Before purchasing, they consider product reviews, other consumers' recommendations, celebrity endorsements, expert blog posts, and social media comments. Further, with growing consumer interest in cosmetics, manufacturers and third-party e-retailers are taking initiatives in launching or offering clean beauty products in their product portfolio. In June 2023, the e-commerce platform Purplle launched the UK's clean beauty brand Dr. PAWPAW in the Indian market, offering multi-tasking lip and skin care products. Investments by international beauty brands and the emergence of start-ups in the cosmetics sector are expected to boost the growth of the India skincare and makeup products market during the forecast period.

Competitive Landscape and Key Companies:

Lotus Herbals Pvt Ltd, The Procter & Gamble Co, Shiseido Co Ltd, Himalaya Wellness Co, L'oreal Sa, Unilever Plc, VLCC Personal Care Pvt Ltd, Avon Beauty Products India Pvt Ltd, Johnson & Johnson, and Beiersdorf Ag are among the key players profiled in the India skincare and makeup products market report. The market players focus on providing high-quality products to fulfill customer demand.

India Skincare and Makeup Products Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 7.51 Billion |

| Market Size by 2030 | US$ 12.29 Billion |

| Global CAGR (2022 - 2030) | 6.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | India

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Category, End User, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Consumer Goods : READ MORE..

The List of Companies - India Skincare and Makeup Products Market

- Lotus Herbals Pvt Ltd

- The Procter & Gamble Co

- Shiseido Co Ltd

- Himalaya Wellness Co

- L'oreal Sa

- Unilever Plc

- VLCC Personal Care Pvt Ltd

- Avon Beauty Products India Pvt Ltd

- Johnson & Johnson

- Beiersdorf Ag

Get Free Sample For

Get Free Sample For