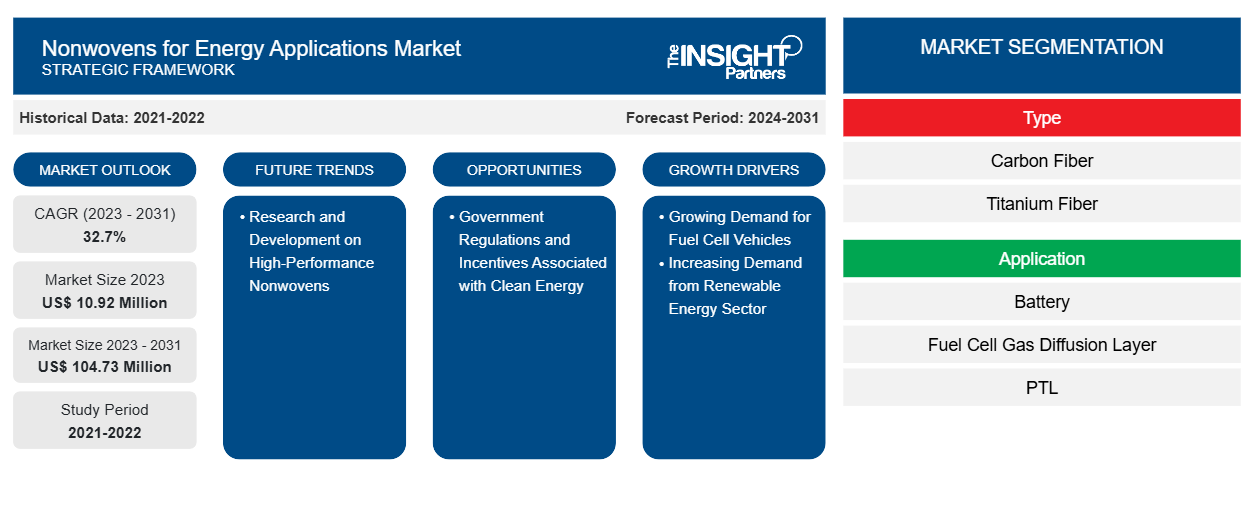

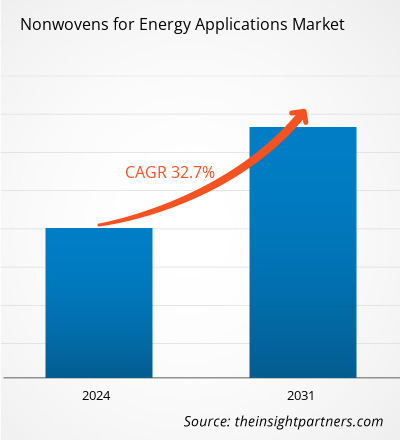

The nonwovens for energy applications market size is projected to reach US$ 104.73 million by 2031 from US$ 10.92 million in 2023. The market is expected to register a CAGR of 32.7% during 2023–2031. The research and development in high-performance nonwovens to cater to demanding applications across various industries are likely to bring new trends to the nonwovens for energy applications market.

Nonwovens for Energy Applications Market Analysis

The automotive industry’s transition toward green and sustainable technologies has catalyzed the development and adoption of fuel cell vehicles. As a result, the demand for advanced materials, including nonwovens, has increased. As per the Hydrogen Development Plan, China has set a goal to have 50,000 fuel cell vehicles on its roads by 2025. In July 2024, the US Department of Transportation announced the provision of US$ 1.5 billion to 117 public transportation projects with zero-emission and low-emission vehicles. Nonwovens are crucial components of fuel cell systems, enhancing performance and efficiency. In fuel cells, nonwovens are used for gas diffusion layer, proton exchange membranes, and insulation. Advancements in nonwoven manufacturing technologies, such as electrospinning and nanofiber production, are enhancing the performance characteristics of nonwoven materials.

Nonwovens for Energy Applications Market Overview

The nonwovens for energy application market is experiencing robust growth as industries seek advanced materials to enhance the performance, efficiency, and sustainability of energy systems. Nonwoven fabrics, known for their versatility, lightweight properties, and customizable characteristics, are increasingly being utilized in various energy-related applications, including batteries, fuel cells, and wind energy. In the energy storage sector, nonwoven carbon fiber materials are crucial for enhancing the performance of batteries and fuel cells. Carbon fiber nonwovens are used in the production of electrodes for batteries, where their conductive properties contribute to improved energy storage capacity and efficiency.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Nonwovens for Energy Applications Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Nonwovens for Energy Applications Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Nonwovens for Energy Applications Market Drivers and Opportunities

Increasing Demand from Renewable Energy Sector

The renewable energy sector is experiencing rapid growth due to widespread efforts to combat climate change and enhance energy security. According to the International Energy Agency 2023 report, the global renewable power capacity is expected to increase in the next five years, of which solar PV and wind energy accounted for 96% of power capacity, as their power generation costs are lower than fossil and nonfossil alternatives. Solar PV and wind energy capacity are forecasted to double by 2028 compared to 2022. The continuous growth in the economic attractiveness of the renewable energy industry coupled with increasing government policy support, especially in China, the US, the European Union, and India, are expected to accelerate capacity growth in the coming years. As per the Global Wind Energy Council, in 2022, a new wind power capacity of 77.6 GW was connected to power grids worldwide, recording a total installed wind capacity of 906 GW and registering growth of 9% compared with 2021.

Government Regulations and Incentives Associated with Clean Energy

Government policies have a significant influence on hydrogen fuel cells and clean energy technologies. These policies influence the demand for advanced materials, including nonwovens, critical for enhancing the performance and efficiency of energy systems. Governments of various countries across the globe have set ambitious targets to lower carbon emissions, encouraging the adoption of clean energy technologies. For instance, the EU aims to achieve net-zero emissions by 2050. Such stringent emission standards necessitate the development of efficient energy systems, boosting the demand for nonwovens in hydrogen fuel cells and clean energy technologies. A few governments are also designing strategies to promote green hydrogen production, using renewable energy sources to electrolyze water. In December 2023, the Energy Security Secretary (UK) announced the funding for 11 projects to produce green hydrogen through electrolysis. In May 2024, Hydrogen Ukraine and AB5 Consulting won a grant to develop its Renewable Hydrogen Project in Ukraine. The project was funded through Innovate Ukraine under the UK International Development.

Nonwovens for Energy Applications Market Report Segmentation Analysis

Key segments that contributed to the derivation of the nonwovens for energy applications market analysis are type and application.

- The nonwovens for energy applications market, based on type, is segmented into carbon fiber, titanium fiber, and others. The carbon fiber segment dominated the market in 2023.

- By application, the market is segmented into battery, fuel cell gas diffusion layer (GDL), PTL, and wind energy. The fuel cell gas diffusion layer (GDL) segment accounted for the largest share of the nonwovens for energy applications market in 2023.

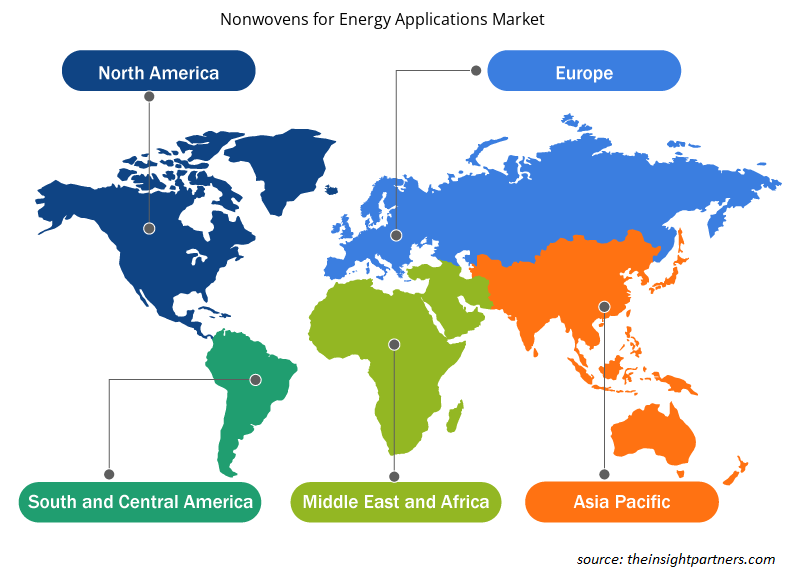

Nonwovens for Energy Applications Market Share Analysis by Geography

The geographic scope of the nonwovens for energy applications market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific held the largest market share in 2023 and is expected to register the highest CAGR during the forecast period. As battery technology continues to improve, Asia Pacific is expected to become a key hub for new energy vehicle production. China has emerged as one of the largest electric vehicle markets worldwide, supported by government policies promoting electric vehicles. According to the China Association of Automobile Manufacturers, ~6,000 fuel-cell electric vehicles were sold in China in 2023, a year-on-year rise of 72%. Several economies in Asia Pacific plan to expand the new energy vehicle industry in accordance with the government to support fuel cell electric vehicle growth in the region in the coming years. According to the hydrogen development plan released in 2022, China has set a goal to put 50,000 fuel cell vehicles on its roads by the end of 2025.

Nonwovens for Energy Applications Market Regional Insights

The regional trends and factors influencing the Nonwovens for Energy Applications Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Nonwovens for Energy Applications Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Nonwovens for Energy Applications Market

Nonwovens for Energy Applications Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 10.92 Million |

| Market Size by 2031 | US$ 104.73 Million |

| Global CAGR (2023 - 2031) | 32.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Nonwovens for Energy Applications Market Players Density: Understanding Its Impact on Business Dynamics

The Nonwovens for Energy Applications Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Nonwovens for Energy Applications Market are:

- Technical Fibers Products

- Tex Tech Industries Inc

- Freudenberg Group

- SGL Carbon SE

- Lydall Inc

- AstenJohnson Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Nonwovens for Energy Applications Market top key players overview

Nonwovens for Energy Applications Market News and Recent Developments

The nonwovens for energy applications market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the nonwovens for energy applications market are listed below:

- Technical Fibers Products announced a groundbreaking advancement in the field of battery technology with the introduction of its high-performance carbon fiber nonwovens. (Source: James Cropper PLC, Company News, July 2024)

- Toray Industries, Inc. announced the development of TORAYCA™ T1200 carbon fiber, the world’s highest strength at 1,160 kilopounds per square inch (Ksi). This new offering will encourage the company to reduce environmental footprints by lightening carbon-fiber-reinforced plastic materials. (Source: Toray Advanced Composites, Press Release, October 2023)

Nonwovens for Energy Applications Market Report Coverage and Deliverables

The “Nonwovens for Energy Applications Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Nonwovens for energy applications market size and forecast for all the key market segments covered under the scope

- Nonwovens for energy applications market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter’s Five Forces and SWOT analysis

- Nonwovens for energy applications market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the nonwovens for energy applications market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The growing demand for fuel cell vehicles and increasing demand from the renewable energy sector are the major factors responsible for the nonwovens for energy applications market growth.

The research and development on high-performance nonwovens is expected to emerge as a future trend in the market.

Technical Fibers Products, Tex Tech Industries Inc, Freudenberg Group, SGL Carbon SE, Lydall Inc, AstenJohnson Inc, Hoftex Group AG, DeatexGroup S.r.l., Sandler AG, and Glatfelter Corporation Sontara are among the leading market players.

The fuel cell gas diffusion layer (GDL) segment dominated the global nonwovens for energy applications market in 2023.

The carbon fiber segment held the largest share of the global nonwovens for energy applications market in 2023.

The market is expected to register a CAGR of 32.7% during 2023–2031.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Nonwovens for Energy Applications Market

- Technical Fibers Products

- Tex Tech Industries Inc

- Freudenberg Group

- SGL Carbon SE

- Lydall Inc

- AstenJohnson Inc

- Hoftex Group AG

- DeatexGroup S.r.l.

- Sandler AG

- Glatfelter Corporation

Get Free Sample For

Get Free Sample For