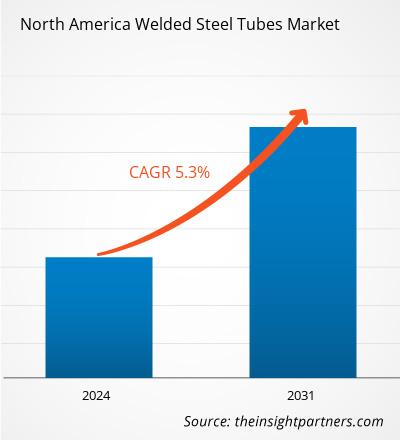

The North America welded steel tubes market size is projected to reach US$ 59.36 billion by 2031 from US$ 39.36 billion in 2023. The market is expected to register a CAGR of 5.3% during 2023–2031. The innovations in welding techniques are likely to bring new key trends in the market in the coming years.

North America Welded Steel Tubes Market Analysis

A business ecosystem is a network of organizations—material suppliers, welded steel tube manufacturers, retailers and authorized distributors, and end users—operating in the North America welded steel tubes market. Ecosystem analysis helps understand a brief overview of stakeholders engaged in offering solutions and providing the final solution to the end users.

Material suppliers or raw material providers play a crucial role in the ecosystem of the North America welded steel tubes market. Suppliers provide essential raw materials such as steel, carbon steel, stainless steel, boron, and alloys, which are used in the manufacturing of welded steel tubes. These materials help manufacturers develop products with enhanced durability, sustainability, and performance. These raw materials are essential in determining the final strength, corrosion resistance, and durability of welded steel tubes.

Welded steel tube manufacturers design, produce, and market welded steel tubes, ensuring product quality and compliance with regulatory standards. Manufacturers such as COREMARK Metals; Phillips Tube Group; ArcelorMittal, as well as various local players, operate in the North America welded steel tubes market. These manufacturers distribute their products directly to the end user or via retail and authorized distributors.

Retailers and authorized distributors facilitate the sale and distribution of welded steel tubes to end users. They provide crucial market access and customer support. A few examples of retailers and distributors are regional wholesalers and online marketplaces. A few end users of welded steel tubes are automotive, food and beverages, energy, and construction sectors.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Welded Steel Tubes Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Welded Steel Tubes Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Welded Steel Tubes Market Overview

High demand for residential and commercial complexes, a rise in government initiatives, and increased high-rise constructions are a few factors contributing to the growth of the construction industry. A few of the major projects involve the construction of residential buildings, commercial complexes, and industrial facilities, as well as infrastructure development. The rise in construction activities is mainly driven by urbanization, a rise in population, and economic growth. According to the data published by the Word Bank in 2023, approximately 56% of the total population in 2022, which is 4.4 billion persons, has been living in urban areas, while in 2010, 3.5 billion people were registered to be living in urban areas. Further, various countries in North America are experiencing a rise in construction spending aimed at improving and developing infrastructure, which leads to an increase in demand for scaffoldings. Scaffolding is another type of welded tube that is used during construction operations. For instance, in October 2024, the overall construction spending across the US reached ~US$ 2,174 billion (1.5% up from October 2023) compared to US$ 2,164.7 billion (1.2% up from September 2023) in September 2024. Thus, the growing use of construction scaffoldings fuels the growth of North America welded steel tubes.

Major companies and governments of various countries across North America are significantly focusing on reducing their carbon emissions and increasingly adopting green energy. With a rise in green energy demand, the need to develop green infrastructure projects is growing significantly. In 2024, the US government approved a commercial-scale offshore wind project to achieve approximately 15 gigawatts of energy. Similarly, in December 2024, the Canadian Cabinet Ministry announced an investment of more than US$ 1 billion for up to 670 megawatts of Indigenous-led wind projects through the Canada Infrastructure Bank (CIB) Clean Power priority sector and Indigenous Equity Initiative, as well as Natural Resources Canada’s Smart Renewables and Electrification Pathways program (SREPs). Such government initiatives to build green energy infrastructure are estimated to increase the demand for construction and safety materials, including welded steel tubes. Thus, the growing number of energy infrastructure development initiatives are expected to create lucrative opportunities for the North America welded steel tubes market growth during the forecast period.

Rapid industrialization and the growing integration of automation are a few factors that support the expansion of existing manufacturing facilities for different industrial products, such as welded steel tubes. The aerospace, defense, and industrial machinery industries rely majorly on steel tubes for respective structural and support components. Further, technological advancements in aerospace, defense, and industrial machinery products require a few modifications in their manufacturing processes and industrial facility design and structures. Furthermore, welded steel tubes are used to support innovation in aircraft design and materials fabrication for producing aircraft panels, as well as help modify facilities due to industrial automation. Thus, the increasing focus on advancements in industrial/manufacturing facilities is likely to generate new opportunities for players operating in the North America welded steel tubes market in the coming years.

North America Welded Steel Tubes Market Drivers and Opportunities

Surging Automotive Production

The growing automobile production, including commercial vehicles and passenger cars, drives the North America welded steel tubes market. A few of the major applications of welded steel tubes in vehicles are chassis and body frames, crash protection, heavy-duty vehicle frames, cargo bodies, suspension components, exhaust pipes and mufflers, brake lines, and roll cages and reinforcement bars. The components require different grades of welded steel tubes, and their demand is growing with the rise in vehicle production and their respective aftermarket replacements across the region. The vehicle production statistics for different countries in North America are mentioned below:

Production 2023 (Units)

Country | Passenger Cars | Commercial Vehicle |

USA | 1,745,171 | 8,866,384 |

Canada | 376,888 | 1,176,138 |

Mexico | 903,753 | 3,098,294 |

Source: OICA (International Organization of Motor Vehicle Manufacturers)

Production 2022 (Units)

Country | Passenger Cars | Commercial Vehicle |

USA | 1,751,736 | 8,308,603 |

Canada | 289,371 | 939,364 |

Mexico | 658,001 | 2,851,071 |

Source: OICA (International Organization of Motor Vehicle Manufacturers)

Increasing Focus on Advancements of Industrial/Manufacturing Facilities

Rapid industrialization and the growing integration of automation are a few factors that support the expansion of existing manufacturing facilities for different industrial products, such as welded steel tubes. The aerospace, defense, and industrial machinery industries rely majorly on steel tubes for respective structural and support components. Further, technological advancements in aerospace, defense, and industrial machinery products require a few modifications in their manufacturing processes and industrial facility design and structures. Furthermore, welded steel tubes are used to support innovation in aircraft design and materials fabrication for producing aircraft panels, as well as help modify facilities due to industrial automation. Thus, the increasing focus on advancements in industrial/manufacturing facilities is likely to generate new opportunities for players operating in the North America welded steel tubes market in the coming years.

North America Welded Steel Tubes Market Report Segmentation Analysis

Key segments that contributed to the derivation of North America welded steel tubes market analysis are steel grades, application, type, and coating type.

- Based on steel grades, North America welded steel tubes market is segmented into carbon base grades, boron grades, alloy grades, HSLA, AHSS, and others. The carbon base grades segment held the largest share of the market in 2023.

- In terms of application, the North America welded steel tubes market is segmented into exhaust, automotive, appliances, medical devices, HVAC, burner, conveyor belts, and others. The automotive segment dominated the market in 2023.

- Based on type, the North America welded steel tubes market is segmented into Electric Resistance Welding (ERW), Longitudinal Submerged Arc Welding (LSAW), and Spiral Submerged Arc Welded (SSAW). The Electric Resistance Welding (ERW) segment dominated the market in 2023.

- In terms of coating type, the North America welded steel tubes market is divided into clear coat and non-coated. The non-coated segment dominated the market in 2023.

North America Welded Steel Tubes Market Regional Insights

North America Welded Steel Tubes Market Regional Insights

The regional trends and factors influencing the North America Welded Steel Tubes Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses North America Welded Steel Tubes Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for North America Welded Steel Tubes Market

North America Welded Steel Tubes Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 39.36 Billion |

| Market Size by 2031 | US$ 59.36 Billion |

| Global CAGR (2023 - 2031) | 5.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Steel Grades

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

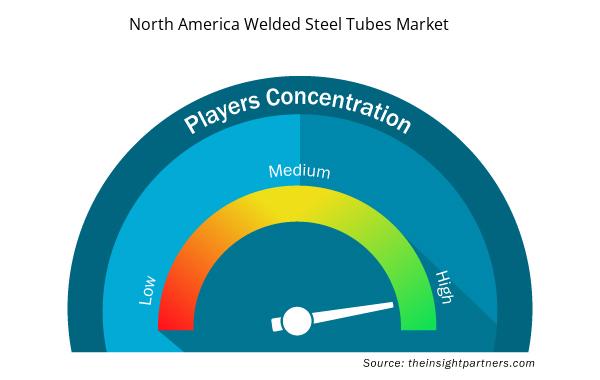

North America Welded Steel Tubes Market Players Density: Understanding Its Impact on Business Dynamics

The North America Welded Steel Tubes Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the North America Welded Steel Tubes Market are:

- COREMARK Metals

- Phillips Tube Group

- ArcelorMittal

- Markin Tubing

- Pennsylvania Steel Company, Inc

- Hofmann Industries, Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the North America Welded Steel Tubes Market top key players overview

North America Welded Steel Tubes Market Share Analysis

The geographic scope of the welded steel tubes market report offers a detailed country analysis in North America. The US dominated the North America welded steel tubes market in 2023, and it is expected to retain its dominance over the forecast period. The demand for modern infrastructure, industrialization, and growing population are a few of the prominent factors driving the US construction industry. For example, according to the US Commerce Department in August 2023, the US construction industry is experiencing growth with a rise in construction spending. In June 2023, the construction grew by 3.5% on a year-on-year basis. The increasing demand for infrastructure projects, including the construction of bridges, buildings, roads, and public infrastructure, leads to a growing need for strong, durable materials and welded steel tubes. These tubes can be used as horizontal and vertical load-bearing structures, such as columns, beams, trusses, and supports, in high-rise buildings, large factories, bridges, and TV towers. According to the U.S. Energy Information Administration’s Annual Energy Outlook 2023 (AEO2023), total energy consumption in the US will rise from 0% to 15% between 2022 and 2050, owing to economic and population growth, among other factors. The energy sector, particularly the oil and gas and renewable energy industries, is a significant driver for the welded steel tubes market in the country. Pipelines, used for the transportation of oil, natural gas, and water, heavily generate the need for welded steel tubes owing to their strength, corrosion resistance, and ability to handle high pressures. The US has a significant presence of many welded steel tube market players such as UNITED STEEL INDUSTRY CO., LTD; Yieh Corp; etc.

North America Welded Steel Tubes Market Report Coverage and Deliverables

The "North America Welded Steel Tubes Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- North America welded steel tubes market size and forecast at country levels for all the key market segments covered under the scope

- North America welded steel tubes market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- North America welded steel tubes market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the North America welded steel tubes market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The North America welded steel tubes market is expected to reach US$ 59.3 billion by 2031.

The key players holding majority shares in the North America welded steel tubes market are US Steel Corporation, Tenaris, JFE Steel Corporation, Vallourec, and Wheatland Tube.

Surging automotive production and growing use of construction scaffoldings are the major factors that propel the North America welded steel tubes market.

The North America welded steel tubes market was estimated to be US$ 39.3 billion in 2023 and is expected to grow at a CAGR of 5.3 % during the forecast period 2023 – 2031.

Innovations in welding techniques is anticipated to play a significant role in the North America welded steel tubes market in the coming years.

The incremental growth expected to be recorded for the North America welded steel tubes market during the forecast period is US$ 20 billion.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - North America Welded Steel Tubes Market

- COREMARK Metals

- Phillips Tube Group

- ArcelorMittal

- Markin Tubing

- Pennsylvania Steel Company, Inc.

- Hofmann Industries, Inc

- AMETEK Inc.

- Infra-Metals Co.

- Vest LLC

- RathGibsonn

Get Free Sample For

Get Free Sample For