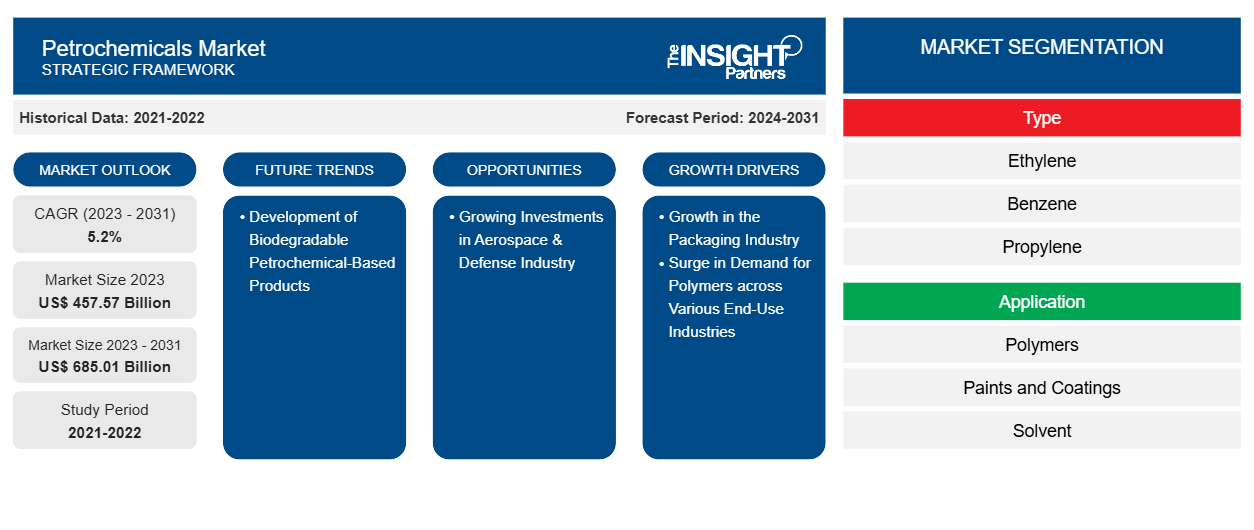

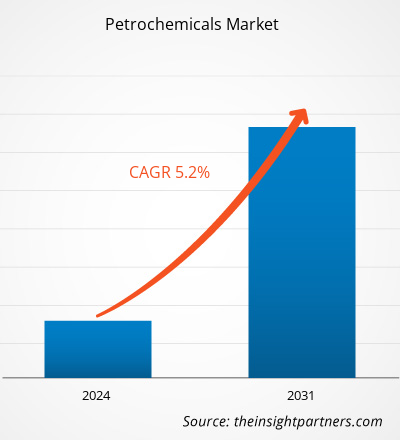

The petrochemicals market size is projected to reach US$ 685.01 billion by 2031 from US$ 457.57 billion in 2023. The market is expected to register a CAGR of 5.2% during 2023–2031. Due to the growing demand for packaging products, petrochemicals have gained traction across the globe. As petrochemicals are required to manufacture various polymers, their utilization is trending in various industries.

Petrochemicals Market Analysis

Petrochemicals play a major role in making packaging solutions, primarily due to their versatility, durability, and cost-effectiveness. The most common petrochemical-based plastics include polyethylene, polypropylene, polyethylene terephthalate (PET), polyvinyl chloride, and polystyrene. Polyethylene is widely used in plastic bags and film wraps due to its flexibility and moisture resistance, while PET is utilized in manufacturing beverage bottles. Moreover, petrochemical-based polymers such as polyamide, polypropylene, polystyrene, high-density polyethylene, thermoplastic elastomers, polyurethane, polycarbonate, and polyvinyl chloride are widely used in the automotive industry as these polymers offer excellent durability and resistance to corrosion.

Petrochemicals Market Overview

The petrochemicals market is a critical segment of the global chemical industry and involves production and distribution of chemicals derived from petroleum and natural gas. These chemicals are essential in manufacturing a wide range of products, such as packaging materials, polymers, synthetic fibers, industrial chemicals, solvents, and coatings, among others. One of the significant driving factors for the petrochemicals market is the growing demand for polymers across end-use industries. Polymers derived from petrochemicals have wide range of applications such as packaging, automotive, electronics, and construction. The automotive industry relies on plastics and polymers for manufacturing lightweight components that enhance fuel efficiency and reduce emissions. Technological advancement in petrochemical production processes have also propelled the market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Petrochemicals Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Petrochemicals Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Petrochemicals Market Drivers and Opportunities

Surge in Demand for Polymers across Various End-Use Industries

Petrochemical-based polymers such as polyamide, polypropylene, polystyrene, high-density polyethylene, thermoplastic elastomers, polyurethane, polycarbonate, and polyvinyl chloride are widely used in the automotive industry as these polymers offer excellent durability and resistance to corrosion. According to the CDI Products Company, the automotive industry is a significant consumer of polymers. These polymers enhance the longevity of automotive components, including interior parts and exterior body panels, as well as under-the-hood applications. As per the Plastics Europe 2023 report, the global production of plastics increased from 380.4 million tons in 2020 to 400.3 million tons in 2022.

According to the CDI Products Company, the automotive industry has various applications of petrochemical-based polymers, including PTFE seals, O-rings, bearings and thrust bearings, low-drag mudflaps, suspension cylinder seals, sensor covers, diaphragms, rotary seals, custom-made gaskets, wiring harnesses & housing, and battery sealing for pressure valves, among others. The EU registered the production of more than 9 million cars in the first three quarters of 2023, a rise of 14% from the same quarter in 2022, as per the European Automobile Manufacturers' Association. The growing utilization of polymers in the automotive industry, coupled with the developments in the automotive industry, fuels the demand for petrochemicals.

Growing Investments in Aerospace & Defense Industry

According to the European Commission, the European Union established Horizon Europe in 2021, a research and innovation program with a total budget of ~US$ 103 billion, which also focuses on aerospace research. Governments of various countries have increased investments in aerospace-related research, including defense and ballistic protection, owing to a rise in security risks and the need to enhance national border security. For instance, the Ministry of Defense (India) published a report in 2022 stating its target of increasing defense production to US$ 22 billion by 2025. The report also revealed that the government started initiatives such as Innovations for Defense Excellence and Technology Development Fund to provide financial assistance for product innovations for the Armed Forces. In the US, the aviation sector is significantly growing due to the presence of established aircraft manufacturers such as The Boeing Company and Gulfstream Aerospace Corporation. The aerospace manufacturing industry in Canada significantly produces aircraft components for commercial use, supported by funding from the government. According to the report by the International Trade Association, the government of Canada provided support of US$ 1.36 billion to the aerospace sector in 2021–2022, through Federal Strategic Innovation Fund. France is the home to five major aircraft manufacturers—Airbus SE (large commercial and military aircraft, drones, and spacecraft), Airbus Helicopters SAS, Dassault Aviation SA (high-end business jets, fighter aircraft, and UAVs), ATR (passenger and cargo turboprop aircraft for regional transport), and Daher (TBM and Kodiak light aircraft and business turboprops). As per the International Trade Administration (ITA), France has full-range military production capabilities, including fighter jets, nuclear submarines, aircraft carriers, and ballistic missile production.

According to the report by the International Trade Administration, the UAE government has invested in various initiatives in the aerospace industry, thus increasing the number of partnerships among market players and original equipment manufacturers (OEMs). In 2023, Markab Capital invested US$ 180 million to build a civil aircraft manufacturing facility in the UAE by signing an agreement with Super Jet International. The first production phase included an annual production capacity of 10–15 aircraft. Petrochemicals and petrochemical-derived products are used in lubricants, greases, aviation fuels, and aerospace components. Thus, the rising investments in the aerospace & defense industry are expected to create lucrative opportunities for the petrochemicals market growth during the forecast period.

Petrochemicals Market Report Segmentation Analysis

Key segments that contributed to the derivation of the petrochemicals market analysis are type, application, and end-use industry.

- Based on type, the petrochemicals market is segmented into ethylene, benzene, propylene, xylene, and others. The ethylene segment held the largest market share in 2023.

- By application, the market is categorized into polymers, paints and coatings, solvent, rubber, adhesives, surfactants, and others. The polymers segment held the largest share of the market in 2023.

In terms of end-use industry, the market is segmented into packaging, automotive, construction, electrical & electronics, healthcare, agriculture, aerospace & defense, and others. In 2023, the packaging segment dominated the market.

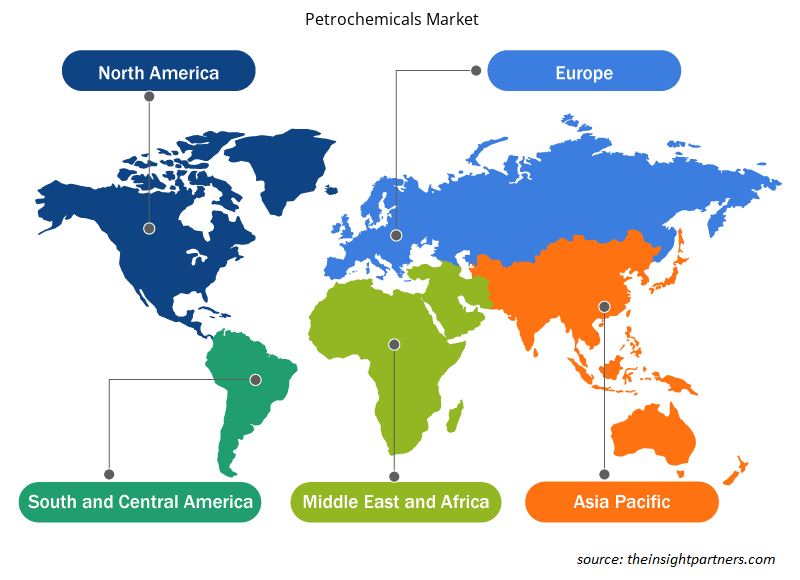

Petrochemicals Market Share Analysis by Geography

The geographic scope of the petrochemicals market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

In 2023, Asia Pacific dominated the petrochemicals market. The growth of the petrochemicals market in Asia Pacific is propelled by the region's robust economic development and industrialization. Asia Pacific countries are at the forefront of this market expansion, leveraging their extensive industrial bases, increasing consumer markets, and making strategic investments in petrochemical infrastructure to enhance their market presence. As rapid urbanization and infrastructure development in China, India, and Southeast Asian nations have led to increased construction activities, such as transportation networks, energy facilities, and public amenities, the construction industry has become a major consumer of petrochemicals. Under the Sustainable Development Goals 2030, the Asian Development Bank has announced its plans to build resilient infrastructure, promote inclusive and sustainable industrialization, and support product innovation in Asia Pacific.

Petrochemicals Market Regional Insights

The regional trends and factors influencing the Petrochemicals Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Petrochemicals Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Petrochemicals Market

Petrochemicals Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 457.57 Billion |

| Market Size by 2031 | US$ 685.01 Billion |

| Global CAGR (2023 - 2031) | 5.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Petrochemicals Market Players Density: Understanding Its Impact on Business Dynamics

The Petrochemicals Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Petrochemicals Market are:

- Shell International BV

- China Petroleum Corporation

- LyondellBasell Industries Holdings BV

- Chevron Phillips Chemical Company LLC

- SABIC

- BASF SE

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Petrochemicals Market top key players overview

Petrochemicals Market News and Recent Developments

The petrochemicals market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the petrochemicals market are listed below:

- Shell Deutschland GmbH has taken a final investment decision (FID) to convert the hydrocracker of the Wesseling site at the Energy and Chemicals Park Rheinland into a production unit for Group III base oils, used in making high-quality lubricants such as engine and transmission oils. Crude oil processing will be completed at the Wesseling site by 2025 but will continue at the Godorf site. (Source: Shell Deutschland GmbH, Press Release, January 2024)

- A joint venture between SABIC and Fujian Energy and Petrochemical Group Co. Ltd. (Fujian Energy Petrochemical) held a groundbreaking ceremony to mark the start of the full execution and construction phase of the SABIC Fujian Petrochemical Complex (Sino-Saudi Gulei Ethylene Complex Project) in Fujian Province, China. (Source: SABIC, Press Release, February 2024)

- In line with its customer-focused corporate strategy, BASF has expanded capacities for ethylene oxide and ethylene oxide derivatives at its Verbund site in Antwerp, Belgium. (Source: BASF SE, Press Release, October 2023)

Petrochemicals Market Report Coverage and Deliverables

The “Petrochemicals Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Petrochemicals market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Petrochemicals market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter’s Five Forces and SWOT analysis

- Petrochemicals market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the petrochemicals market

- Detailed company profiles

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The major players operating in the global petrochemicals market are Shell International BV, China Petroleum Corporation, LyondellBasell Industries Holdings BV, Chevron Phillips Chemical Company LLC, SABIC, BASF SE, BP Plc, INEOS, DOW Inc, and Mitsubishi Chemical Corp.

Growing investments in the aerospace & defense industry act as a significant future opportunity for the petrochemicals market. Governments of various countries have increased investments in aerospace-related research, including defense and ballistic protection, owing to a rise in security risks and the need to enhance national border security.

Ethylene is a colorless, flammable gas that has an odor and sweet taste. Ethylene can be sourced primarily from two natural sources, including both natural gas and petroleum. It is a crucial industrial chemical derived from petrochemicals. It is produced by either heating natural gas or petroleum to 800°C–900°C, where ethylene is separated from the mixture of gases. The melting point of ethylene is −169.4°C, and its boiling point is −103.9°C.

Asia Pacific accounted for the largest share of the global petrochemicals market. The growth of the petrochemicals market in Asia Pacific is propelled by the region's robust economic development and industrialization. The abovementioned countries are at the forefront of this market expansion, leveraging their extensive industrial bases, increasing consumer markets, and making strategic investments in petrochemical infrastructure to enhance their market presence.

Polymers segment is expected to grow at the fastest CAGR during the forecast period. A few of the key petrochemicals, such as ethylene, propylene, and benzene, serve as fundamental building blocks in polymer synthesis. Ethylene is polymerized to produce polyethylene; it is a type of plastic that is used in packaging materials, containers, and household goods. Propylene is crucial for making polypropylene, valued for its strength and flexibility in applications ranging from automotive parts to textiles.

Petrochemicals play a major role in making packaging solutions, primarily due to their versatility, durability, and cost-effectiveness. The most common petrochemical-based plastics include polyethylene, polypropylene, polyethylene terephthalate (PET), polyvinyl chloride, and polystyrene. Polyethylene is widely used in plastic bags and film wraps due to its flexibility and moisture resistance, while PET is utilized in manufacturing beverage bottles.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Petrochemicals Market

- BASF SE

- BP Plc

- Chevron Phillips Chemical Company LLC

- China Petroleum Corporation

- DOW Inc

- INEOS

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Corp.

- SABIC

- Shell International BV

Get Free Sample For

Get Free Sample For