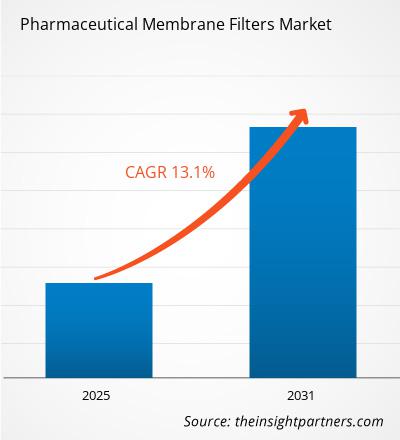

The Pharmaceutical Membrane Filters market size is projected to reach US$ 20,053.1 million by 2031 from US$ 8,470.0 million in 2024. The market is expected to register a CAGR of 13.1% during 2025-2031. Advancements in medical cable design are likely to bring new trends in the Pharmaceutical Membrane Filters market in the coming years.

Pharmaceutical Membrane Filters Market Analysis

The factors driving the pharmaceutical membrane filters market include the increasing demand for biopharmaceuticals and stringent regulatory requirements and quality assurance. Moreover, technological advancements in membrane filtration are expected to create future growth opportunities in the market.

Pharmaceutical Membrane Filters Market Overview

North America is expected to dominate the pharmaceutical membrane filters market, and Asia Pacific is expected to register significant growth owing to the rapidly expanding healthcare infrastructure, rising pharmaceutical production, increasing biologics adoption, and supportive regulations. China and India lead in manufacturing, Japan and South Korea focus on innovation, while Australia sees growing biotech investments, collectively fuelling market expansion. Likewise, Europe is experiencing strong growth in the market. Stringent EU regulations, rising biologics adoption, and increasing pharmaceutical manufacturing drive demand. Germany leads in innovation, the UK and France see strong R&D, while Italy and Spain expand production, collectively fuelling market expansion.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Pharmaceutical Membrane Filters Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Pharmaceutical Membrane Filters Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Pharmaceutical Membrane Filters Market Drivers and Opportunities

Stringent Regulatory Requirements and Quality Assurance Favors Market Growth

Stringent regulatory requirements and the growing emphasis on quality assurance in drug manufacturing drive the growth of the pharmaceutical membrane filters market. Regulatory bodies such as the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose strict guidelines on sterile filtration, ensuring the safety and efficacy of pharmaceutical products. At the same time, compliance with Good Manufacturing Practices (GMP) necessitates the adoption of high-quality filtration systems to prevent contamination. Standards such as USP 797 & 800 and ISO 14644 reinforce the need for pharmaceutical companies to use advanced membrane filters in sterile drug production. Quality assurance plays a critical role, as membrane filters are essential for sterility and contamination control, particularly in injectables, vaccines, and biologics, where stringent filter integrity tests (e.g., bubble point, diffusion, and pressure hold tests) are mandatory for regulatory compliance. The industry is witnessing a rising demand for single-use filtration systems, which enhance quality control and minimize cross-contamination risks, especially in biopharmaceutical production. The adoption of gene therapies and personalized medicine, which require advanced membrane filtration technologies, is increasing. For instance, as of March 2024, the US FDA approved 36 gene therapies, with an additional 500 therapies in the pipeline. The National Bureau of Economic Research projects that by the end of 2034, over 1 million patients will receive gene therapy treatments in the US, with annual costs exceeding US$ 25 billion. The FDA anticipates approving 10–20 new gene therapies annually by 2025. The expansion of contract development and manufacturing organizations (CDMOs) is driving demand for high-performance filtration solutions, while continuous technological advancements in nanofiltration and ultrafiltration are expanding market opportunities. As pharmaceutical manufacturers strive to meet evolving global regulations and ensure the highest quality standards, the demand for high-performance membrane filters is expected to grow significantly. As a result, pharmaceutical companies are actively enhancing their compliance and quality assurance systems to meet these rigorous standards. For instance, Sumitomo Pharma emphasizes adherence to various guidelines, including Good Laboratory Practice (GLP), Good Clinical Practice (GCP), and Good Manufacturing Practice (GMP), by auditing work procedures in research, development, and post-marketing activities to ensure reliability. Similarly, AstraZeneca has established a comprehensive global policy outlining top-level requirements to support product quality and compliance in the development, manufacture, and distribution of pharmaceutical products.

Technological Advancements in Membrane Filtration Ample Opportunities for Market Growth

The world of membrane filtration is evolving fast, with groundbreaking innovations creating fresh opportunities for industries such as pharmaceuticals, biotechnology, food and beverage, and water treatment. Companies are pushing the boundaries of efficiency, durability, and automation to meet demands. Whether improving drug production, ensuring safer drinking water, or optimizing food processing, the latest advancements—such as nanofiber membranes, smart filtration systems, and automation—are transforming the landscape. Manufacturers investing in research and development (R&D) to create next-generation filtration technologies are well-positioned to lead in a market that’s expanding at an unprecedented pace.

One of the breakthroughs in this space is nanofiber membrane technology. Traditional filtration systems often struggle with issues such as clogging, reduced lifespan, and inconsistent performance. Nanofiber membranes solve these problems by offering a higher surface area, allowing for better filtration efficiency and longer-lasting performance. Their enhanced mechanical strength and resistance to chemicals make them ideal for industrial use, especially in the pharmaceutical sector, where purity and sterility are non-negotiable. With rising demand for high-capacity filtration in drug manufacturing, vaccine production, and bioprocessing, these advanced membranes provide a scalable and cost-effective solution that improves efficiency and reduces maintenance issues.

The smart filtration systems are changing how industries monitor and manage filtration processes. By integrating the Internet of Things (IoT), manufacturers are embedding sensors within filtration units to provide real-time insights into pressure levels, filter health, and potential blockages. These systems detect problems and predict them, allowing businesses to perform maintenance before failures occur. This kind of predictive technology is particularly valuable for pharmaceutical and biotech companies, where maintaining precise filtration standards is critical for safety, compliance, and efficiency. As industries move toward digitalization, the demand for IoT-enabled filtration systems is skyrocketing, making it a huge market opportunity. Another game-changer is automated filtration. Traditionally, filtration systems required constant human monitoring, which led to higher costs and the risk of errors. Now, self-cleaning mechanisms, automated backflushing, and adaptive process controls are making filtration systems more reliable and efficient. Industries such as food and beverages are quickly adopting these automated solutions for dairy processing, juice clarification, and water purification. The ability to reduce water and energy consumption while ensuring consistent product quality makes automation an attractive investment for companies looking to cut costs and improve sustainability.

For pharmaceutical manufacturers, these advancements couldn’t come at a better time. The industry is expanding rapidly, particularly in biologics and vaccine production, where high-throughput filtration is essential. Traditional methods often struggle with scalability, but modern solutions—such as nanofiber membranes and smart filtration—allow for more efficient processing without sacrificing quality. Further, strict regulatory standards from agencies such as the FDA and EMA require companies to invest in top-tier filtration technology to maintain compliance and avoid costly production. The water and wastewater treatment sector is set to benefit significantly from advanced membrane filtration. With global concerns over water scarcity and contamination on the rise, industries and municipalities are actively seeking effective purification technologies. Nanofiber membranes are proving highly effective in removing bacteria, viruses, and micropollutants, making them suitable for desalination, wastewater recycling, and potable water production. The integration of smart sensors further enhances efficiency, optimizing chemical use and filtration cycles to lower operating costs.

Investing in R&D for next-generation membrane filtration is perceived as a winning strategy to gain a competitive edge. Companies that innovate in this space will meet the rising demand for precision filtration and position themselves as leaders in an industry that is shifting toward automation, digitalization, and sustainability. Major players are forming strategic partnerships, exploring advanced materials, and integrating AI-driven monitoring systems to expand their businesses. For instance,

- In 2025, Cleanova expanded its portfolio by acquiring Allied Filter Systems Ltd, a UK-based company renowned for high-quality liquid filtration systems. This move aligns with Cleanova's strategy to pioneer advanced filtration solutions and strengthen its commitment to customer-centric innovation.

- In 2024, ABB enhanced its capabilities in smart water management by acquiring Real Tech, a Canadian supplier of optical sensor technology. This acquisition enables real-time water monitoring and testing, integrating advanced sensor technology into ABB's portfolio.

- In 2024, Donaldson Company, Inc. acquired a 49% stake in Medica S.p.A., an Italian firm specializing in medical filtration solutions. This investment supports Donaldson's strategy to expand its life sciences segment and leverage Medica's expertise in advanced filtration materials.

By embracing nanofiber technology, IoT-driven smart systems, and automation, manufacturers are making filtration more efficient, reliable, and cost-effective. The companies prioritizing innovation in filtration technology are expected to gain prominence in the market share. Key developments in this area include:

- Elmarco has developed the Nanospider, an industrial-scale machine pivotal in producing pure nanofiber HEPA-grade filter media. This technology has been instrumental in advancing high-efficiency air filtration applications.

- RESPILON, a nanofiber R&D company, has introduced NUENEX, a unique nanofiber production technology. This innovation transforms existing drugs into a revolutionary personal delivery system in the form of an invisible patch, showcasing the versatility of nanofiber applications.

- Turkey-based HiFyber has introduced a new multilayer, fully synthetic, energy-saving, and pleatable nanofiber media. This development responds to the demand for filters that consume less energy, addressing economic and environmental concerns.

Pharmaceutical Membrane Filters Market Report Segmentation Analysis

Key segments that contributed to the derivation of Pharmaceutical Membrane Filters market analysis are material, technology, design, and end user.

- Based on material, the pharmaceutical membrane filters is segmented into Polyethersulfone (PES), Polysulfone (PS), Cellulose-Based, Polytetrafluoroethylene (PTFE), Polyvinyl Chloride (PVC), Polyacrylonitrile (PAN), and Others. The Polyethersulfone segment held the largest share of the market in 2024 and is expected to register a higher CAGR in the market during 2024-2031.

- By design, the pharmaceutical membrane filters market is segmented into spiral wound, tubular system, hollow fiber, plate & frame. The hollow fiber segment held the largest share of the market in 2024, and this segment is expected to register the highest CAGR in the market during 2024-2031.

- As per end user, the pharmaceutical membrane filters market is segmented into pharmaceutical and biotech industries and CROs and CDMOs. The pharmaceutical and biotech industries segment dominated the market in 2024 and is expected to register a higher CAGR in the market during 2024-2031.

- In terms of technology, the medical injection molding market is segmented into reverse osmosis, microfiltration, ultrafiltration, and nanofiltration. The microfiltration segment dominated the market in 2024, and the nanofiltration segment is anticipated to register the highest CAGR during 2024-2031.

Pharmaceutical Membrane Filters Market Share Analysis by Geography

The geographical scope of the pharmaceutical membrane filters market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America held a significant share of the market in 2023, driven by a robust biopharmaceutical industry, stringent regulatory standards, and increasing demand for sterile drug manufacturing. Rising investments in bioprocessing, the adoption of single-use filtration technologies, and advancements in precision medicine fuel the region's dominance. According to industry reports, North America accounts for over 35% of the global pharmaceutical filtration market, with the US leading due to the presence of key players and a strong R&D ecosystem. Additionally, the growing prevalence of chronic diseases and expanding vaccine production accelerate market growth in the region.

Pharmaceutical Membrane Filters Market Regional Insights

The regional trends and factors influencing the Pharmaceutical Membrane Filters Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Pharmaceutical Membrane Filters Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Pharmaceutical Membrane Filters Market

Pharmaceutical Membrane Filters Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 8,470.0 Million |

| Market Size by 2031 | US$ 20,053.1 Million |

| Global CAGR (2025 - 2031) | 13.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

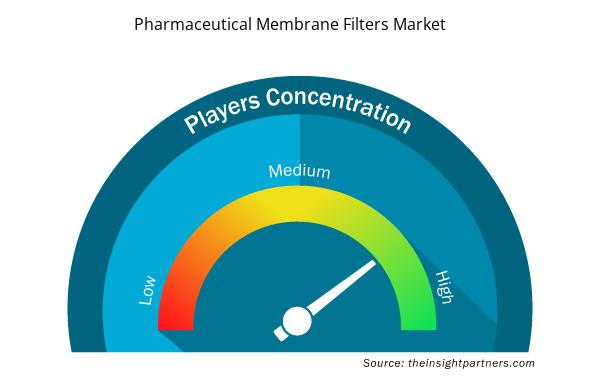

Pharmaceutical Membrane Filters Market Players Density: Understanding Its Impact on Business Dynamics

The Pharmaceutical Membrane Filters Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Pharmaceutical Membrane Filters Market are:

- Sartorius AG

- Parker Hannifin Corporation

- Repligen Corporation

- Asahi Kasei Corporation

- GEA Group

- Alfa Laval

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Pharmaceutical Membrane Filters Market top key players overview

Pharmaceutical Membrane Filters Market News and Recent Developments

The pharmaceutical membrane filters market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the pharmaceutical membrane filters market are listed below:

- In 2023, Meissner Corporation revealed plans to invest nearly US$ 250 million in a new manufacturing facility in Athens-Clarke County, Georgia. This expansion is expected to create over 1,700 jobs over the next eight years and will include state-of-the-art cleanroom facilities, laboratories, and R&D spaces. The new site aims to enhance Meissner's production capabilities for advanced microfiltration and single-use systems, supporting the pharmaceutical and bioprocessing industries.

- In 2024, Asahi Kasei Pharma entered into an exclusive licensing agreement with Chiome Bioscience for a humanized anti-CX3CR1 antibody. This strategic partnership aligns with Asahi Kasei's Open Innovation platform, aiming to address unmet medical needs through collaborative efforts and advanced scientific research.

Pharmaceutical Membrane Filters Market Report Coverage and Deliverables

The “Pharmaceutical Membrane Filters Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Pharmaceutical membrane filters market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Pharmaceutical membrane filters market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Pharmaceutical membrane filters market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the pharmaceutical membrane filters market and detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Broth Market

- Compounding Pharmacies Market

- Artificial Turf Market

- Resistance Bands Market

- Vision Care Market

- Arterial Blood Gas Kits Market

- EMC Testing Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- Pharmacovigilance and Drug Safety Software Market

- Public Key Infrastructure Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global pharmaceutical membrane filters market is estimated to register a CAGR of 13.1% during the forecast period.

North America dominated the pharmaceutical membrane filters market in 2024.

The estimated value of the Pharmaceutical Membrane Filters market can reach US$ 20053.1 million by 2031.

The increasing demand for biopharmaceuticals. and stringent regulatory requirements and quality are the most influential factors responsible for market growth.

Thermo Fisher Scientific Inc, Merck KGaA, Danaher Corporation, 3M, Sartorius AG, Repligen Corporation, Parker Hannifin Corporation, Asahi Kasei Corporation, GEA Group, Alfa Laval, TAMI Industries, Membrane Solutions, Koch Industries, W L Gore and Associates Inc, and Meissner Filtration Products, Inc are among the key players operating in the pharmaceutical membrane filters market.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Pharmaceutical Membrane Filters Market

- Sartorius AG

- Parker Hannifin Corporation,

- Asahi Kasei Corporation,

- GEA Group,

- Alfa Laval,

- TAMI Industries,

- Membrane Solutions,

- Koch Industries,

- W L Gore and Associates Inc,

- Meissner Filtration Products, Inc.

- Thermo Fisher Scientific Inc,

- Merck KGaA,

- Danaher Corporation

- 3M.

- Repligen Corporation

Get Free Sample For

Get Free Sample For