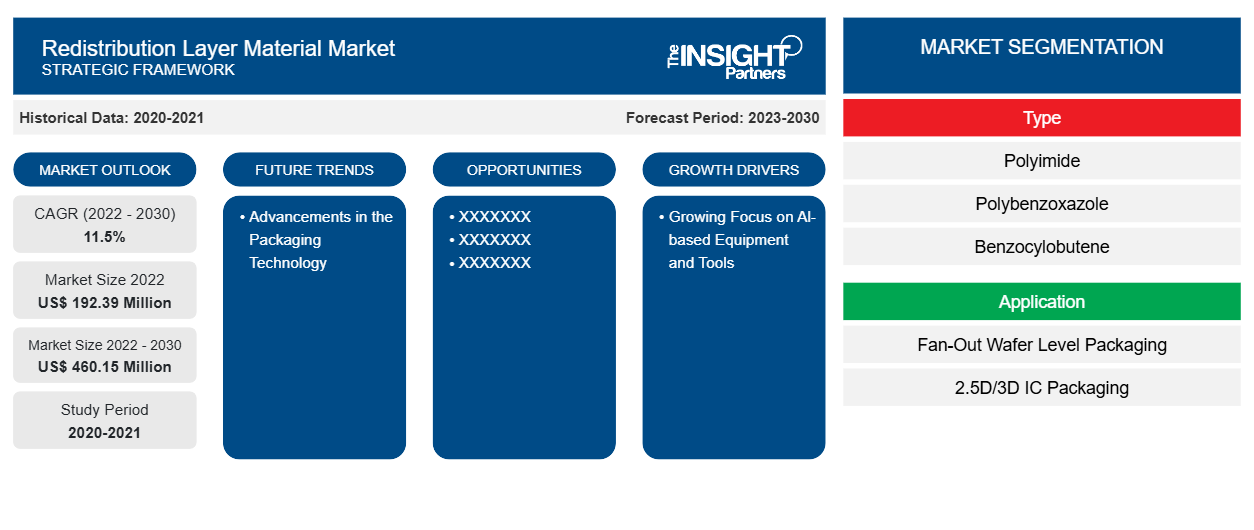

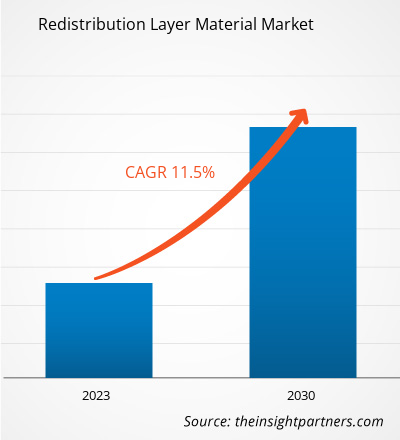

[Research Report] The redistribution layer material market size is expected to grow from US$ 192.39 million in 2022 to US$ 460.15 million by 2030; it is estimated to record a CAGR of 11.5% from 2022 to 2030.

Market Insights and Analyst View:

The advanced packaging process starts at the die level, where the objective is always to lessen the die sizes without compromising the input-output (I/O) density. Several other budding packaging technologies play a key role in the heterogeneous integration of devices. Wafer-level fan-out packaging (WLFO) is one of the major packaging technologies that has emerged as a comprehensive packaging process. The WLFO process earlier had only single-die designs, i.e., a single redistribution layer (RDL) on one side of a reconstituted wafer. RDL acts as a crucial step in advanced wafer packaging. RDL serves as a rerouting of the I/O layout and allows a higher I/O number. A high I/O density usually creates better electrical performance, as more outputs result in faster electrical signals between the die and minimize the risk posed by electrical shorts. Besides, a higher I/O density enables the package to achieve better performance simultaneously. Moreover, the Asia's strategic location as a global manufacturing hub, coupled with competitive production costs, has attracted multinational corporations looking to optimize their supply chains. This has created a robust ecosystem for the redistribution layer material market, with various suppliers and manufacturers establishing a presence in the region. This factor is significantly driving the global redistribution layer material market growth.

Growth Drivers and Challenges:

Redistribution layer (RDL) materials are fundamental in enabling the miniaturization of semiconductor packages, which is essential to accommodate the increasing complexity of AI devices. The quest for more advanced AI capabilities necessitates the development of compact and densely integrated hardware components. As AI systems become more sophisticated, the demand for smaller and more efficient components grows. Thus, the growing demand for AI-based equipment and tools is driving the redistribution layer material market. Furthermore, the global redistribution layer material market is experiencing significant growth, driven primarily by the surging demand from two key industries: automotive and telecommunication. The ever-expanding production needs of the automotive industry propel the growth of the market. According to the ISEAS-Yusof Ishak Institute, Southeast Asia is an important automobile production base. Southeast Asia is the seventh largest automotive manufacturing hub worldwide and produced 3.5 million vehicles in 2021. However, fluctuations in raw material prices pose a significant challenge to the growth of the global redistribution layer material market. These price changes can have a significant impact on the industry, affecting production costs, pricing strategies, and overall market stability. One of the key issues is the dependency on imported raw materials. Many essential components for redistribution layer materials, such as specialized polymers, metals, and chemicals, are often sourced from international suppliers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Redistribution Layer Material Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Redistribution Layer Material Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

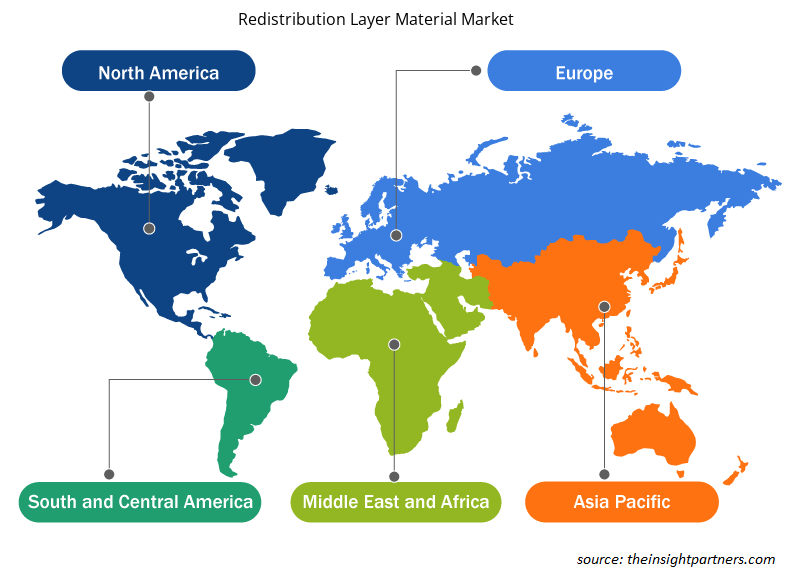

The global redistribution layer material market is bifurcated on the basis of type and application. Based on type, the redistribution layer material market is segmented into polyimide (PI), polybenzoxazole (PBO), benzocylobutene (BCB), and others. Based on application, the redistribution layer material market is bifurcated into fan-out wafer level packaging (FOWLP) and 2.5D/3D IC packaging. Geographically, the market is categorized into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, South Africa, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

Based on type, the redistribution layer material market is segmented into polyimide (PI), polybenzoxazole (PBO), benzocylobutene (BCB), and others. The polyimide (PI) segment held the largest market share in 2022. Polyimides are polymer-based thermoplastics with a high melt viscosity and require higher pressures for forming molded parts. Polyimides offer good chemical resistance, high mechanical strength, higher thermal stabilities, and exceptional electrical properties. For the IC packaging methods, polyimides are used as high-temperature adhesives, mechanical stress buffers, and as a film supporting the micro-sized circuitry. The only drawback with polyimides used was higher cure temperatures, while packaging demands lower cure temperatures. Several material suppliers have thus focused on providing polyimides with lower cure temperatures. PI is majorly used in all the flip-chip wafer bumping and WLP applications. Based on application, the redistribution layer material market is bifurcated into fan-out wafer level packaging (FOWLP) and 2.5D/3D IC packaging [high bandwidth memory (HBM), multi-chip integration, package on package (FOPOP), and others]. The redistribution layer material market share of the 2.5D/3D IC packaging segment was notable in 2022. The increased costs of lithography steps and wafer processing in general at the next-generation silicon nodes are driving the industry to find alternatives to improve the performance and functionality of electronic devices. Additionally, the need to integrate disparate technologies such as logic, memory, RF, and sensors in small form factors is driving the industry toward 3D integration as a solution.

Regional Analysis:

The redistribution layer material market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. Asia Pacific dominated the global redistribution layer material market, which accounted for ∼US$ 150 million in 2022. North America is also a major contributor, holding a significant global redistribution layer material market share. The North America redistribution layer material market is expected to reach over US$ 60 million by 2030. Europe is anticipated to record a considerable CAGR of over 10% from 2022 to 2030. The Asia Pacific redistribution layer material market, by country, is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. The market is driven by the growing demand for redistribution layer material by the automotive and telecommunication industries. Taiwan dominates the regional market, followed by countries such as China, South Korea, Japan, and Vietnam. The region is considered a global manufacturing hub owing to the presence of diverse manufacturing industries. With China’s evolution into a high-skilled manufacturing hub, developing countries such as India, South Korea, Taiwan, and Vietnam are attracting several businesses that plan to relocate their low to medium-skilled manufacturing facilities to neighboring countries, which results in reduced labor costs.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the redistribution layer material market are listed below:

- In August 2022, ASE Technology hosted a ceremony for the construction of a new semiconductor assembly and testing facility in Penang, Malaysia. The new facility at ASE Malaysia (ASEM) will comprise two buildings (Plants 4 and 5) with a built-up area of 982,000 square feet, located in the Bayan Lepas Free Industrial Zone.

- In July 2021, DuPont Mobility & Materials announced its plan to invest US$ 5 million in capital and operating resources at its manufacturing facilities in Germany and Switzerland to increase capacity for its high-performance automotive adhesives.

COVID-19 Pandemic Impact:

The COVID-19 pandemic adversely affected almost all industries in various countries. Lockdowns, business shutdowns, and travel restrictions in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA) hampered the growth of several industries, including the chemical & materials industry. The shutdown of manufacturing units disturbed global supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. Various companies reported delays in product deliveries and a slump in their product sales in 2020. Due to the pandemic-induced economic recession, consumers became cautious and selective in purchasing decisions. Consumers significantly reduced nonessential purchases due to lower incomes and uncertain earning prospects, especially in developing regions. Many redistribution layer material manufacturers reported declining profits due to reduced consumer demand during the initial phase of the pandemic. However, by the end of 2021, many countries were fully vaccinated, and governments announced relaxation in certain regulations, including lockdowns and travel bans. There has been a rise in disposable income of the population, due to which the focus on purchasing new furniture and renovation has increased, which boosted the demand for redistribution layer materials. All these factors boost the growth of the redistribution layer material market across different regions.

Redistribution Layer Material Market Regional Insights

Redistribution Layer Material Market Regional Insights

The regional trends and factors influencing the Redistribution Layer Material Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Redistribution Layer Material Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Redistribution Layer Material Market

Redistribution Layer Material Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 192.39 Million |

| Market Size by 2030 | US$ 460.15 Million |

| Global CAGR (2022 - 2030) | 11.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

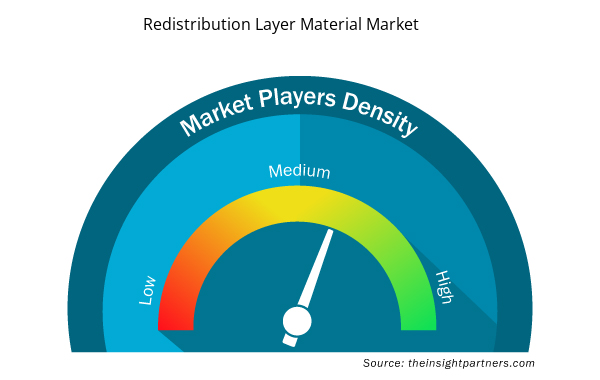

Redistribution Layer Material Market Players Density: Understanding Its Impact on Business Dynamics

The Redistribution Layer Material Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Redistribution Layer Material Market are:

- SK Hynix Inc

- Samsung Electronics Co Ltd

- Infineon Technologies AG

- Dupont De Nemours Inc

- Fujifilm Holdings Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Redistribution Layer Material Market top key players overview

Competitive Landscape and Key Companies:

SK Hynix Inc, Samsung Electronics Co Ltd, Infineon Technologies AG, Dupont De Nemours Inc, Fujifilm Holdings Corp, Amkor Technology Inc, ASE Technology Holding Co Ltd., NXP Semiconductors NV, JCET Group Co Ltd, and Shin-Etsu Chemical Co Ltd are among the prominent players operating in the global redistribution layer material market. These players offer high-quality redistribution layer material and cater to many consumers across the world.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The Internet of Things (IoT) market across the globe has gained considerable popularity recently, with businesses acknowledging the significance of connectivity. IoT has enabled each device to be connected to the Internet. According to the International Data Corporation (IDC), 41.6 billion IoT devices will be in 2025, capable of generating 79.4 zettabytes (ZB) of data. This exponential increase in data traffic over the internet is due to the increasing penetration of smartphones and other consumer electronics that can be connected to the internet due to the rising popularity of IoT.

Based on type, the redistribution layer material market is segmented into polyimide (PI), polybenzoxazole (PBO), benzocylobutene (BCB), and others. The polyimide (PI) segment held the largest market share in 2022. Polyimides are polymer-based thermoplastics with a high melt viscosity and require higher pressures for forming molded parts. Polyimides offer good chemical resistance, high mechanical strength, higher thermal stabilities, and exceptional electrical properties. For the IC packaging methods, polyimides are used as high-temperature adhesives, mechanical stress buffers, and as a film supporting the micro-sized circuitry.

The major players operating in the global redistribution layer material market are SK Hynix Inc, Samsung Electronics Co Ltd, Infineon Technologies AG, Dupont De Nemours Inc, Fujifilm Holdings Corp, Amkor Technology Inc, ASE Technology Holding Co Ltd., NXP Semiconductors NV, JCET Group Co Ltd, and Shin-Etsu Chemical Co Ltd.

The growing demand for AI-based equipment and tools is significantly impacting the redistribution layer material market. The quest for more advanced AI capabilities necessitates the development of more compact and densely integrated hardware components. Redistribution layer (RDL) materials are fundamental in enabling the miniaturization of semiconductor packages, which is essential to accommodate the increasing complexity of AI devices. As AI systems become more sophisticated, the demand for smaller and more efficient components grows.

Asia Pacific accounted for the largest share of the global redistribution layer material market. Asia Pacific is one of the most significant regions for the redistribution layer material market owing to drastic increase in the demand for semiconductors.

Based on application, the redistribution layer material market is bifurcated into fan-out wafer level packaging (FOWLP) and 2.5D/3D IC packaging [high bandwidth memory (HBM), multi-chip integration, package on package (FOPOP), and others]. The redistribution layer material market share of the 2.5D/3D IC packaging segment was notable in 2022. The increased costs of lithography steps and wafer processing in general at the next-generation silicon nodes are driving the industry to find alternatives to improve the performance and functionality of electronic devices.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Redistribution Layer Material Market

- SK Hynix Inc

- Samsung Electronics Co Ltd

- Infineon Technologies AG

- Dupont De Nemours Inc

- Fujifilm Holdings Corp

- Amkor Technology Inc

- ASE Technology Holding Co Ltd.

- NXP Semiconductors NV

- JCET Group Co Ltd

- Shin-Etsu Chemical Co Ltd

Get Free Sample For

Get Free Sample For