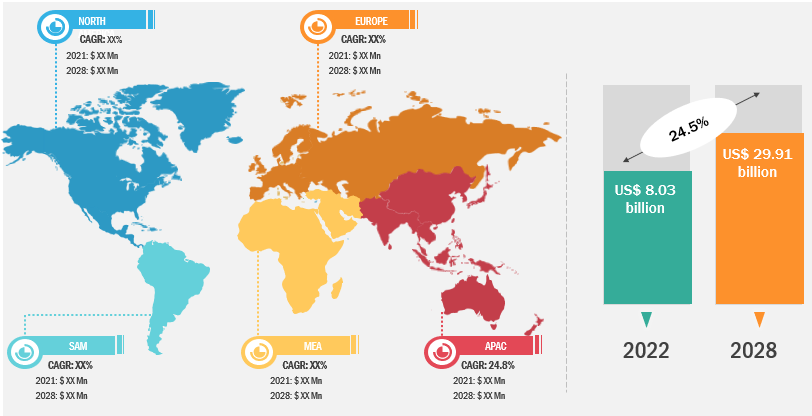

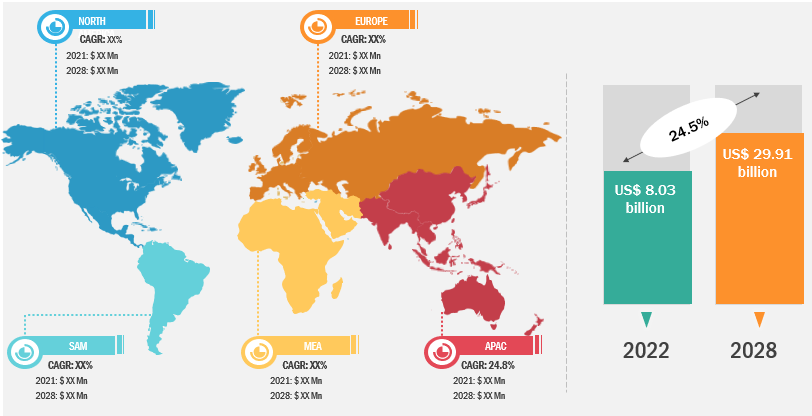

The enterprise file synchronization and sharing (EFSS) market is expected to grow from US$ 8.03 billion in 2022 to US$ 29.91 billion by 2031; it is estimated to grow at a CAGR of 24.5% from 2022 to 2031.

An EFSS solution allows individuals and organizations to share and synchronize various kinds of files across and out of the organization, allowing access to individuals, organizations, and customers. EFSS solutions can be deployed or provided to organizations via two different deployment models, on-premise and cloud. Each model has disadvantages and advantages, but the cloud deployment model has been the prime adopted model for this market. Apart from the on-premise and cloud deployment type, the hybrid model is also adopted by multiple enterprises as it benefits both on-premises and cloud models. The hybrid segment accounted for a major market share in 2021 and is anticipated to witness promising growth over the forecast timeline. Moreover, hybrid deployments are complex and typically require cautious planning and management of various factors such as budgets, faults, security, change control, and configuration management. The hybrid approach enables enterprises to take full advantage of the cost-effectiveness and scalability offered by a pure cloud environment without exposing critical data and applications to third-party vulnerabilities. Therefore, this method is ideal for organizations that aim to simplify mobile workers' access to corporate data via the cloud without creating and storing data replicas in a third-party cloud.

Citrix Systems, Inc.; Box Inc.; Dropbox; Microsoft; and Google are among the major players operating in enterprise file synchronization and sharing (EFSS) market

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Enterprise File Synchronization and Sharing (EFSS) Market: Strategic Insights

Market Size Value in US$ 8.03 billion in 2022 Market Size Value by US$ 29.91 billion by 2028 Growth rate CAGR of 24.5% from 2022 to 2028 Forecast Period 2022-2028 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Enterprise File Synchronization and Sharing (EFSS) Market: Strategic Insights

| Market Size Value in | US$ 8.03 billion in 2022 |

| Market Size Value by | US$ 29.91 billion by 2028 |

| Growth rate | CAGR of 24.5% from 2022 to 2028 |

| Forecast Period | 2022-2028 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Regional Analysis of Enterprise File Synchronization and Sharing (EFSS) Market

From the regional perspective, North America holds the largest share of the enterprise file synchronization and sharing (EFSS) market. There is massive adoption of EFSS solutions across major industry verticals, which is expected to contribute to the highest overall revenue generation worldwide. The US economic forecasts for the IT sector are uncertain. They continue to highlight an industry transitioning from legacy platforms to mobile, cloud, big data, and social solutions, propelling the enterprise file synchronization and sharing (EFSS) market growth in the region. Furthermore, Asia Pacific is anticipated to grow at the highest growth rate in the enterprise file synchronization and sharing (EFSS) market. The rising demand for flexibility across business operations has boosted the adoption of mobile apps, cloud software, and automation. Moreover, rapid technological advancement, the adoption of the work hybrid model, and the need for efficient and cost-effective management solutions are accelerating the growth of the enterprise file synchronization and sharing (EFSS) market in Asia Pacific.

Enterprise File Synchronization and Sharing (EFSS) Market Report Scope

Market Insights – Enterprise File Synchronization and Sharing (EFSS) Market

Industry Vertical-Based Insights

Based on industry vertical, the enterprise file synchronization and sharing (EFSS) market is segmented into healthcare & life sciences, BFSI, IT & telecom, media & entertainment, consumer goods & retail, industrial goods & automotive, and others. In 2021, the IT & telecom segment accounted for the largest share of the enterprise file synchronization and sharing (EFSS) market. EFSS enables enterprises of all sizes to manage, track, and evaluate communication processes and enhances resource distribution channels to execute tasks effectively. Moreover, EFSS demand continues to rise in this segment as it provides major benefits such as data authentication, data replication, business file sync, and sharing and access controls, mainly for bring your own device (BYOD). These factors collectively drive the enterprise file synchronization and sharing (EFSS) market for the IT & telecom segment.

Players operating in the enterprise file synchronization and sharing (EFSS) market mainly focus on developing advanced and efficient products.

- In September 2022, Google and Instructure, the developer of Elevate Data Sync, entered into a strategic partnership to bridge the gap for Google Classroom customers with a robust solution. In addition, educational institutions can maintain synchronization of course data between their student information systems (SIS) and Google Classroom.

- In May 2022, Citrix Systems, Inc. partnered with Microsoft to introduce a new offering, "Citrix HDX Plus for Windows 365." Citrix HDX Plus for Windows 365 allows users to store, sync, and share their work files and focuses on enhancing the Cloud PC experience.

The enterprise file synchronization and sharing (EFSS) market is segmented into five major regions—North America, Europe, Asia Pacific (APAC), Middle East, and South America. In 2022, North America led the market with a substantial revenue share, followed by Europe. Further, Asia Pacific is expected to register the highest CAGR in the enterprise file synchronization and sharing (EFSS) market from 2022 to 2031.

Citrix Systems, Inc.; Box Inc.; Dropbox; Microsoft; Accellion; VMware, Inc.; Google; Thomson Reuters; IBM Corporation; and OpenText are among the key players operating in the enterprise file synchronization and sharing (EFSS) market. The market report provides detailed market insights, which help the key players strategize growth in coming years.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Deployment Model, End User, Industry Vertical, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Table of Contents

1 Table of Contents

1.1 List of Tables

1.2 List of Figures

2 Introduction

2.1 The Insight Partners Research Report Guidance

3 Key Takeaways

4 EFSS Market Landscape

4.1 Overview

4.2 Market Segmentation

4.2.1 Global EFSS Market – By Solution

4.2.2 Global EFSS Market – By Services

4.2.3 Global EFSS Market – By Deployment Model

4.2.4 Global EFSS Market – By End-User

4.2.5 Global EFSS Market – By Industry Verticals

4.2.6 Global EFSS Market – By Geography

4.3 Value Chain Analysis

5 Global EFSS Market – Key Industry Dynamics

5.1 Key Market Drivers

5.1.1 Implementation of BYOD programs in organizations

5.1.2 Need for mobility and a secured mobile service to access data

5.1.3 Custom made solutions in the market

5.2 Key Market Restraints

5.2.1 Sharing of data beyond the physical boundaries of organization raises security concerns

5.2.2 Integration, control, compliance & regulatory issues

5.3 Key Market Opporunities

5.3.1 Developing ICT infrastructure worldwide

5.3.2 Integration with content aware Data Loss Prevention (DLP) vendors

5.4 Future Trends

5.4.1 Market consolidation due to growing competition

6 EFSS Functionality

6.1 Enterprise Content Management System

6.2 Enterprise Storage and Backup

6.3 Enterprise Document Collaboration

6.4 Enterprise Mobility

6.5 Others

7 EFSS Market – Porters Five Forces Analysis

7.1 Porters Five Forces Analysis

7.1.1 Bargaining Power of Suppliers

7.1.2 Bargaining Power of Buyers

7.1.3 Threat of Substitutes

7.1.4 Threat of New Entrants

7.1.5 Degree of Competition

8 EFSS Market – Competitive Landscape

8.1 Global EFSS Market Revenue (US$ Mn), 2014 – 2025

8.2 EFSS Market – Market Positioning of Key Players, 2015

8.2.1 Global EFSS Market – Market Positioning of Key Players

9 Global EFSS Market Analysis – By Solution

9.1 Overview

10 Global EFSS Market Analysis –By Services

10.1 Overview

10.2 Professional Services

10.2.1 Overview

10.2.2 Global EFSS Professional Services Market Revenue and Forecasts to 2025 (US$ Mn)

10.3 Integration Services

10.3.1 Overview

10.3.2 Global EFSS Integration Services Market Revenue and Forecasts to 2025 (US$ Mn)

11 Global EFSS Market Analysis – By Deployment Model

11.1 Overview

11.2 On-premise Deployment Model

11.2.1 Overview

11.2.2 Global EFSS On-premise Deployment Model Market Revenue and Forecasts to 2025 (US$ Mn)

11.3 Cloud Deployment Model

11.3.1 Overview

11.3.2 Global EFSS Cloud Deployment Model Market Revenue and Forecasts to 2025 (US$ Mn)

11.4 Hybrid Model

11.4.1 Overview

11.4.2 Global EFSS Hybrid Deployment Model Market Revenue and Forecasts to 2025 (US$ Mn)

12 Global EFSS Market Analysis – By End Users

12.1 Overview

12.2 Small Enterprises

12.2.1 Overview

12.2.2 Global EFSS Small Enterprises Market Revenue and Forecasts to 2025 (US$ Mn)

12.3 Mid-Size Enterprises

12.3.1 Overview

12.3.2 Global EFSS Mid-Size Enterprises Market Revenue and Forecasts to 2025 (US$ Mn)

12.4 Large Enterprises

12.4.1 Overview

12.4.2 Global EFSS Large Enterprises Market Revenue and Forecasts to 2025 (US$ Mn)

13 Global EFSS Market Analysis – By Industry Vertical

13.1 Overview

13.2 Healthcare & Life Sciences

13.2.1 Overview

13.2.2 Global EFSS Healthcare & Life Sciences Market Revenue and Forecasts to 2025 (US$ Mn)

13.3 Financial Services & Insurance

13.3.1 Overview

13.3.2 Global EFSS Financial Services & Insurance Market Revenue and Forecasts to 2025 (US$ Mn)

13.4 Telecommunication & IT

13.4.1 Overview

13.4.2 Global EFSS Telecommunication & IT Market Revenue and Forecasts to 2025 (US$ Mn)

13.5 Media & Entertainment

13.5.1 Overview

13.5.2 Global EFSS Media & Entertainment Market Revenue and Forecasts to 2025 (US$ Mn)

13.6 Consumer Goods & Retail

13.6.1 Overview

13.6.2 Global EFSS Consumer Goods & Retail Market Revenue and Forecasts to 2025 (US$ Mn)

13.7 Industrial Goods & Automotive

13.7.1 Overview

13.7.2 Global EFSS Industrial Goods & Automotive Market Revenue and Forecasts to 2025 (US$ Mn)

13.8 Others

13.8.1 Overview

13.8.2 Global EFSS Others Market Revenue and Forecasts to 2025 (US$ Mn)

14 Global EFSS Market – Geographical Analysis

14.1 Overview

14.2 North America EFSS Market Revenue and Forecasts to 2025

14.2.1 Overview

14.2.2 North America EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.2.3 North America EFSS Market Breakdown by Key Countries

14.2.3.1 U.S. EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.2.3.2 Canada EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.2.3.3 Mexico EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.3 Europe EFSS Market Revenue and Forecasts to 2025

14.3.1 Overview

14.3.2 Europe EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.3.3 Europe EFSS Market Breakdown by Countries

14.3.3.1 France EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.3.3.2 Germany EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.3.3.3 Italy EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.3.3.4 Spain EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.3.3.5 U.K EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.3.3.6 Rest of Europe EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.4 Asia Pacific (APAC) EFSS Market Revenue and Forecasts to 2025

14.4.1 Overview

14.4.2 Asia Pacific EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.4.3 Asia Pacific EFSS Market Breakdown by Countries

14.4.3.1 Australia EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.4.3.2 China EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.4.3.3 India EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.4.3.4 Japan EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.4.3.5 Rest of APAC EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.5 Middle East & Africa (MEA) EFSS Market Revenue and Forecasts to 2025

14.5.1 Overview

14.5.2 Middle East & Africa EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.5.3 Middle East & Africa EFSS Market Breakdown by Countries

14.5.3.1 Saudi Arabia EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.5.3.2 South Africa EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.5.3.3 UAE EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.5.3.4 Rest of MEA EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.6 South America (SAM) EFSS Market Revenue and Forecasts to 2025

14.6.1 Overview

14.6.2 South America EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.6.3 South America EFSS Market Breakdown by Countries

14.6.3.1 Brazil EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

14.6.3.2 Rest of SAM EFSS Market Revenue and Forecasts to 2025 (US$ Mn)

15 EFSS Market, Key Company Profiles

15.1 Accellion, Inc

15.1.1 Key Facts

15.1.2 Business Description

15.1.3 Financial Overview

15.1.4 SWOT Analysis

15.1.5 Key Developments

15.2 Box, Inc.

15.2.1 Key Facts

15.2.2 Business Description

15.2.3 Financial Overview

15.2.4 SWOT Analysis

15.2.5 Key Developments

15.3 Citrix Systems, Inc.

15.3.1 Key Facts

15.3.2 Business Description

15.3.3 Financial Overview

15.3.4 SWOT Analysis

15.3.5 Key Developments

15.4 Dropbox, Inc

15.4.1 Key Facts

15.4.2 Business Description

15.4.3 Financial Overview

15.4.4 SWOT Analysis

15.4.5 Key Developments

15.5 Egnyte, Inc.

15.5.1 Key Facts

15.5.2 Business Description

15.5.3 Financial Overview

15.5.4 SWOT Analysis

15.5.5 Key Developments

15.6 Google,Inc.

15.6.1 Key Facts

15.6.2 Business Description

15.6.3 Financial Overview

15.6.4 SWOT Analysis

15.6.5 Key Developments

15.7 Microsoft Corporation

15.7.1 Key Facts

15.7.2 Business Description

15.7.3 Financial Overview

15.7.4 SWOT Analysis

15.7.5 Key Developments

15.8 SugarSync, Inc.

15.8.1 Key Facts

15.8.2 Business Description

15.9 Syncplicity LLC

15.9.1 Key Facts

15.9.2 Business Description

15.9.3 Financial Overview

15.9.4 SWOT Analysis

15.9.5 Key Developments

15.1 VMware, Inc.

15.10.1 Key Facts

15.10.2 Business Description

15.10.3 Financial Overview

15.10.4 SWOT Analysis

15.10.5 Key Developments

16 Appendix

16.1 About The Insight Partners

16.2 Glossary of Terms

16.3 Methodology

16.3.1 Coverage

16.3.2 Secondary Research

16.3.3 Primary Research

16.4 Contact Us

16.5 Disclaimer

1.1 List of Tables

Table 1: Enterprise File Sharing and Synchronization Market – Porters Five Forces Analysis 33

Table 2: Global EFSS Market Revenue (US$ Mn), 2015 – 2025 38

Table 3: Glossary of Terms, EFSS Market 159

1.2 List of Figures

Figure 1: EFSS Market Segmentation 18

Figure 2: EFSS Market Segmentation 19

Figure 3: EFSS Market – Value Chain Analysis 22

Figure 4: EFSS Market – Porters Five Forces Analysis 32

Figure 5: Global EFSS Market Revenue (US$ Mn), 2015 – 2025 37

Figure 6: Global EFSS Market, Market Positioning of Key Players 39

Figure 7: Global EFSS Market By Solution, 2015 & 2025 (%) 42

Figure 8: Global EFSS Market Breakdown By Services, 2015 & 2025 (%) 43

Figure 9: Global EFSS Professional Services Market Revenue and Forecasts to 2025 (US$ Mn) 45

Figure 10: Global EFSS Integration Services Market Revenue and Forecasts to 2025 (US$ Mn) 47

Figure 11: Global EFSS Market Breakdown By Deployment Model, 2015 & 2025(%) 48

Figure 12: Global EFSS On-premise Market Revenue and Forecasts to 2025 (US$ Mn) 50

Figure 13: Global EFSS Cloud Deployment Model Market Revenue and Forecasts to 2025 (US$ Mn) 52

Figure 14: Global EFSS Hybrid Deployment Model Market Revenue and Forecasts to 2025 (US$ Mn) 54

Figure 15: Global EFSS Market Breakdown By End-User, 2015 & 2025(%) 55

Figure 16: Global EFSS Small Enterprises Market Revenue and Forecasts to 2025 (US$ Mn) 57

Figure 17: Global EFSS Mid-Size Enterprises Market Revenue and Forecasts to 2025 (US$ Mn) 59

Figure 18: Global EFSS Large Enterprises Market Revenue and Forecasts to 2025 (US$ Mn) 61

Figure 19: Global EFSS Market Breakdown By Industry Vertical, 2015 & 2025(%) 63

Figure 20: Global EFSS Healthcare & Life Sciences Market Revenue and Forecasts to 2025 (US$ Mn) 65

Figure 21: Global EFSS Financial Services & Insurance Market Revenue and Forecasts to 2025 (US$ Mn) 67

Figure 22: Global EFSS Telecommunication & IT Market Revenue and Forecasts to 2025 (US$ Mn) 69

Figure 23: Global EFSS Media & Entertainment Market Revenue and Forecasts to 2025 (US$ Mn) 71

Figure 24: Global EFSS Consumer Goods & Retail Market Revenue and Forecasts to 2025 (US$ Mn) 73

Figure 25: Global EFSS Industrial Goods & Automotive Market Revenue and Forecasts to 2025 (US$ Mn) 75

Figure 26: Global EFSS Others Market Revenue and Forecasts to 2025 (US$ Mn) 77

Figure 27: EFSS Market, Global Breakdown by Regions, 2015 & 2025 (%) 79

Figure 28: North America EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 81

Figure 29: North America EFSS Market Breakdown by Key Countries, 2015 & 2025(%) 82

Figure 30: U.S. EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 83

Figure 31: Canada EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 84

Figure 32: Mexico EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 85

Figure 33: Europe EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 86

Figure 34: Europe EFSS Market Breakdown By Key Countries, 2015 & 2025 (%) 88

Figure 35: France EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 89

Figure 36: Germany EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 90

Figure 37: Italy EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 91

Figure 38: Spain EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 92

Figure 39: U.K EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 93

Figure 40: Rest of Europe EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 94

Figure 41: Asia Pacific EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 96

Figure 42: Asia Pacific EFSS Market Breakdown by Key Countries, 2015 & 2025 (%) 97

Figure 43: Australia EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 98

Figure 44: China EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 99

Figure 45: India EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 100

Figure 46: Japan EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 101

Figure 47: Rest of APAC EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 102

Figure 48: MEA EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 104

Figure 49: Middle East & Africa EFSS Market Breakdown by Key Countries, 2015 & 2025 (%) 105

Figure 50: Saudi Arabia EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 106

Figure 51: South Africa EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 107

Figure 52: UAE EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 108

Figure 53: Rest of MEA EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 109

Figure 54: South America EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 111

Figure 55: South America EFSS Market Breakdown by Key Countries, 2015 & 2025 (%) 112

Figure 56: Brazil EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 113

Figure 57: Rest of SAM EFSS Market Revenue and Forecasts to 2025 (US$ Mn) 114

The List of Companies

- Accellion, Inc

- Box, Inc.

- Citrix Systems, Inc.

- Dropbox, Inc

- Egnyte, Inc.

- Google,Inc.

- Microsoft Corporation

- SugarSync, Inc.

- Syncplicity LLC

- VMware, Inc.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For