The US Land Survey Equipment market size was valued at US$ 1.51 billion in 2022 and is expected to reach US$ 2.82 billion by 2030; it is estimated to record a CAGR of 8.1% from 2022 to 2030.

Analyst Perspective:

Land survey equipment plays a vital role in the fields of construction, real estate, forestry, mining, oil & gas, and others. These equipment are majorly used for evaluating the area of the land and to settle disputes. The US Land Survey Equipment market report emphasizes on the key factors driving the market and prominent players' developments.

US Land Survey Equipment Market Overview:

Survey equipment tools include surveying instrument tripods, levels, land surveying markers, marking machines, GPS equipment, surveying prisms, survey drones, land surveying rods, transits, stakes, and grade rods. Surveyors/engineers use these tools for mapping, surveying, and land measurement. Surveying contractors who work out in the field use GPS, camera, and computation devices along with different software solutions to process survey data and draft maps, plans, and survey reports. Land survey equipment is essential for accurately determining the distances, positions, and elevations of points on the earth's surface. The US land survey equipment market is driven by the increasing demand for this equipment in the construction, renewable energy, mining, oil & gas, forestry, precision farming, disaster management, and transportation industries; scientific and geological research; and utilities.

The rising urbanization and industrialization are fueling the growth of the land survey equipment market. The US Government is significantly investing in the development and upgradation of infrastructure projects. For instance, in Q4 2023, the US Government started the construction of a 31km zero-emission BRT line with 21 stations from Pomona to Rancho Cucamonga in California. The project aims to improve transit efficiency and corridor mobility and is expected to be completed by Q2 of 2026. The construction of this project requires numerous land survey equipment such as levels, total stations, and theodolites to measure distance and angles between specified points. Further, major cities in the US are rapidly expanding, and several new infrastructures are being constructed in different parts. Several plans for the development of smart cities are also rolled out, and land survey equipment plays a critical role in surveying development sites during the planning stage.

Growing demand and adoption of unmanned aerial vehicles (UAVs) and drones by engineers/surveyors is fueling the market. Drones are increasingly being used for capturing images and videos and providing real-time visual data without the need for human interference. Moreover, drones are easy to control using computers or smartphones, which drives their demand for surveying purposes. UAVs are also used in surveying and for surveillance in the commercial and defense sectors. The videos and images captured by UAVs and drones are also used in research and planning operations. Moreover, land survey equipment, when used in the field, helps save time and provides accurate output using the data processing software.

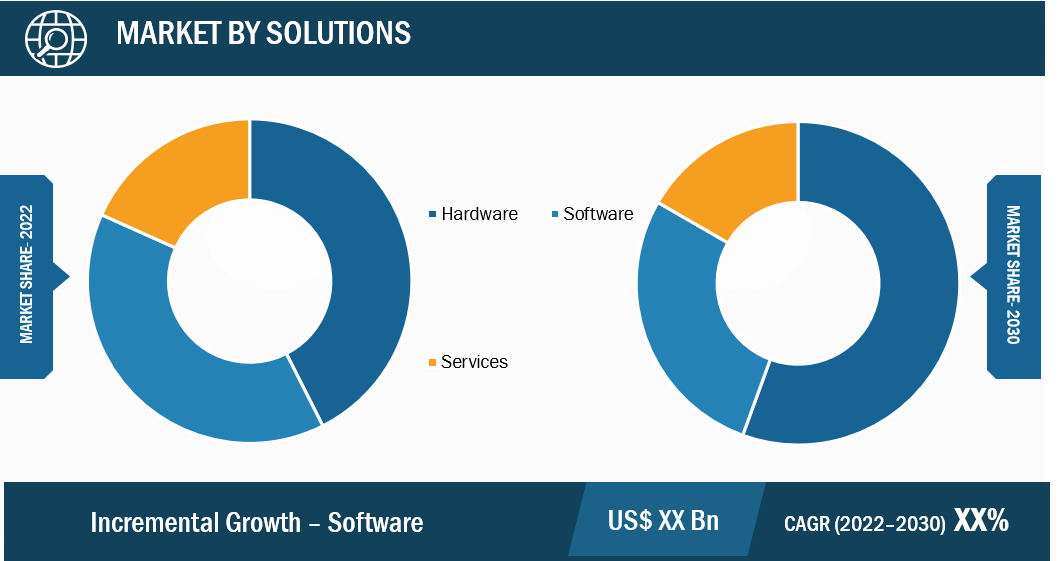

The US land survey equipment market analysis has been carried out by considering the following segments: solution, industry, and application. Based on solution, the US land survey equipment market is segmented into hardware, software, and services. Based on industry, the US land survey equipment market is segmented into mining, construction, agriculture, oil & gas, and others. Based on application, the US land survey equipment market is segmented into volumetric calculations, inspection, layout points, monitoring, and others. The US land survey equipment market trends include the rising deployment of cloud-based software and services.

Hexagon AB; Topcon; Septentrio; Trimble Inc.; Carlson Software Inc.; Juniper Systems Inc.; Raven Industries, Inc.; Shanghai Huace Navigation Technology Ltd.; Spectra Precision; and Robert Bosch Tool Corporation are among the key players operating in the US LAND SURVEY EQUIPMENT market. Additionally, several other important market players were studied and analyzed during this research study to get a holistic view of the ecosystem.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Land Survey Equipment Market: Strategic Insights

Market Size Value in US$ 1.51 billion in 2022 Market Size Value by US$ 2.82 billion by 2030 Growth rate CAGR of 8.1% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Land Survey Equipment Market: Strategic Insights

| Market Size Value in | US$ 1.51 billion in 2022 |

| Market Size Value by | US$ 2.82 billion by 2030 |

| Growth rate | CAGR of 8.1% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

US Land Survey Equipment Market Driver:

Increasing Need for Drones or UAVs in Mapping and Surveying Drives US Land Survey Equipment Market Growth

The drone/unmanned aerial vehicle (UAV) industry is considered one of the fastest-growing industries. Drones/UAVs have gained immense traction due to the growing need for safe, cost-effective solutions for data collection, mapping, surveying, and inspection. They can perform increasingly complex tasks such as data collection, mapping, and surveying in extreme environments where manual surveying techniques are risky and impossible. Particularly, mini and micro quad drones are used for scanning and surveying and are extremely beneficial in places where humans cannot perform tasks in a timely and efficient manner.

Drones/UAVs are used in applications such as topographic surveying, dam surveying, forestry management and monitoring, geological hazard monitoring, and mining mapping, which increases the demand among users for high-precision mapping and surveying. For instance, in December 2023, the Federal Aviation Administration (FAA) reported that 790,918 drones were registered in the US. Therefore, the increasing demand for drones in mapping and surveying applications is driving the market. Drones cover large areas and provide accurate data in less time as compared to manual surveying, which helps users in the study of aerial data of land for making precise measurements.

Growing demand for 3D drones in land surveys is boosting the US land survey equipment market size. 3D drones are equipped with advanced sensors such as light detection and ranging (LiDAR) and photogrammetry cameras for collecting highly accurate spatial data of terrain. For example, Vision Aerial Inc offers 3D drones used in numerous applications, including land surveying, aerial mapping, land planning & management, urban planning, site scouting, and topographic surveys. Surveillance by these drones helps better analyze situations and make decisions that are beneficial to increase productivity. Thus, significant benefits offered by 3D drones, such as safety, accuracy, analysis, and data visualization, drive the US land survey equipment market.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

US Land Survey Equipment Market Segmental Analysis:

Based on solution, the US land survey equipment market is segmented into hardware, software, and services. The hardware segment accounted for 56.85% of the US land survey equipment market share.

Hardware is a physical part or a tool used for surveying. Commonly used surveying instruments include theodolite, GPS/GNSS systems, total station, 3D scanners, measuring tape, level, and rod. This equipment speeds up the surveying process and provides more accurate data than traditional surveying methods. GNSS can help determine precise locations irrespective of the impact of weather conditions. The theodolite is employed for the measurement of angles, whereas the total station is used for leveling when it is set to the horizontal plane. UAVs used in surveying provide quick and accurate data with minimal requirement for human efforts.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

US Land Survey Equipment Market Analysis:

The US land survey equipment market growth depends on several factors, such as the growing digitalization, urbanization, real estate business, and increasing use of advanced construction software. For instance, according to CBRE Group data of December 2023, investors are planning to invest in commercial real estate from Q2 of 2024 actively. This is projected to increase the construction of new apartments, thereby creating demand for land survey equipment among engineers. Land survey equipment such as total stations and GPS are highly used by the real estate industry for precise measurement of dimensions, land boundaries, and topographical features. This further supports engineers in assessing land value, determining property boundaries, and creating detailed maps.

The presence of a large number of manufacturers is driving the US land survey equipment market. These players are continuously engaged in the development of advanced equipment to attract customers. Further, the market in the US is projected to grow, owing to the rising demand for land survey equipment from the construction, agriculture, and real estate industries. Additionally, technological advancements leading to increased production and growing R&D activities are a few factors supporting the land survey equipment market growth.

The rising adoption of automobiles has increased the need for new road developments. For instance, as reported by the US Census Bureau, in December 2023, the government raised funding of US$ 100.4 billion in November 2023 for the construction of highways. The government is also engaged in the development and maintenance of roads to enhance traveler experience by reducing the risks of accidents. For instance, according to RAMSEY COUNTY data, Hodgson Road, Lexington Avenue, and Maryland Avenue are under construction. The Old Highway 8 is also in the resurfacing phase. Such infrastructure development requires land survey equipment to calculate area, location, route, and site planning.

The US is one of the most advanced countries in terms of technology and architecture. The country is always ahead in constructing smart homes and healthcare retails. In April 2023, LEGO Group announced the construction of a 1.7 million sq. ft. carbon-neutral production facility for children in Chesterfield County, Virginia. This project incurred a cost of ~US$ 1 billion and is expected to commence operation by the end of 2025. The company is using energy-efficient production equipment for building facilities and reducing carbon emissions.

Similarly, in July 2022, the US Energy Department disbursed a loan of US$ 2.5 billion to General Motors and LG Energy Solution's joint venture, Ultium Cells, a unit of LG Chem, for the construction of a new manufacturing facility of the lithium-ion battery cell. Ultium Cells is investing US$ 7 million to construct three plants. One plant started operating in August 2022, whereas other plants will commence operation in 2024. Land survey equipment is required for the appropriate construction of these plants as it helps in measuring site feasibility and generating detailed survey data to make better decisions and minimize the risk of structural failures.

In July 2022, the Texas Department of Transportation awarded the contract to Webber (a subsidiary of Ferrovial) for the expansion of four highways, including Denton, Collin, Kaufman, and Coman Counties. The US$ 340 million project is expected to start by the end of 2022 and is expected to complete by 2025. Thus, such activities are enabling the expansion of US land survey equipment market share.

US Land Survey Equipment Market Key Player Analysis:

Hexagon AB; Topcon; Septentrio; Trimble Inc.; Carlson Software Inc.; Juniper Systems Inc.; Raven Industries, Inc.; Shanghai Huace Navigation Technology Ltd.; Spectra Precision; and Robert Bosch Tool Corporation are among the prominent players profiled in the US Land Survey Equipment market report.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies operating in the US Land Survey Equipment market. A few recent key US Land Survey Equipment market developments are listed below:

- In January 2024, CHCNAV launched its H3 GNSS monitoring receiver, which integrates millimeter accuracy positioning, communications, and sensor technology in a single enclosure. The receiver, designed with a 1408-channel Geodetic-grade GNSS module, 4G modem, MEMS sensors, and rugged antenna, provides high-accuracy data for deformation and subsidence monitoring in critical infrastructure sectors such as construction, mining, and energy.

- In October 2023, Leica Geosystems, part of Hexagon, released the Leica BLK2GO PULSE, a first-person laser scanner that combines LiDAR sensor technology with the original Leica BLK2GO form factor. The device, built in collaboration with Sony Semiconductor Solutions Corporation, offers a rapid, intuitive first-person scanning method controlled with a smartphone, delivering full-color 3D point clouds instantly in the field. The BLK2GO PULSE is primarily used for indoor applications such as 3D digital twins and 2D floor plans.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Solution, Industry, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The estimated market size for the US land survey equipment market in 2022 is expected to be around US$ 1.51 billion

Carlson Software Inc, Trimble Inc, Juniper Systems Inc, Robert Bosch Tool Corp, Raven Industries Inc, Septentrio NV, Shanghai Huace Navigation Technology Ltd, Hexagon AB, Topcon Corp, and Spectra Precision LLC, are the key market players expected to hold a major market share of US land survey equipment market in 2022

Hardware segment is expected to hold a major market share of the US land survey equipment market in 2022

Technological advancement and automation in the land survey equipment are anticipated to play a significant role in the US land survey equipment market in the coming years.

Growing number of infrastructural development activities and increasing need for drones or UAVs in mapping and surveying are the major factors that propel the US land survey equipment market.

The US market size of land survey equipment market by 2030 will be around US$ 2.82 billion

The US land survey equipment market is expected to register an incremental growth value of US$ 1.31 billion during the forecast period

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. US Land Survey Equipment Market Landscape

4.1 Overview

4.2 PEST Analysis

4.1 Ecosystem Analysis

4.1.1 List of Vendors in the Value Chain

5. US Land Survey Equipment Market – Key Market Dynamics

5.1 US Land Survey Equipment Market – Key Market Dynamics

5.2 Market Drivers

5.2.1 Growing Number of Infrastructural Development Activities

5.2.2 Increasing Need for Drones or UAVs in Mapping and Surveying

5.2.3 Rising Demand for Land Survey Equipment

5.3 Market Restraints

5.3.1 High Costs Associated with Land Survey Equipment

5.3.2 Lack of Skilled Man Power

5.4 Market Opportunities

5.4.1 Technological Advancement and Automation

5.4.2 Government Investments and Spending to Promote Construction Activities

5.5 Future Trends

5.5.1 Rising Deployment of Cloud-Based Software and Services

5.6 Impact of Drivers and Restraints:

6. US Land Survey Equipment Market –Market Analysis

6.1 US Land Survey Equipment Market Revenue (US$ Million), 2022–2030

6.2 US Land Survey Equipment Market Forecast Analysis

7. US Land Survey Equipment Market Analysis – by Solutions

7.1 Hardware

7.1.1 Overview

7.1.2 Hardware: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

7.1.3 GNSS Systems

7.1.3.1 Overview

7.1.3.2 GNSS Systems Market Revenue and Forecasts To 2030 (US$ Million)

7.1.4 Total Stations

7.1.4.1 Overview

7.1.4.2 Total Stations: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

7.1.5 Theodolites

7.1.5.1 Overview

7.1.5.2 Theodolites: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

7.1.6 3D Laser Scanner

7.1.6.1 Overview

7.1.6.2 3D Laser Scanner: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

7.1.7 Unmanned Aerial Vehicles

7.1.7.1 Overview

7.1.7.2 Unmanned Aerial Vehicles: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

7.1.8 Machine Control Systems

7.1.8.1 Overview

7.1.8.2 Machine Control Systems: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

7.1.9 Levels

7.1.9.1 Overview

7.1.9.2 Levels: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

7.1.10 Machine Guidance Systems

7.1.10.1 Overview

7.1.10.2 Machine Guidance Systems: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

7.1.11 Others

7.1.11.1 Overview

7.1.11.2 Others: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

7.2 Services

7.2.1 Overview

7.2.2 Services: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

7.3 Software

7.3.1 Overview

7.3.2 Software: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

8. US Land Survey Equipment Market Analysis – by Industry

8.1 Construction

8.1.1 Overview

8.1.2 Construction: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

8.2 Oil and Gas

8.2.1 Overview

8.2.2 Oil and Gas: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

8.3 Mining

8.3.1 Overview

8.3.2 Mining: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Agriculture

8.4.1 Overview

8.4.2 Agriculture: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

8.5 Others

8.5.1 Overview

8.5.2 Others: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

9. US Land Survey Equipment Market Analysis – by Application

9.1 Inspection

9.1.1 Overview

9.1.2 Inspection: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

9.2 Monitoring

9.2.1 Overview

9.2.2 Monitoring: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

9.3 Layout Points

9.3.1 Overview

9.3.2 Layout Points: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

9.4 Volumetric Calculations

9.4.1 Overview

9.4.2 Volumetric Calculations: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

9.5 Others

9.5.1 Overview

9.5.2 Others: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

10. Competitive Landscape

10.1 Heat Map Analysis by Key Players

10.2 Company Positioning & Concentration

11. Industry Landscape

11.1 Overview

11.2 Market Initiative

11.3 Product Development

11.4 Mergers & Acquisitions

12. Company Profiles

12.1 Carlson Software Inc

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Trimble Inc

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Juniper Systems Inc

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Robert Bosch Tool Corp

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Raven Industries Inc

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Septentrio NV

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Shanghai Huace Navigation Technology Ltd

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Hexagon AB

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 Topcon Corp

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 Spectra Precision LLC

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About The Insight Partners

List of Tables

Table 1. US Land Survey Equipment Market Segmentation

Table 2. List of Vendors

Table 3. US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Table 4. US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million) – by Solutions

Table 5. US Land Survey Equipment Market Revenue and Forecasts To 2030 (US$ Million) – Hardware

Table 6. US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million) – by Industry

Table 7. US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million) – by Application

List of Figures

Figure 1. US Land Survey Equipment Market Segmentation, by Geography

Figure 2. PEST Analysis

Figure 3. Ecosystem: Embedded Systems Market

Figure 4. Impact Analysis of Drivers and Restraints

Figure 5. US Land Survey Equipment Market Revenue (US$ Million), 2022–2030

Figure 6. US Land Survey Equipment Market Share (%) – by Solutions (2022 and 2030)

Figure 7. Hardware: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 8. US Land Survey Equipment Market Share (%) – Hardware, 2022 and 2030

Figure 9. GNSS Systems Market Revenue and Forecasts To 2030 (US$ Million)

Figure 10. Total Stations: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. Theodolites: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. 3D Laser Scanner: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. Unmanned Aerial Vehicles: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Machine Control Systems: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. Levels: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. Machine Guidance Systems: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. Others: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. Services: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Software: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 20. US Land Survey Equipment Market Share (%) – by Industry (2022 and 2030)

Figure 21. Construction: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 22. Oil and Gas: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 23. Mining: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 24. Agriculture: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 25. Others: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 26. US Land Survey Equipment Market Share (%) – by Application (2022 and 2030)

Figure 27. Inspection: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 28. Monitoring: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 29. Layout Points: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 30. Volumetric Calculations: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 31. Others: US Land Survey Equipment Market – Revenue and Forecast to 2030 (US$ Million)

Figure 32. Heat Map Analysis by Key Players

Figure 33. Company Positioning & Concentration

The List of Companies - US Land Survey Equipment Market

- Carlson Software Inc

- Trimble Inc

- Juniper Systems Inc

- Robert Bosch Tool Corp

- Raven Industries Inc

- Septentrio NV

- Shanghai Huace Navigation Technology Ltd

- Hexagon AB

- Topcon Corp

- Spectra Precision LLC

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to US Land Survey Equipment Market

Mar 2024

Remote Access Solution Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Secure Remote Access-VPN, Identity and Access Management (IAM) Solutions, Multi-Factor Authentication, Single Sign-On (SSO), Endpoint Security, and Others], Mode of Deployment (Cloud and On-Premise), End-Use Industry (IT and Telecommunications, BFSI, Healthcare, Government, Manufacturing, and Others), and Geography

Mar 2024

Hall Effect Teslameter Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Analog Hall Effect Teslameters and Digital Hall Effect Teslameters), End Users (Automotive, Industrial, Healthcare, Aerospace, Laboratory, and Others), and Geography

Mar 2024

Automotive Board to Board Connector Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Pin Headers, Sockets, Floating Connector, and Card Edge Connector), Pin Headers (Stacked Headers and Shrouded Headers), Application (Powertrain Control Systems, Infotainment and Navigation Systems, Advanced Driver Assistance Systems (ADAS), Electric Vehicles (EV) and Hybrid Vehicle Systems, Lighting Control Systems, Autonomous Vehicles, and Others), Pitch (Less Than 1 mm, 1–2 mm, and More Than 2 mm), Number of Pin (2–12 Pin, 13–30 Pin, 31–50 Pin, 51–100 Pin, and 100+ Pin), and Geography

Mar 2024

Radiation Hardened Motor Controller and Motor Drive Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Motor Controller and Motor Drive), Motor Drive (AC Drive, DC Drive, and BLDC), Application (Space Exploration, Military and Defense, Nuclear Power Plants, and Others), and Geography

Mar 2024

Pluggable Optics for Data Center Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Switches, Routers, and Servers), Data Rate (100–400 Gb/s, 400–800 Gb/s, and 800 Gb/s and above), and Geography

Mar 2024

Doors and Windows Automation Market

Size and Forecast (2021–2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Pedestrian Doors, Industrial Doors, and Windows), Component (Sensors and Detectors, Access Control Systems, Control Panels, Motors and Actuators, and Others), Industry Vertical (Commercial, Industrial, and Residential), Control System (Fully Automatic, Semi-Automatic, and Power Assist), and Geography

Mar 2024

Substrate-Like PCB Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Line/Space (25/25 and 30/30 µm and Less than 25/25 µm), Fabrication Process (MSAP and UV LDI), Application (Consumer Electronics, Automotive, Industrial, Medical, and Others), and Geography

Mar 2024

LED Flashlight Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Rechargeable LED Flashlight and Non-Rechargeable LED Flashlight), Product (Everyday Carry Flashlights, Tactical Flashlights, and Safety Flashlights), Application (Residential, Commercial, and Military and Law Enforcement), and Geography

Get Free Sample For

Get Free Sample For