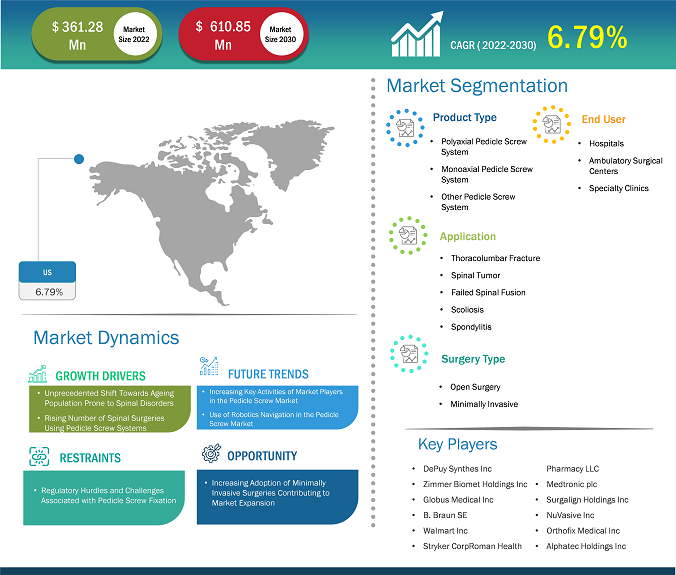

[Research Report] The US pedicle screw market size is expected to grow from US$ 361.28 million in 2022 to US$ 610.85 million by 2030; it is estimated to register a CAGR of 6.79% from 2022 to 2030.

Analyst’s ViewPoint

The US pedicle screw market analysis explains market drivers such as the susceptibility of aging population to spinal disorders and the rising number of spinal surgeries using pedicle screw system. Further, product launches, expansions, collaborations, and partnerships among market players and use of robotics for navigation during screw placement are expected to introduce new trends in the market during 2022–2030. Based on product type, the polyaxial pedicle screw system segment accounted for the largest share in 2022. Based on application, the thoracolumbar fracture segment dominated the market by accounting maximum share. By surgery type segment, the open surgery segment is likely to account for a considerable share of the US pedicle screw market during the forecast period. Based on end user, the hospitals segment is expected to account for a maximum share of the US pedicle screw market during 2022–2030.

Pedicle screws are threaded titanium or stainless-steel implants that are fastened through the vertebral pedicles located at the back of spinal bones. Pedicle screws help secure rods and/or plates to the spinal segment during a spinal fusion surgery. The screw act as an anchor point and are typically positioned at 2 or 3 consecutive spinal segments connected by a short rod.

Market Insights

Susceptibility of Aging Population to Spinal Disorders

The geriatric population is more susceptible to spinal disorders such as degenerative disc diseases, osteoarthritis, scoliosis, spinal tumors, and spinal stenosis. The natural wear and tear of the spine, associated with aging, can lead to several spinal disorders. Moreover, this demographic group poses a unique challenge to spine surgeons due to multiple frailty, comorbidities, decreased nutritional status, and higher probability of postoperative complications. According to the World Health Organization (WHO) data published in October 2022, ~80% of the elderly population would be living in low-and middle-income countries by 2050. Moreover, it is anticipated that the pace of this population aging would be much faster than the pace reported in the past. Pedicle screws are widely used during surgical procedures performed to correct vertebral fracture, vertebral deformity, spinal trauma, spinal tumor, etc. Thus, pedicle screw systems are gaining traction owing to the rising elderly population, which is prone to various spinal disorders. The following figure depicts the cumulative incidence rate (%) among the aging population in two groups, i.e., age under 70 (Group A) and age 70 and older (Group B). Vertebral fracture cases after posterior fusion surgery were higher in Group A than in Group B. Pedicle screws are widely used during surgical procedures performed to correct vertebral fracture, vertebral deformity, spinal trauma, spinal tumor, etc. According to the US Census Bureau 2023 report, the elderly population in the US has grown rapidly in the last few decades. During 2010–2020, the population aged 65 and above saw the largest and fastest growth since the decade of 1880–1890; this population reached 55.8 million or 16.8% of the total population in 2020. This upsurge is primarily attributed to the aging of baby boomers, born between 1946 and 1964.

Fig 1: Number of Patients at Risk of Vertebral Fractures

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Source: Nakahashi et al. BMC Musculoskeletal Disorders,2019

Postoperative vertebral fractures with pedicle screw fixation are relatively common complications among ageing population. The surgical management of vertebral fractures and spinal disorders often requires pedicle screw fixation. For instance, surgical management of scoliosis includes the decompression of neutral elements and fusion to realign the spinal segment pedicle screw system.

Future Trend

Use of Robotics for Navigation During Screw Placement

In recent years, the pedicle screw market has witnessed the advent of robotic navigation, especially in minimally invasive spinal surgeries (MISS) has led to an improvement in the accuracy of pedicle screw placement, as robotics aid in screw trajectory planning, size, and real-time visualization during the surgery. In surgeries related to lumbar interbody fusion, the applications of robotics have reached beyond pedicle screw placement. According to an article published in the Journal of Bone and Joint Surgery in 2020, robotic devices facilitate the placement of pedicle screws in patients with difficult anatomy, resulting in increased procedure accuracy, feasibility, and efficiency. The US FDA has approved the use of robotics to analyze the ideal trajectory for pedicle screw placement. The robotic devices serve as a semiactive surgical assistive tool that allows surgeons to broaden their ability to treat patients.

- In 2022, Beijing TINAVI Medical Technologies introduced TiRobot, an orthopedic robot developed as a new technology to aid in minimally invasive, percutaneous pedicle screw placement. This technique is accurate and safe, potentially reducing intraoperative blood loss, shortening operative time, improving fixation accuracy, and reducing surgical risk in the aging population.

- In May 2021, CUREXO Corp., a medical robot specialist company, received a US FDA license for developing the CUVIS-Spine spinal surgery robot. It is a next-generation spinal surgery robot that guides the insertion of a pedicle screw and functions according to the surgery plan by using a high-precision robot arm, wireless one-step navigation based on a real-time OTS sensor to confer precise, safe, and faster operations. CUVIS-Spine also minimizes the filming and reduces the radiation exposure of patients and medical staff.

- In May 2022, Altus Spine, a pioneer in the development and innovation of medical devices used in spinal correction surgeries, announced FDA 510 (K) clearance for Monaco HA Pedicle Screw System. This system comprises a low-profile construct and insertion devices, featuring an optimized surface intended for enhanced fixation. This surfaced is made of calcium and phosphorous to enhance the fixation of a pedicle screw into the surrounding bone.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Pedicle Screw Market: Strategic Insights

Market Size Value in US$ 361.28 million in 2022 Market Size Value by US$ 610.85 million by 2030 Growth rate CAGR of 6.79% from 2022 to�2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

US Pedicle Screw Market: Strategic Insights

| Market Size Value in | US$ 361.28 million in 2022 |

| Market Size Value by | US$ 610.85 million by 2030 |

| Growth rate | CAGR of 6.79% from 2022 to�2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

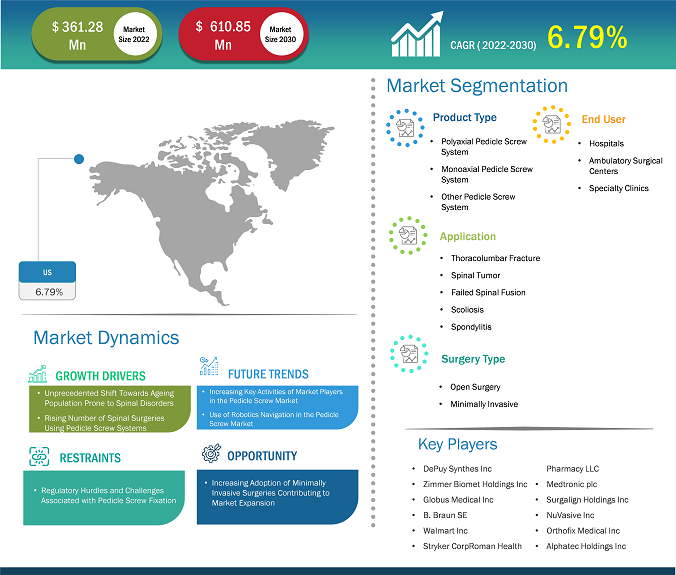

Product Type-Based Insights

Based on product type, the US pedicle screw market is segmented into polyaxial pedicle screw system, monoaxial pedicle screw system, and other pedicle screw systems. The polyaxial pedicle screw system segment held the largest market share in 2022 and is expected to record a significant CAGR during 2022–2030. Polyaxial pedicle screw systems are used in spinal surgeries designed to stabilize and immobilize the spine. Screws are anchored in the pedicle, which are small bony projections on the vertebral bodies. This type of screw can move in multiple directions, giving surgeons greater flexibility during pedicle placement. In recent years, minimally invasive surgery has been a preferred approach for spinal surgeries using posterior pedicle screw fixation.

Companies Offering Polyaxial Pedicle Screw Systems

Companies | Polyaxial Pedicle Screw System |

Auxien Medical | VERTAUX – Polyaxial Pedicle Screw with Cap |

Stryker | Xia3 |

B. Braun | S4 Spinal System (Monoaxial and Polyaxial) |

Zimmer Biomet | Vital Spinal Fixation System |

Source: Company Websites and The Insight Partners Analysis

The increasing number of spinal surgeries performed and technological advancements in polyaxial pedicle screw systems coupled with rising number of minimally invasive surgeries is expected to bolster the growth of the market for this product type.

Application-Based Insights

Based on application, the global US pedicle screw market is segmented into thoracolumbar fracture, spinal tumor, failed spinal fusion, scoliosis, and spondylitis. The thoracolumbar fracture segment held the largest market share in 2022 and is anticipated to register the highest CAGR during 2022–2030. Thoracolumbar fractures can significantly affect the quality of life, resulting in neurological deficits, deformities, and pain. According to an article published in Orthopaedic Surgery in 2020, spinal fractures account for 32.8/100,000 per population, and thoracolumbar fractures account for ~90% of spinal fractures. In addition, nearly 20% of these fractures are burst fractures due to axial pressure. Most of the thoracolumbar fractures occur between T11 and L2, a stress concentration area.

Pedicle screws are mostly used to correct thoracolumbar burst fractures and are considered the gold standard for spinal internal fixation in posterior surgery. The commonly used pedicle screw systems comprise 4 nails and 2 rods. A large number of biochemical studies have been carried out using pedicle screws. Although pedicle screw fixation has been proven advantageous in correcting spinal fractures, the disadvantage of screw loosening persists in patients with osteoporosis, leading to the failure of the correction procedure.

Surgery Type-Based Insights

In terms of surgery type, the US pedicle screw market is bifurcated into open surgery and minimal invasive surgery. The open surgery segment held a larger share of the market in 2022 and the minimally invasive segment is anticipated to register a higher CAGR during 2022–2030.

Minimally invasive surgeries (MIS) have gained traction owing to the rising application of technologically advanced robotic and image-guided (IG) surgeries. The market for the MIS segment is anticipated to grow six times faster as compared to the open surgeries segment during the forecast period. These surgeries are associated with less damage to the surrounding muscles, lower bleeding, minimum pain, faster recovery, and shorter hospital stays. At present, MIS is considered a common procedure for spinal fusion.

Key US pedicle screw market players are focusing on expanding their portfolios of product types supporting minimally invasive surgeries. In September 2021, Alphatec Holdings, Inc. launched the InVictus OsseoScrew spinal fixation system, which is an expandable pedicle screw system. Thus, with the growing preference for MIS among surgeons and patients, and the burgeoning prevalence of spinal cord degenerating diseases, the US pedicle screw market is set to pick pace during the forecast period.

End User-Based Insights

By end user, the market is segregated into hospitals, ambulatory surgical centers, and specialty clinics. The hospital segment held the largest share of the market in 2022 and is anticipated to register the highest CAGR in the US pedicle screw market during 2022–2030.

US Pedicle Screw Market, by Product Type – 2022 and 2030

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Country Analysis

The growth of the US pedicle screw in the US is attributed due to unprecedented shift toward aging population prone to spinal disorders and rising number of spinal surgeries using pedicle screw systems. However, regulatory hurdles and challenges associated with pedicle screw fixation hinder the market growth.

Major market players operating in the US pedicle screw include DePuy Synthes, Stryker, and Intelivation Technologies. These companies engage in product type developments and launches to remain competitive in the market. In the US, technologically advanced pedicle screws are widely adopted for various minimally invasive and open surgeries.

Following is the list of major developments undertaken by the companies in the pedicle screw ecosystem:

- In May 2023, Intelivation Technologies launched a new minimally invasive pedicle screw system. The Golden Isles is a percutaneous system that improves procedural flexibility and visualization for surgeons, resulting in minimal soft tissue disruption in patients.

- In March 2022, SurGenTec, a US-based privately held company specializing in spine and orthopedic technology, received US FDA approval for its standalone spine fixation implant—the ION Screw.

- In February 2022, OsteoCentric Spine, LLC, announced its plans to enter the pedicle screw fixation market after executing a private-label deal with Altus Spine. The arrangement allows OsteoCentric to integrate an existing FDA-cleared system with its UnifiMI mechanical integration technology platform.

- In October 2020, Stryker announced that its Mesa Pedicle Screw (launched in 2006) reached the count of 1 million implantations globally. This system was featured during the North American Spine Society (NASS) annual meeting in 2020.

An increase in the number of cases of lumbar fracture, spinal deformities, and spinal tumors in the US population and technological advancements in pedicle screws favor the pedicle screw market. Lumbar fracture is the most common spinal fracture, which includes a complex injury and a high disability rate and causes serious psychological and economic stress in patients.

The report profiles leading players operating in the global US pedicle screw market. These include DePuy Synthes Inc, Zimmer Biomet Holdings Inc, Globus Medical Inc, B. Braun SE, Stryker Corp, Medtronic Plc, Surgalign Holdings Inc, NuVasive Inc, Orthofix Medical Inc, and Alphatec Holdings Inc.

- In August 2022, Surgalign Holdings, Inc. received FDA 510(k) approval of the CorteraTM Spinal Fixation System. This new flagship product from Surgalign is a key piece to the foundational portfolio designed to drive the company’s future growth over the next 10 years.

- In September 2021, Alphatec Holdings, Inc., a provider of innovative solutions dedicated to revolutionizing the approach to spine surgery, launched of the InVictus OsseoScrew Expandable Spinal Fixation System.

Company Profiles

- DePuy Synthes Inc

- Zimmer Biomet Holdings Inc

- Globus Medical Inc

- B. Braun SE

- Stryker Corp

- Medtronic Plc

- Surgalign Holdings Inc

- NuVasive Inc

- Orthofix Medical Inc

- Alphatec Holdings Inc

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Application, Surgery Type, End User, and Country Analysis

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key factor that is driving the pedicle screws market growth include increased adoption of these devices in treating degenerative spinal disorders, and the rising number of life-saving surgeries.

Pedicle screws are used sometimes in a spinal fusion to add extra support and strength to the fusion while it heals. Pedicle screws are placed above and below the vertebrae that were fused. A rod is used to connect the screws which prevents movement and allows the bone graft to heal. After the fusion is completely healed, the screws and rods can be removed. Removal isn't necessary unless they cause the patient discomfort.

The pedicle screws market, by product type, is fragmented into polyaxial pedicle screw system, monoaxial pedicle screw system, and other pedicle screw systems. The polyaxial pedicle screw system segment held the largest market share in 2022 and services segment is anticipated to register the highest CAGR during the forecast period.

The US pedicle screws market, by end user, is fragmented into hospitals, ambulatory surgical centers, and specialty clinics. The hospitals segment held the largest market share in 2022 and ambulatory surgical center anticipated to register the highest CAGR during the forecast period.

US pedicle screws market comprises top players such as Johnson & Johnson (Depuy Synthes), Zimmer Biomet, Globus Medical, Inc., B. Braun Melsungen AG, Orthofix International N.V., Stryker, Medtronic PLC, RTI Surgical, Inc and NuVasive.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. US Pedicle Screw Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 US PEST Analysis

5. US Pedicle Screw Market - Key Industry Dynamics

5.1 Key Market Drivers:

5.1.1 Susceptibility of Aging Population Prone to Spinal Disorders

5.1.2 Rising Number of Spinal Surgeries Using Pedicle Screw System

5.3 Key Market Restraints:

5.3.1 Regulatory and Operational Complexities

5.4 Key Market Opportunities:

5.4.1 Increasing Adoption of Minimally Invasive Surgeries

5.5 Future Trends

5.5.1 Use of Robotics Navigation in the Pedicle Screw Market

5.6 Impact Analysis:

6. US Pedicle Screw Market - Market Analysis

6.1 US Pedicle Screw Market Revenue (US$ Mn), 2022 – 2030

7. US Pedicle Screw Market – Revenue and Forecast to 2030 – by Product Type

7.1 Overview

7.2 US Pedicle Screw market Revenue Share, by Product Type 2022 & 2030 (%)

7.3 Polyaxial Pedicle Screw System

7.3.1 Overview

7.3.2 Table 1: Companies Offering Polyaxial Pedicle Screw Systems

7.3.3 Polyaxial Pedicle Screw System: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

7.4 Monoaxial Pedicle Screw System

7.4.1 Overview

7.4.2 Monoaxial Pedicle Screw System: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

7.4.3 Other Pedicle Screw System

7.4.4 Other Pedicle Screw System: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

8. US Pedicle Screw market – Revenue and Forecast to 2030 – by Surgery Type

8.1 Overview

8.2 US Pedicle Screw Market Revenue Share, by Type 2022 & 2030 (%)

8.3 Open Surgery Type

8.3.1 Overview

8.3.2 Open Surgery: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Minimally Invasive Spine Surgery Type

8.4.1 Overview

8.4.2 Minimally Invasive Surgery: US Pedicle Screw market – Revenue and Forecast to 2030 (US$ Million)

9. US Pedicle Screw market – Revenue and Forecast to 2030 – by Application

9.1 Overview

9.2 US Pedicle Screw Market Revenue Share, by Application 2022 & 2030 (%)

9.3 Thoracolumbar Fracture

9.3.1 Overview

9.3.2 Thoracolumbar Fracture: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

9.4 Spinal Tumor

9.4.1 Overview

9.4.2 Spinal Tumor: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

9.5 Scoliosis

9.5.1 Overview

9.5.2 Scoliosis: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

9.6 Failed Spinal Fusion

9.6.1 Overview

9.6.2 Failed Spinal Fusion: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

9.7 Spondylitis

9.7.1 Overview

9.7.2 Spondylitis: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

10. US Pedicle Screw Market – Revenue and Forecast to 2030 – by End User

10.1 Overview

10.2 US Pedicle Screw Market Revenue Share, by End User 2022 & 2030 (%)

10.3 Hospitals

10.3.1 Overview

10.3.2 Hospitals: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

10.4 Ambulatory Surgical Centres (ASCs)

10.4.1 Overview

10.4.2 Ambulatory Surgical Centers: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

10.5 Specialty Clinics

10.5.1 Overview

10.5.2 Specialty Clinics: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

11. Industry Landscape

11.1 Overview

11.2 Growth Strategies in Pedicle Screw Market

11.3 Organic Growth Strategies

11.3.1 Overview

11.4 Inorganic Growth Strategies

11.4.1 Overview

12. Company Profiles

12.1 DePuy Synthes Inc

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Zimmer Biomet Holdings Inc

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Globus Medical Inc

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 B. Braun SE

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Stryker Corp

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Medtronic Plc

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Surgalign Holdings Inc

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 NuVasive Inc

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 Orthofix Medical Inc

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 Alphatec Holdings Inc

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About Us

13.2 Glossary of Terms

List of Tables

Table 1. US Pedicle Screw Market Segmentation

Table 2. Companies Offering Monoaxial Pedicle Screw System

Table 3. Recent Organic Growth Strategies in Pedicle Screw Market

Table 4. Recent Inorganic Growth Strategies in the Pedicle Screw Market

Table 5. Glossary of Terms, US Pedicle Screw Market

List of Figures

Figure 1. Key Insights

Figure 2. US PEST Analysis

Figure 3. US Pedicle Screw Market - Key Industry Dynamics

Figure 4. Fig 1: Incidence of Subsequent Vertebral Fractures in Two Groups in Aging Population-Based Study

Figure 5. Impact Analysis of Drivers and Restraints

Figure 6. US Pedicle Screw Market Revenue (US$ Mn), 2022 – 2030

Figure 7. US Pedicle Screw market Revenue Share, by Product Type 2022 & 2030 (%)

Figure 8. Polyaxial Pedicle Screw System: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

Figure 9. Monoaxial Pedicle Screw System: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

Figure 10. Other Pedicle Screw System: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. US Pedicle Screw Market Revenue Share, by Type 2022 & 2030 (%)

Figure 12. Open Surgery: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. Minimally Invasive Surgery: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. US Pedicle Screw Market Revenue Share, by Application 2022 & 2030 (%)

Figure 15. Thoracolumbar Fracture: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. Spinal Tumor: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. Scoliosis: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. Failed Spinal Fusion: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Spondylitis: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

Figure 20. US Pedicle Screw Market Revenue Share, by End User 2022 & 2030 (%)

Figure 21. Hospitals: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

Figure 22. Ambulatory Surgical Centers: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

Figure 23. Specialty Clinics: US Pedicle Screw Market – Revenue and Forecast to 2030 (US$ Million)

Figure 24. Growth Strategies in Pedicle Screw Market

The List of Companies - US Pedicle Screw Market

- DePuy Synthes Inc

- Zimmer Biomet Holdings Inc

- Globus Medical Inc

- Hill-Rom Holdings Inc

- Stryker Corp

- B. Braun SE

- Medtronic Plc

- Surgalign Holdings Inc.

- NuVasive Inc

- Orthofix Medical Inc

- Alphatec Holdings Inc

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to US Pedicle Screw Market

Oct 2023

Pediatric Cardiology Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Transcatheter Heart Valves, Occlusion Devices, Catheters, Stents, Introducer Sheaths, and Others), Disease Indication (Congenital Heart Disease, Acquired Heart Disease, Arrhythmias, Cardiomyopathies, and Others), Surgical Procedure (Interventional Procedures, Heart Rhythm Management Procedures, and Others), End User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Oct 2023

Pharmaceutical Membrane Filters Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Microfiltration, Ultrafiltration, Reverse Osmosis and Nanofiltration), Design (Hollow Fiber, Spiral Wound, Tubular System and Plate and Frame), Material (Polyethersulfone (PES), Polysulfone (PS), Cellulose-Based Membranes, Polytetrafluoroethylene (PTFE), Polyvinyl Chloride (PVC), Polyacrylonitrile (PAN) and Others), End User (Pharmaceutical and Biotech Industries and CROs and CDMOs), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, South & Central America)

Oct 2023

ECG Devices Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Resting ECG and Stress ECG), Lead Type (12-Lead ECG, 3–6 Lead ECG, and Single Lead), Technology [Portable (Wired) ECG System and Wireless ECG System], End User (Hospital and Clinics, Ambulatory Surgical Centers, Cardiac Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Oct 2023

Surgical Laser Fiber Units Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (CO2 Laser, Diode Laser, Erbium Laser, Nd:YAG Laser, Holmium Laser, Alexandrite Laser, and Others), Material (Silica-Based Fibers, Quartz Fibers, Polymer-Based Fibers, Multimode Fibers, and Others), Power (Low-Power Lasers, Medium-Power Lasers, and High-Power Lasers), Application (Urology, Dermatology, Gynecology, Cardiology, Neurology, Ophthalmology, Respiratory, Dentistry and Others), Wavelength (9,301 nm and above, 2,941–9,300 nm, and 1,441–2,940 nm, 821–1,440 nm, 710–820 nm, and below 710 nm), End User (Hospitals, Specialty Clinics, Physician Office, and Others), and Geography

Oct 2023

Therapeutic Vaccines Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Cancer Vaccines, Infectious Disease Vaccines, and Others), Technology (Allogenic Vaccines and Autologous Vaccines), End User (Hospitals, Clinics, and Others), and Geography

Oct 2023

Medical Cables Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Disposable Medical Cables, Reusable Medical Cables, and Custom Medical Cables), Applications [Diagnostics (Ultrasound Cables, Endoscopy Cables, Patient Interface Cables, and Others), Motorized Equipment, Patient Monitoring (ECG Cables, SpO2 Cables, NiBP Cables, EEG Cables, and Others), Surgical and Life Support (Fiber Optics, Modular Local Area Network, and Others), and Others], End User (Hospital and Clinics, Diagnostic Laboratories and Imaging Centers, Ambulatory Surgical Centers, and Others), and Geography

Oct 2023

Laser-Assisted ENT Surgeries Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (C02 Laser, Nd:YAG Laser, Diode Laser, Blue Laser, KTP Laser, Argon Laser, and Other Laser Types), Surgery Type [Laser Laryngeal Surgery, Laser Endoscopic Sinus Surgery (LESS), Laser-Assisted Uvulopalatoplasty (LAUP), Laser-Assisted Stapedotomy, Laser-Assisted Tonsillectomy and Adenoidectomy, Laser Turbinates Reduction, Transoral Laser Microsurgery (TLM), Nasal Surgery, and Other Surgery Types], End User (Hospitals and Specialty Clinics, Physician Offices, and Other End Users), and Geography (North America, Europe, Asia Pacific, South and Central America, and Middle East and Africa)

Oct 2023

Mobile Cleanroom Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Softwall and Hardwall), End User (Microelectronics Industry, Pharmaceuticals and Biotechnology Industry, Medical Device Manufacturers, and Others), and Geography

Get Free Sample For

Get Free Sample For