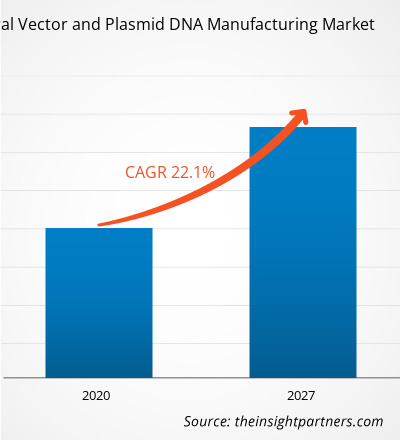

[Research Report] The viral vector and plasmid DNA manufacturing market size was projected to grow from US$ 459.4 million in 2019 to US$ 2,247.7 million by 2027; it is further estimated to record a CAGR of 22.1% from 2020–2027.

Analyst Perspective:

The increasing demand for gene therapy and advancement in gene editing technologies for the development of treatment option for various chronic disorders, viral infection, and others are driving the viral vector and plasmid DNA manufacturing market growth. Additionally, increase in research activities and growing investments in pharmaceutical & biotechnology industries followed by the favorable regulatory scenario is expected to anticipate the market growth. Moreover, integration of advanced computing technologies is further expected to enhance the application area of viral vector and plasmid DNA manufacturing in near future which in turn propelling the market growth.

Market Overview:

A viral vector is a tool used in gene delivery and manipulation. It is modified virus that has been engineered to carry and deliver specific genes into cells. Viral vectors are commonly used in gene therapy for gene editing application, as they can efficiently deliver genetic material into target cells. Plasmid vector is a small circular piece of DNA that is separate from the chromosomal DNA in a cell. Plasmids can replicate independently and are commonly found in bacteria. In research, plasmids are often used as vectors to introduce genes into cells for various purposes, such as protein production or genetic engineering. Both viral vector and plasmid DNA are essential tools for gene delivery and manipulation in research, allowing researchers to understand potential applications.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Viral Vector and Plasmid DNA Manufacturing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Viral Vector and Plasmid DNA Manufacturing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Trends:

I

ntegration of Advanced Computing Technologies

Emergence of revolutionary technologies such as artificial intelligence, data science, natural language processing, and others are estimated to reshape the future of healthcare technologies during the forecast period. However, gene therapy offers innovative solutions for treatment of diseases, the execution of it faces some technical challenges. For instance, error in gene replacing may lead to harmful mutations in the DNA, resulting into severe health problems. To achieve high level of precision in procedures, intelligent algorithms can offer a significant way. Further, a majority of players are engaged in R&D of new technologies, which will deal with increasing demand for modern technologies. For instance, in March 2019, Oxford Biomedica entered into strategic collaboration with Microsoft to improve gene therapies. Moreover, in May 2020, Dyno Therapeutics announced its proposed financial investments of an estimated US$ 2.0 billion to design AI-based gene therapies. Such events represent a huge opportunity for the integrations of advanced computing technologies, which will eventually redefine the concept of gene therapies during years to come.

Segmental Analysis:

Based on application, the viral vector and plasmid DNA manufacturing market is segmented into cancer, inherited disorders, viral infections, and others. The cancer segment held the largest share of the market in 2019, and the same segment is anticipated to register the highest CAGR of 22.6% during the forecast period. Viral vectors and non-viral vectors have their application and are being studied for both preventive and therapeutic applications in cancer or oncology. Viral vector-based immunization with anticancer agents or delivery of anticancer genes is some critical areas of research that have shown steady progress. Moreover, the government approvals of lentiviral vector-based CAR-T cell therapies, which is used for the treatment of Acute Lymphoblastic Leukemia (ALL) and large B cell lymphoma, have attracted considerable attention from users. Viral vectors and non-viral vectors have resulted in a significant proliferation of the cancer-based pipeline projects on advanced therapies. For instance, around two-thirds of the research in gene therapy is focused on oncology. The above-mentioned factors have contributed to the dominance of cancer over other disease areas. Based on products, the global viral vector and plasmid DNA manufacturing market is bifurcated into viral and non-viral vectors. In 2019, the viral vectors segment held the largest market share, and the same segment is expected to grow at the fastest CAGR during the coming years.

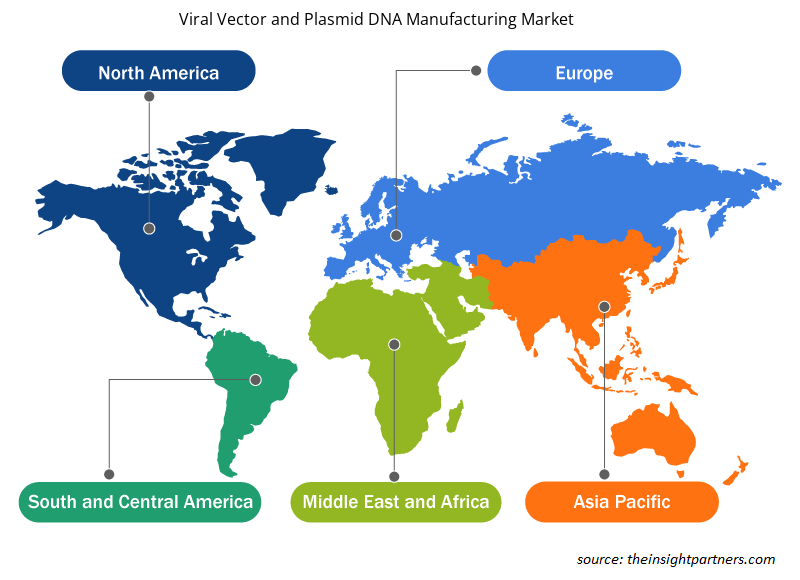

Regional Analysis:

Based on geography, global viral vector and plasmid DNA manufacturing market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. North America held the largest viral vector and plasmid DNA manufacturing market share which is closely followed by Europe. The US held the largest share of the North American viral vector and plasmid DNA manufacturing market in 2019. The growth of the US market is primarily driven by the growing awareness regarding benefits of gene therapy, increasing research and development activities, and rising demand for advanced therapeutic solutions to treat chronic conditions and viral infections.

In addition, increasing demand for viral vectors due to growing adoption of gene therapies is also anticipated to drive the US viral vector and plasmid DNA manufacturing market growth during the forecast period. In addition, due to this growing demand, major players in the market are focusing on expansion of their viral vector manufacturing capacity. For instance, in May 2020, Thermo Fisher Scientific Inc. announced its plan to expand viral vector manufacturing capacity. According to company estimates, the new facility will be operational by 2022. Further, in April 2020, Merck announced its proposed plan to open a new US-based manufacturing facility for viral vectors. The company has invested around US$ 112.6 million for this proposed expansion.

In Canada, the viral vector and plasmid DNA manufacturing market growth is expected owing to the development of the healthcare systems and rapidly increasing adoption of modern cell related technologies. On the other hand, in Mexico, it is expected that the viral vector and plasmid DNA manufacturing market is likely to experience growth opportunities due increasing awareness of benefits offered by viral vectors and plasmid DNA.

Key Player Analysis:

The viral vector and plasmid DNA manufacturing market majorly consists of the players such as Brammer Bio, Sanofi, Cardinal Health Inc, FUJIFILM Diosynth Biotechnologies, Cell and Gene Therapy Catapult, Cobra Biologics, FinVector, Kaneka Eurogentec SA, MassBiologics, Spark Therapeutics, and Uniqure among others. Among the players in the viral vector and plasmid DNA manufacturing market, Sanofi and FUJIFILM Diosynth Biotechnologies are the top two players owing to their organic and inorganic activities.

Viral Vector and Plasmid DNA Manufacturing Market Regional Insights

Viral Vector and Plasmid DNA Manufacturing Market Regional Insights

The regional trends and factors influencing the Viral Vector and Plasmid DNA Manufacturing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Viral Vector and Plasmid DNA Manufacturing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Viral Vector and Plasmid DNA Manufacturing Market

Viral Vector and Plasmid DNA Manufacturing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 459.4 Million |

| Market Size by 2027 | US$ 2,247.7 Million |

| Global CAGR (2019 - 2027) | 22.1% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

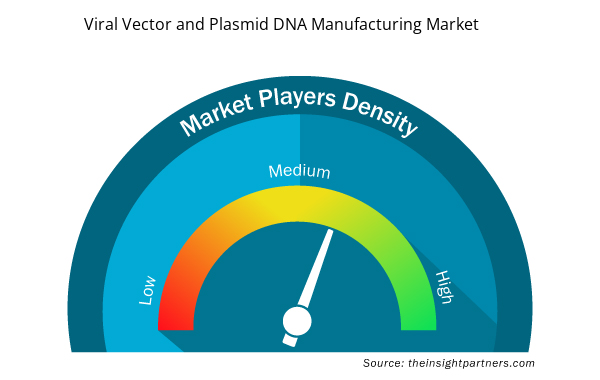

Viral Vector and Plasmid DNA Manufacturing Market Players Density: Understanding Its Impact on Business Dynamics

The Viral Vector and Plasmid DNA Manufacturing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Viral Vector and Plasmid DNA Manufacturing Market are:

- Brammer Bio

- Sanofi

- FUJIFILM Diosynth Biotechnologies

- Cell and Gene Therapy Catapult

- Cobra Biologics

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Viral Vector and Plasmid DNA Manufacturing Market top key players overview

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the viral vector and plasmid DNA manufacturing market. A few recent key market developments are listed below:

- In March 2023, Sartorius acquired French company Polyplus for 2.4 billion euros ($2.6 billion). The deal gives Sartorius additional know-how in nucleic acid delivery, including transfection reagents and plasmid DNA design, all of which are key elements in the production of viral vectors for building cell and gene therapies.

- In July 2021, Thermo Fisher Scientific Inc. opened a new cGMP plasmid DNA manufacturing facility in Carlsbad, Calif., enabling it to meet rapidly growing demand for plasmid DNA-based therapies and vital mRNA-based vaccines.

- In March 2021, WACKER acquired 100% of the shares in pharmaceutical contract manufacturer Genopis Inc. from Helixmith Co Ltd, Seoul (South Korea) and Medivate Partners LLC, Seoul (South Korea) in February. The signing of the related agreement was followed by the successful closing in late February and, now, the acquisition’s new name: Wacker Biotech US Inc.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Gene delivery into target cells can be performed using several different vectors. These are broadly classified into viral and non-viral vectors, both of which present benefits and risks. Viral vectors are tools that are commonly used by molecular biologists to deliver genetic material into cells. The non-viral vectors are Naked DNA, particle-based, and chemical-based.

The viral vector & plasmid DNA manufacturing market majorly consists of the players such as Brammer Bio, Sanofi, Cardinal Health Inc., FUJIFILM Diosynth Biotechnologies. Cell and Gene Therapy Catapult, Cobra Biologics, FinVector, Kaneka Eurogentec S.A., MassBiologics, Spark Therapeutics, and Uniqure among others.

Driving factor such as growing awareness of gene therapy and increasing prevalence of genetic disorders and infectious diseases across the world are expected to upsurge the market growth. In addition, growth in the global healthcare market is likely to have a positive impact on the market in the coming years.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Portable and Wearable Dialysis Devices Market

- Brammer Bio

- Sanofi

- FUJIFILM Diosynth Biotechnologies

- Cell and Gene Therapy Catapult

- Cobra Biologics

- FinVector

- Kaneka Eurogentec S.A.

- MassBiologics

- Spark Therapeutics

- Uniqure

Get Free Sample For

Get Free Sample For