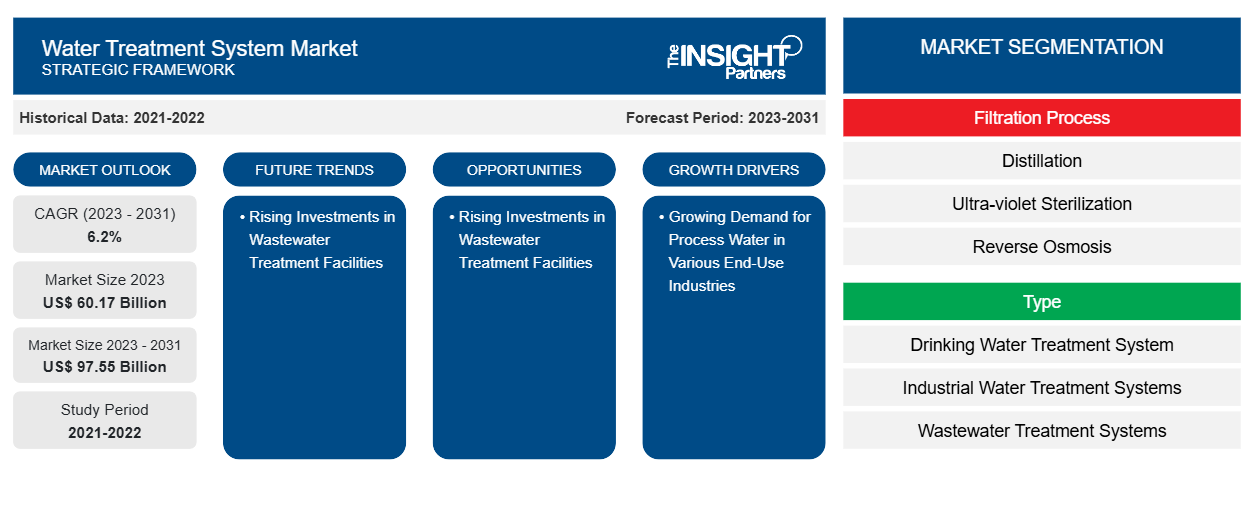

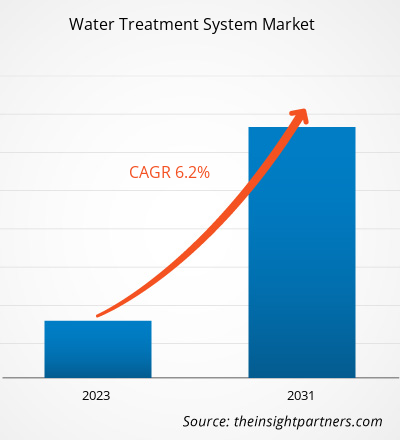

The water treatment system market size is projected to reach US$ 97.55 billion by 2031 from US$ 60.17 billion in 2023. The market is expected to register a CAGR of 6.2% during 2023–2031. The development of smart cities in emerging countries is likely to remain a key trend in the market.

Water Treatment System Market Analysis

The demand for purified water in various end-use industries, such as power generation, manufacturing, pharmaceutical, and food & beverages, is growing worldwide. In these end-use industries, clean and purified water is utilized for various applications, including steam generation, dilution, and manufacturing equipment washing and cooling. This has increased the requirement for a reliable and consistent water supply in sectors such as agriculture, power generation, manufacturing, and food & beverages. The energy & power sector is one of the major end users of water. Additionally, the food & beverage sector is contributing to the rising demand for water treatment systems worldwide, as clean water is widely used for food production, food item cleaning, food processing, and preservation. Water filtration or treatment systems are also used in the manufacturing sector for removing contaminants, impurities, and other unnecessary substances from water utilized in industrial processes. Water treatment systems are crucial for enhancing product quality, meeting regulatory requirements, and equipment protection, which is anticipated to fuel the growth of the water treatment systems market in the coming years. Also, the increasing government focus on implementing sustainable alternatives in the industrial sector is boosting the application of water treatment systems.

Water Treatment System Market Overview

Water treatment systems are an important part of water management in the industrial, residential, and commercial sectors. Water treatment systems are designed and developed to remove impurities, contaminants, and unwanted or toxic substances from water. Water treatment methods studied in this report include distillation, filtration, ultraviolet sterilization, and reverse osmosis. Water treatment systems are increasingly used in applications such as groundwater treatment, brackish or seawater treatment, rainwater harvesting, and drinking water treatment.

A rise in water demand owing to population growth, rapid industrialization, and an increase in awareness about waterborne diseases across the globe is projected to fuel the need for water treatment systems. In addition, a rise in investment in the construction of power generation plants, residential and commercial buildings, and other related infrastructure worldwide is projected to boost the market growth in the coming years. Moreover, the rise in demand for desalination and purification of water in the Middle East & Africa is anticipated to boost the water treatment systems market growth during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Water Treatment System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Water Treatment System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Water Treatment System Market Drivers and Opportunities

Growing Demand for Process Water in Various End-Use Industries

According to data from the Central Pollution Control Board (CPCB) of India, ~500 billion cubic meters of fresh water is utilized in Indian industries annually. The increasing development in the municipal sector is also contributing to the demand for water treatment systems, specifically in economies such as China, India, and Brazil.

Mineral exploration is one of the major application areas of water treatment systems since mineral exploration sites require water purification systems for cleaning equipment and other drilling processes. Nations such as China, Australia, Russia, Brazil, Canada, and the US are widely engaged in mineral exploration activities. These countries are also promoting the discovery of new mineral exploration sites and upgrade and maintenance of existing sites, which is anticipated to propel the application of water treatment systems worldwide. Thus, the growing demand for purified water in various end-use industries is a major driving factor for the water treatment systems market.

Increased Investments in Wastewater Treatment Facilities

In March 2022, the US Department of the Interior stated that the Bureau of Reclamation invested US$ 420 million in rural water-building efforts in fiscal year 2022. Along with government funding, several water treatment companies worldwide are also investing in developing water treatment facilities. In October 2023, Hydro funded a new water treatment plant at the Schwandorf heritage site in Germany. Additionally, in September 2022, BIPSO initiated its cutting-edge wastewater treatment plant at its Singen site. The company spent US$ 1.5 million on the development of this factory. Thus, the increase in investments in water treatment plants is expected to provide growth opportunities to the water treatment systems market.

Water Treatment System Market Report Segmentation Analysis

Key segments that contributed to the derivation of the water treatment system market analysis are filtration process type, application, and end user.

- Based on filtration process, the water treatment system market is segmented into distillation, ultra-violet sterilization, reverse osmosis, filtration, ion-exchange, and others. The reverse osmosis segment held the largest market share in 2023.

- By type, the market is segmented into drinking water treatment systems, industrial water treatment systems, wastewater treatment systems, portable water treatment systems, and well water treatment systems. The drinking water treatment system segment dominated the market in 2023.

- By application, the market is segmented into groundwater, brackish and seawater desalination, rainwater harvesting, drinking water, and others. The groundwater segment held the largest share of the market in 2023

- By end user, the market is segmented into residential, municipal, agriculture, food and beverage, commercial, mining and metal, oil and gas, pharmaceuticals, others. The municipal segment held the largest market share in 2023.

Water Treatment System Market Share Analysis by Geography

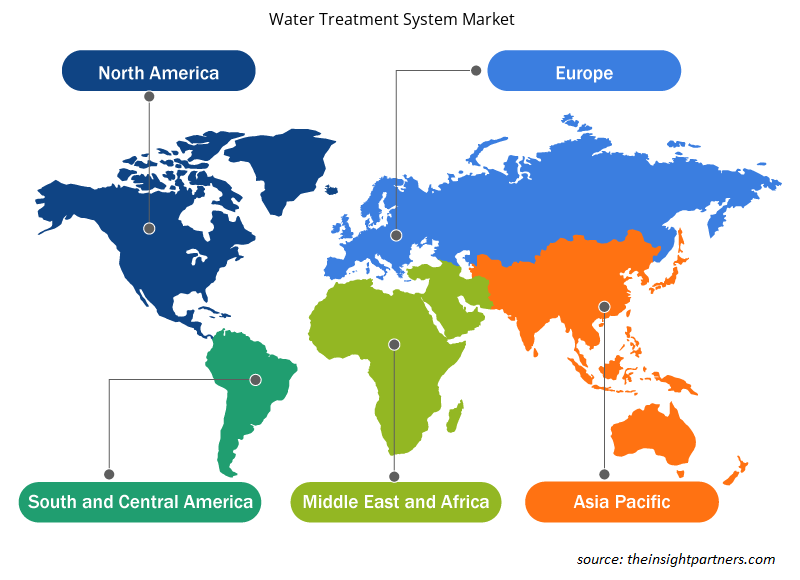

The geographic scope of the water treatment system market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

China, India, Australia, Japan, and South Korea are among the key countries in the Asia Pacific water treatment systems market. High population growth in China and India, rapid industrialization, rise in awareness regarding water pollution, and government financing are contributing to the growth of the water treatment systems market in Asia Pacific. As per the Asian Water Development Outlook 2020 report by the Asian Development Bank (ADB), ~1.5 billion people in rural areas and ~0.6 billion people in urban areas lacked access to sufficient water supply and hygiene. Additionally, the majority of the ADB members are confronting key water quality concerns. Governments of various countries in Asia Pacific are taking initiatives to develop standards and techniques for deploying water treatment systems. Rapid urbanization and demand for clean water from water-driven industries are among the prime factors propelling the growth of the water treatment systems market in emerging economies in Asia Pacific. In March 2024, Brihanmumbai Municipal Corporation awarded a contract to Welspun Enterprises in Mumbai, India, to develop and operate a water treatment plant with the capacity to process 2,000 million liters daily. Thus, rising infrastructure development and increasing government focus on upgrading the aging water treatment facilities and building new ones are anticipated to propel the growth of the water treatment systems market in Asia Pacific.

Water Treatment System Market Regional Insights

The regional trends and factors influencing the Water Treatment System Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Water Treatment System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Water Treatment System Market

Water Treatment System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 60.17 Billion |

| Market Size by 2031 | US$ 97.55 Billion |

| Global CAGR (2023 - 2031) | 6.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Filtration Process

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

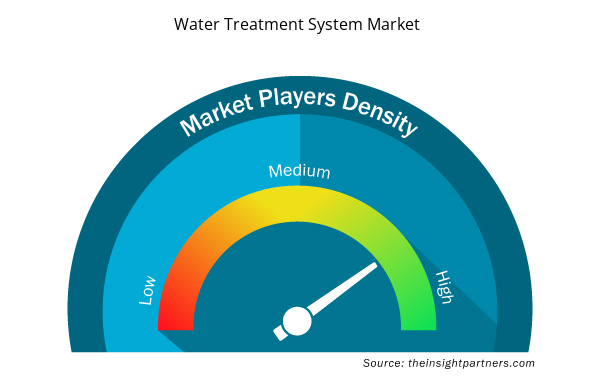

Water Treatment System Market Players Density: Understanding Its Impact on Business Dynamics

The Water Treatment System Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Water Treatment System Market are:

- Hitachi Zosen Corporation

- Pentair PLC

- Thermax Limited

- Xylem Inc

- Veolia Environnement SA

- Pall Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Water Treatment System Market top key players overview

Water Treatment System Market News and Recent Developments

The water treatment system market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market for water treatment systems are listed below:

- Thermax, a leading provider of energy and environment solutions, announced the opening of its state-of-the-art manufacturing facility in Pune for water and wastewater treatment solutions. This marks a significant step aligned with Thermax's broader mission of conserving resources and preserving the future. (Source: Thermax , Press Release, April 2024)

- Pall Corporation, a global leader in filtration, separation, and purification, and Tanajib [Al-Khobar]—a prominent petroleum services company throughout the GCC—announced the expansion of its Pall Arabia facility to include filter coalescer manufacturing capabilities to support the oil & gas and petrochemical industries in the Kingdom of Saudi Arabia. (Source: XYZ Company Name, Press Release/Company Website/Newsletter, February 2024)

Water Treatment System Market Report Coverage and Deliverables

The “Water Treatment System Market” Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Water treatment system market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Water treatment system market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Water treatment system market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the water treatment system market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Regions such as Asia-Pacific, Europe and North America will boost the growth of the water treatment system market during the forecast period. This growth is owing to the rise in urbanization and industrialization in the regions.

Development of Smart Cities in Emerging Countries.

Hitachi Zosen Corporation; Pentair PLC; Thermax Limited; Xylem Inc; Veolia Environnement SA; Pall Corp; Culligan International Co; Dupont De Nemours Inc; Thermo Fisher Scientific Inc; 3M Co.; Aqua Filsep Inc; Pure Aqua, Inc.; RITE Water Solutions (India) Pvt. Ltd.; Aquatec International LLC; and Filtra-Systems Company LLC are the key market players operating in the global water treatment system market.

There is a growing demand for purified water in various end-use industries, such as power generation, manufacturing, pharmaceutical, and food & beverages. In these end-use industries, clean and purified water is utilized for various applications, including steam generation, dilution, and manufacturing equipment washing and cooling. This has mounted the requirement for a reliable and consistent water supply in sectors such as agriculture, power generation, manufacturing, and food & beverages. The energy & power sector is one of the major end users of water.

Governments worldwide are focusing on building wastewater treatment facilities. For instance, in August 2022, the United States Department of Agriculture announced a US$ 75 million investment in an infrastructure development project that involves offering clean drinking water and sanitary wastewater systems to Greenbrier County residents in the rural area.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - Water Treatment Systems Market

- Hitachi Zosen Corporation

- Pentair PLC

- Thermax Limited

- Xylem Inc

- Veolia Environnement SA

- Pall Corp

- Culligan International Co

- Dupont De Nemours Inc

- Thermo Fisher Scientific Inc

- 3M Co.

Get Free Sample For

Get Free Sample For